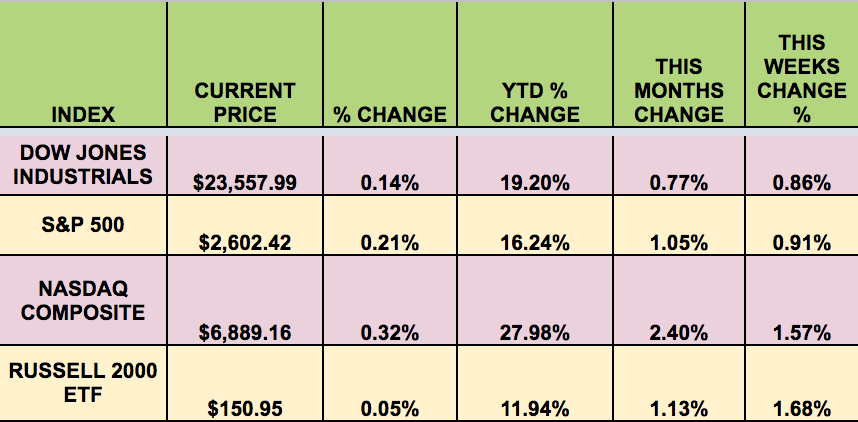

Markets: It was a shortened, but up week for the market, helped by rising Crude Oil prices, with all 4 indexes hitting new highs. WTI Crude Oil futures are up 9.8% in 2017, and have risen in 6 of the past 7 weeks. The spread between WTI and Brent crude has been closing – WTI gained 4% and Brent futures, the international benchmark, marked a 1.8% climb.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: SPKE, BEP, BPY, CLDT, GECC, IRT, JMP, PSEC, STB, UFAB, TSLX, ANF, BGFV, EFC, GLPI, NYLD, PEI, WPG, AMC, FUN.

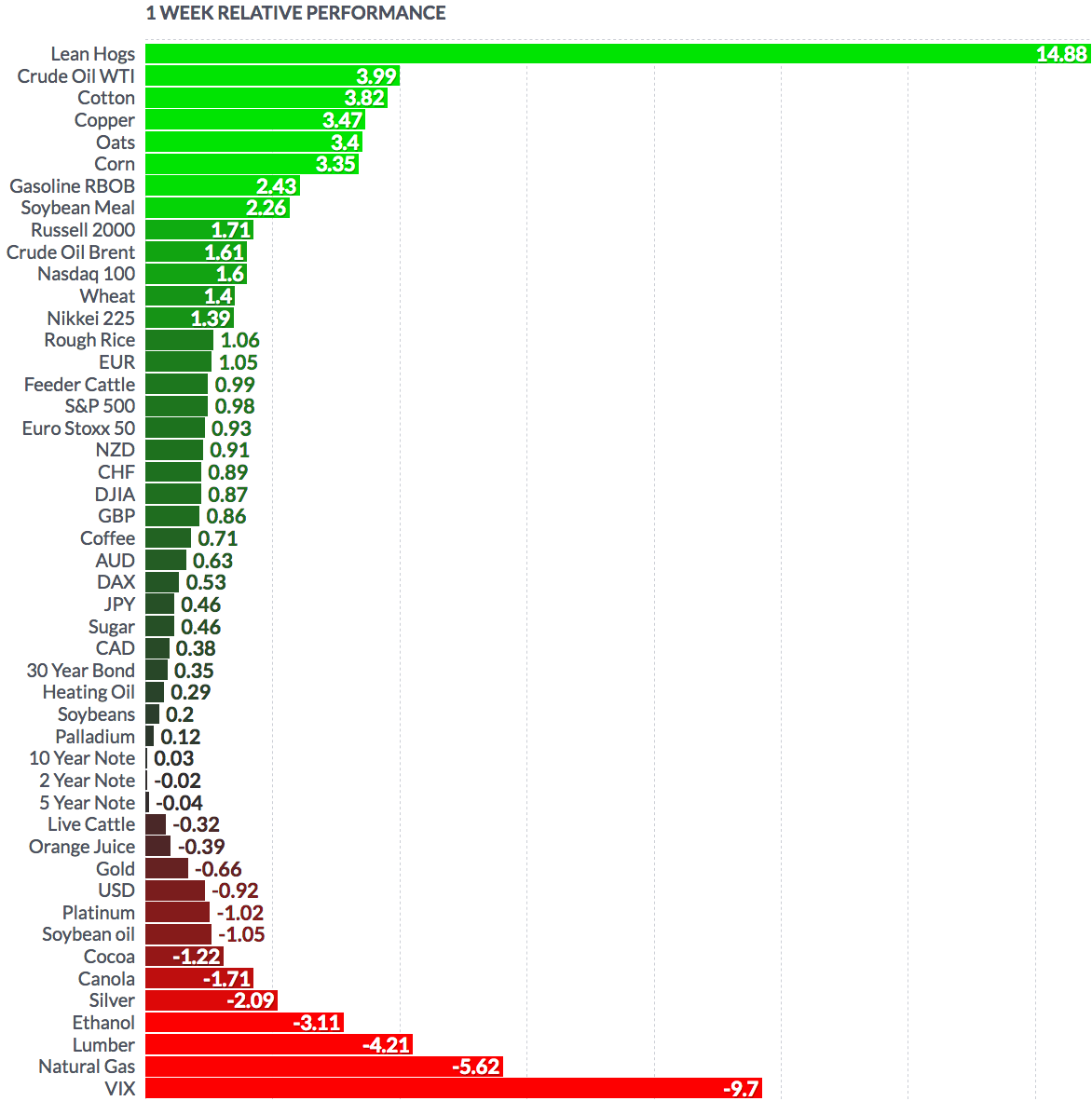

Volatility: The VIX fell 15.6% this week, and finished at $9.65, its lowest close since early November.

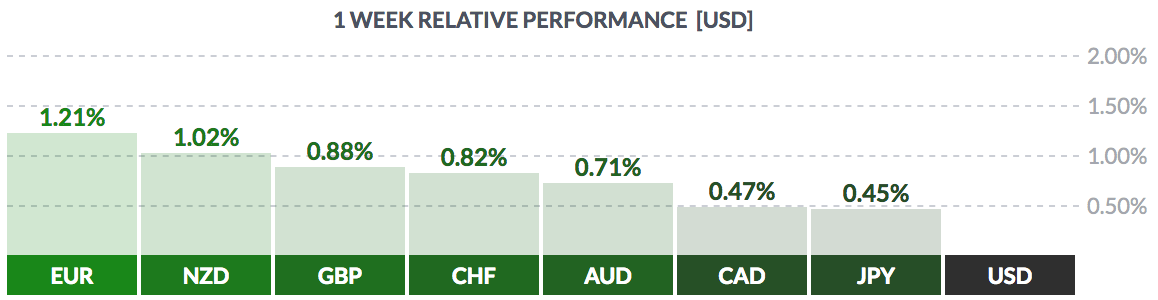

Currency: The $ weakened and fell vs. most major currencies this week.

“The US $ fell to a 4-week low against its major rivals on Wednesday, pummeled by mixed data and a mixed message from the minutes of the Federal Reserve’s last policy meeting.

The minutes confirmed that a near-term interest rate increase was all but assured, but showed doubt over persistently low U.S. inflation grew, casting doubt on the pace of rate increases in 2018.”

Market Breadth: 19 of the DOW 30 stocks rose this week, vs. 13 last week. 73% of the S&P 500 rose, vs. 60% last week.

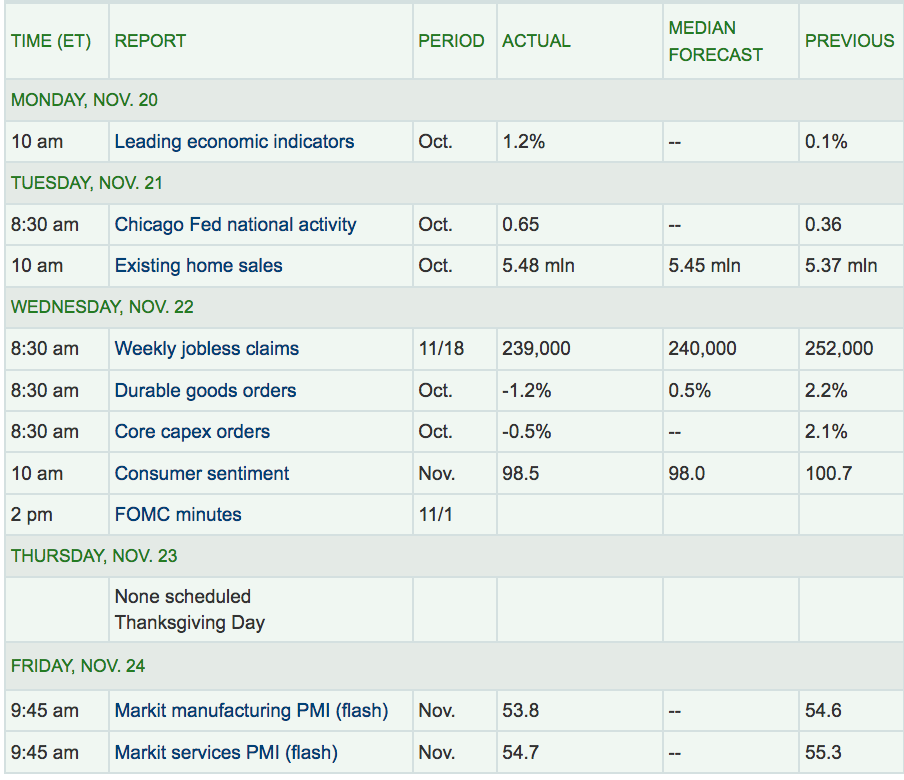

Economic News: Leading Economic Indicators posted a strong 1.2% gain, but Durable Goods Orders and Capex orders both declined.

Week Ahead Highlights: The market will be focused on the OPEC meeting, which begins next Thursday, 11/30/17. Oil has risen recently, due in part to speculation that OPEC ministers may work out further production cuts.

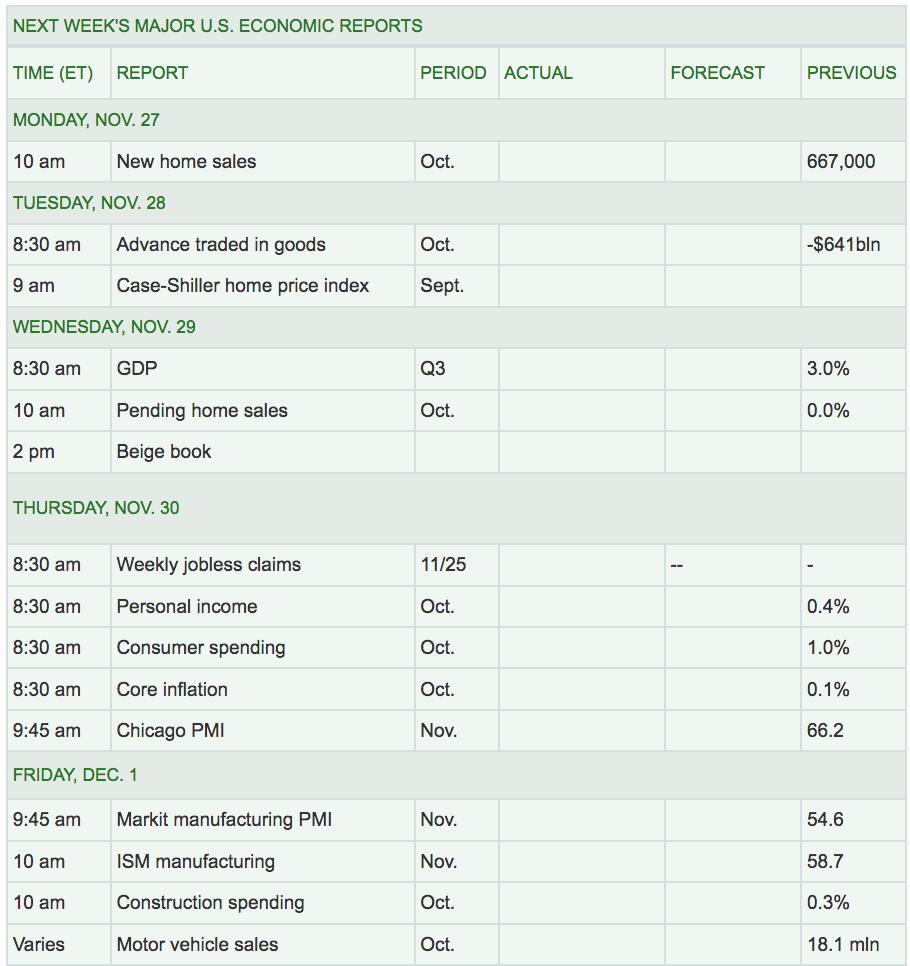

Next Week’s US Economic Reports: We’ll get another estimate for Q3 GDP on Wednesday. There will also be several housing reports due out next week, including new and pending home sales, plus the Home Price Index.

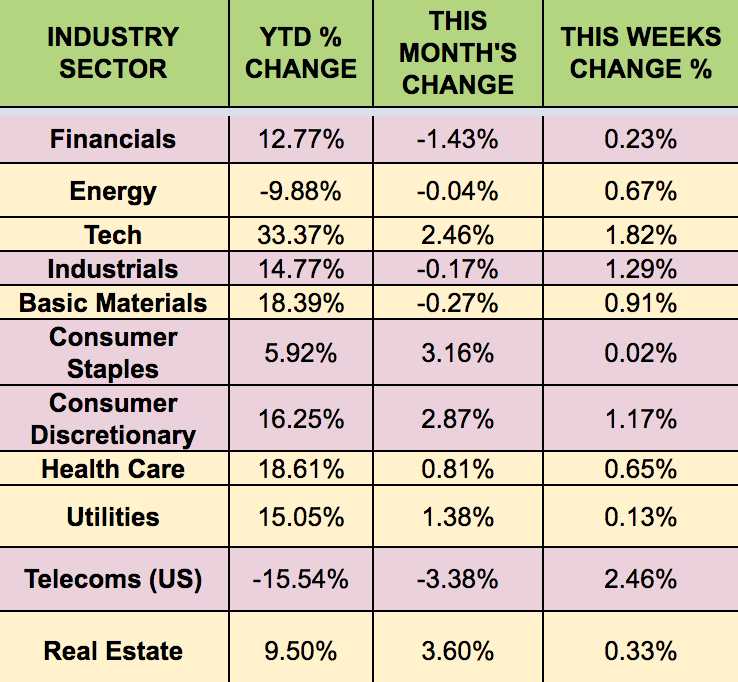

Sectors: The Telecom and Tech sectors led this week, with Utilities trailing.

Futures: WTI Crude rose 4% this week. Natural gas fell 5.62%. Oil rose Friday on speculation that there may be further cuts announced at the 11/30/17 OPEC meeting. Crude was further strengthened by the Keystone oil spill – about 5,000 barrels of oil, or roughly 210,000 gallons, spilled in South Dakota after the leak last Thursday. The pipeline is a key artery that carries crude into the United States from the oil sands of Alberta, carrying about one-fifth of Canadian pipeline imports into the US. Keystone pipeline operator TransCanada said Tuesday that flow from its pipeline to the U.S. would be reduced by 85% through the end of November.

The US EIA also survey also showed that crude stockpiles fell by 1.9 million barrels last week, further adding to the bullish outlook for US crude.