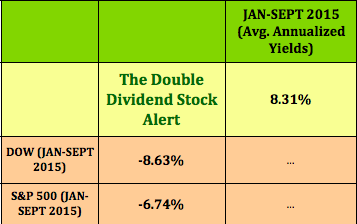

Check out our returns so far in 2015:

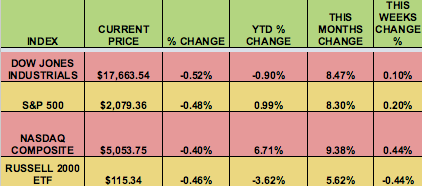

Markets: The S&P had its best month since 2010 this month. All 4 indexes had big gains, but investors favored large caps, as the Russell small caps trailed significantly. With no Fed rate hike to worry about, the market was able to shake off mixed worldwide economic data, and was further buoyed by several upbeat earnings reports from large cap firms.

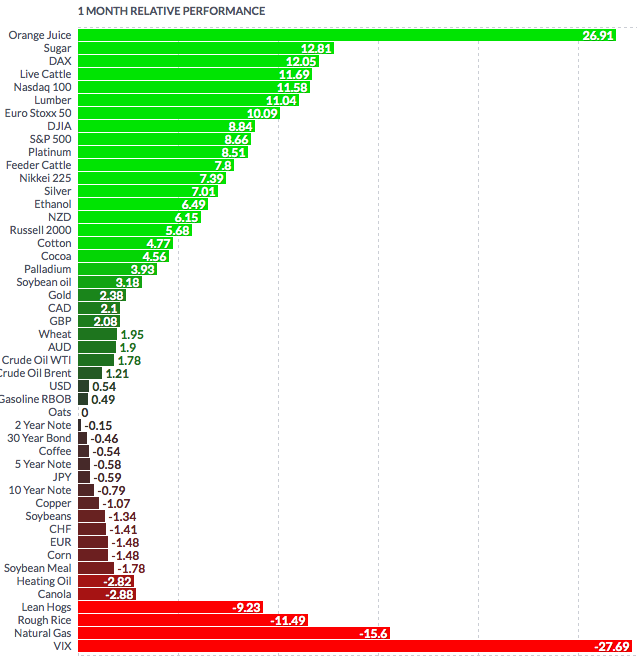

Volatility: The VIX fell 35% in October, opening at 23.14, and closing at 15.07.

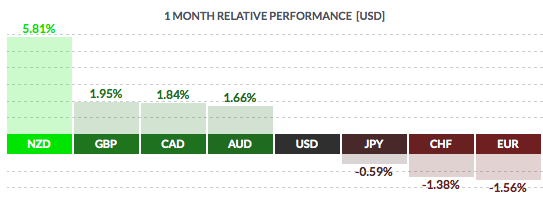

Currency: The dollar was mixed this month, gaining vs. the euro, Swiss franc, and yen, but falling vs. the pound and the 3 commodity-rich nations’ currencies – New Zealand, Australia, and Canada. This decline helped boost Basic Materials and Energy-related stocks.

Market Breadth: 15 of the Dow 30 stocks rose this week, vs. 25 last week. 51% of the S&P 500 rose this week, vs. 68% last week.

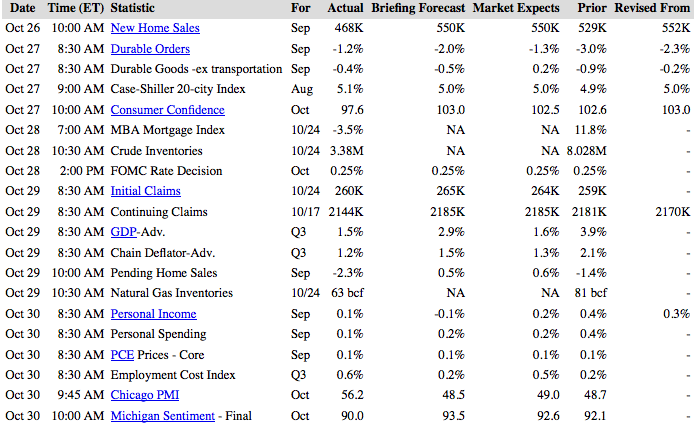

US Economic News: US GDP fell to 1.5% in the 3rd quarter, with export firms hurting contracting due to a strong dollar. Inflation remained tame, with PCE prices up only 0.1%. Consumer Confidence fell to 97.6 from 102.6.

Week Ahead Highlights: Q3 Earnings season rolls on, with 20% of all S&P 500 firms reporting, including Visa (N:V), Qualcomm (O:QCOM), Clorox (N:CLX), Celgene (O:CELG), Berkshire Hathaway (N:BRKa), Time Warner (N:TWX), CBS (N:CBS), and many others. DOW stock Disney (N:DIS) reports on Thursday, and may miss analysts’ consensus estimates – lowered its profit forecast for its cable networks unit in August.

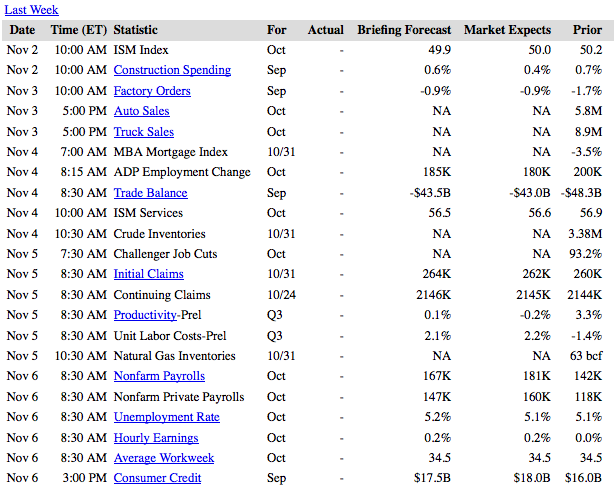

The Non-Farm Weekly Payrolls Report comes out on Friday – ironically, if it’s another weak report. like September’s, it may boost stocks, due to investors betting that slower growth will stay the Fed’s hand in raising rates in Dec. 2015.

Next Week’s US Economic Reports:

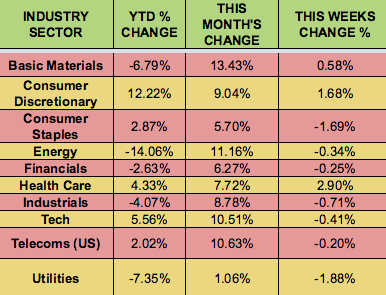

Sectors and Futures:

Basic Materials and Energy, 2 of the weakest sectors in 2015 made mighty comeback in October, as Utilities trailed.

OJ futures rose 27% this month, with Natural Gas falling over 15%, due to warm winter forecasts: