Does Your Portfolio Need More Protection In This Volatile Market

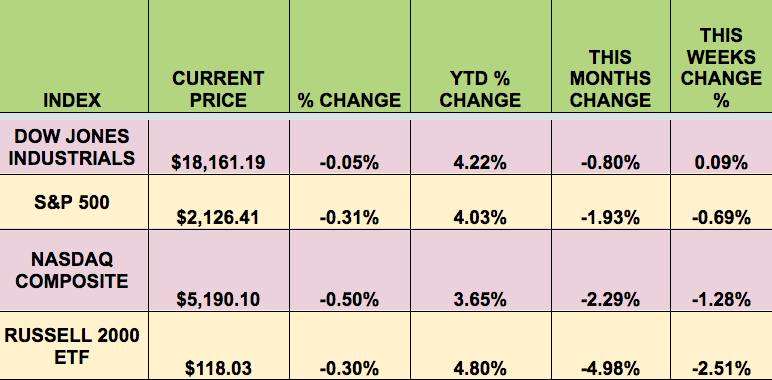

Markets: All 4 indexes fell this week, in the wake of mixed earnings reports, crude oil declines due to a lack of an OPEC production freeze agreement yet, and political volatility fallout from the upcoming election.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: (NYSE:APLE), (NYSE:TRGP), (NYSE:CEQP), (NASDAQ:CPLP), (NASDAQ:MMLP), (NYSE:GLOP), (NASDAQ:GMLP), (NYSE:NAP).

Volatility: The VIX rose 17.6% this week, jumping on Friday, and finishing at $16.19.

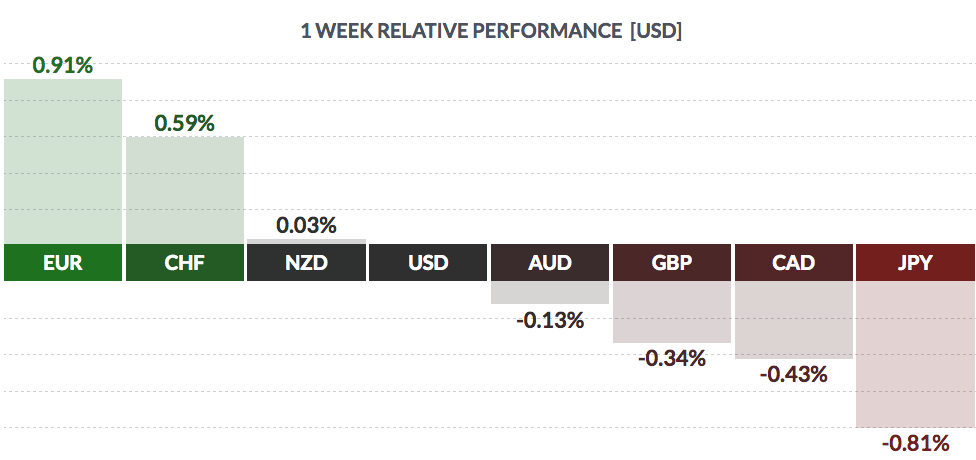

Currency: The dollar rose vs. most other major currencies, except the euro and the Swiss franc.

Market Breadth: 17 of the DOW 30 stocks rose this week, vs. 14 last week. 40% of the S&P 500 rose this week, vs. 56% last week.

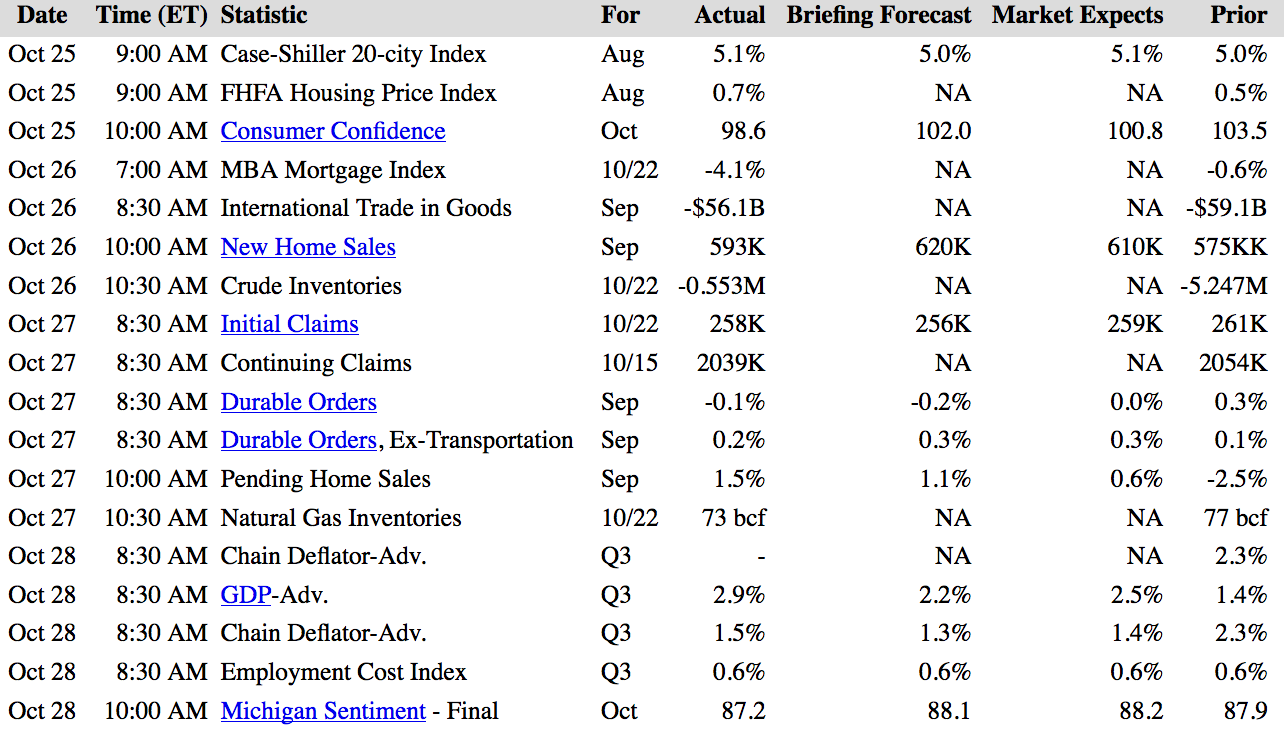

US Economic News: Core Q3 GDP growth of 2.9% surprised to the upside. New Home Sales rose to 593K, close to a 9-year high.

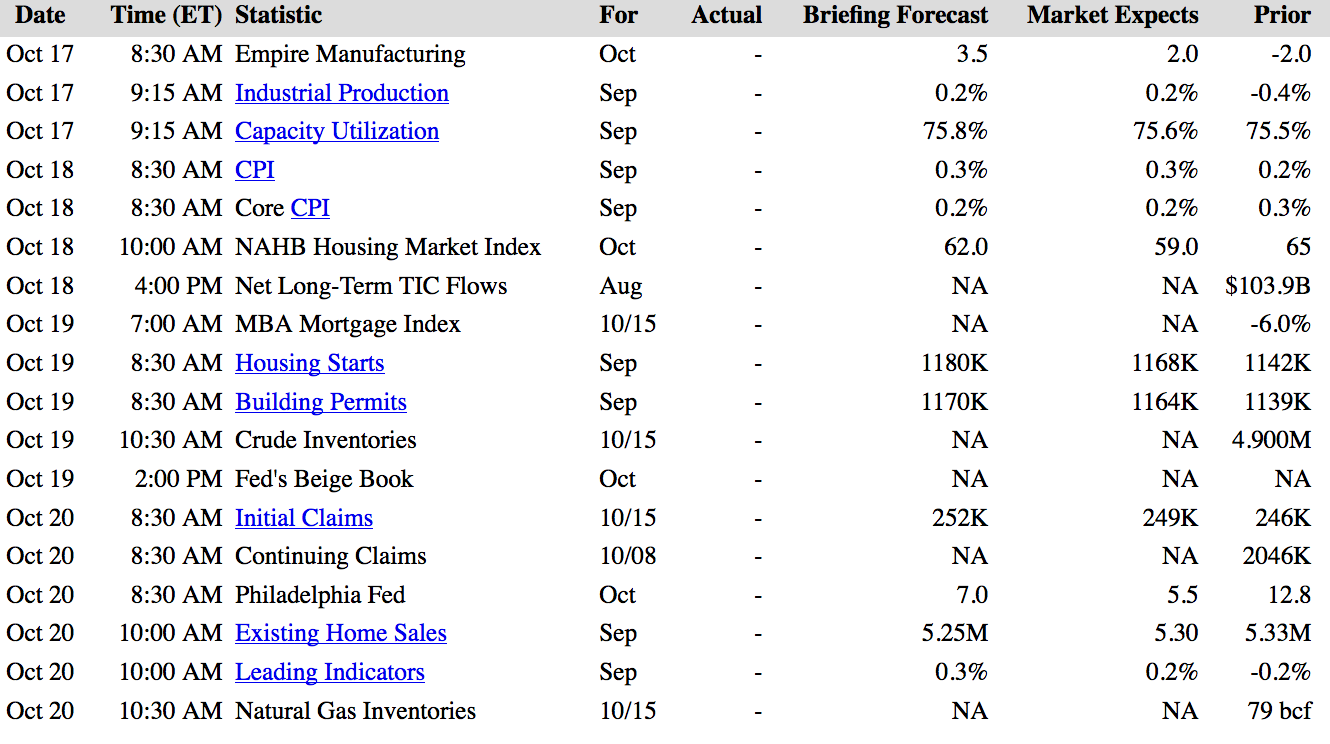

Week Ahead Highlights: The Q3 earnings season rolls on…the Fed meets on Tues-Wed, with very little chance, (10%), of a rate hike. However, any specific hawkish commentary could send markets down again. Futures now place a 75% chance of a December Fed rate hike. It’ll be a data-heavy week.

The Non-Farm Payrolls report comes out on Friday – the last one before the election – projections are for 175K – any radical departure would probably move markets as well, in addition to affecting the election.

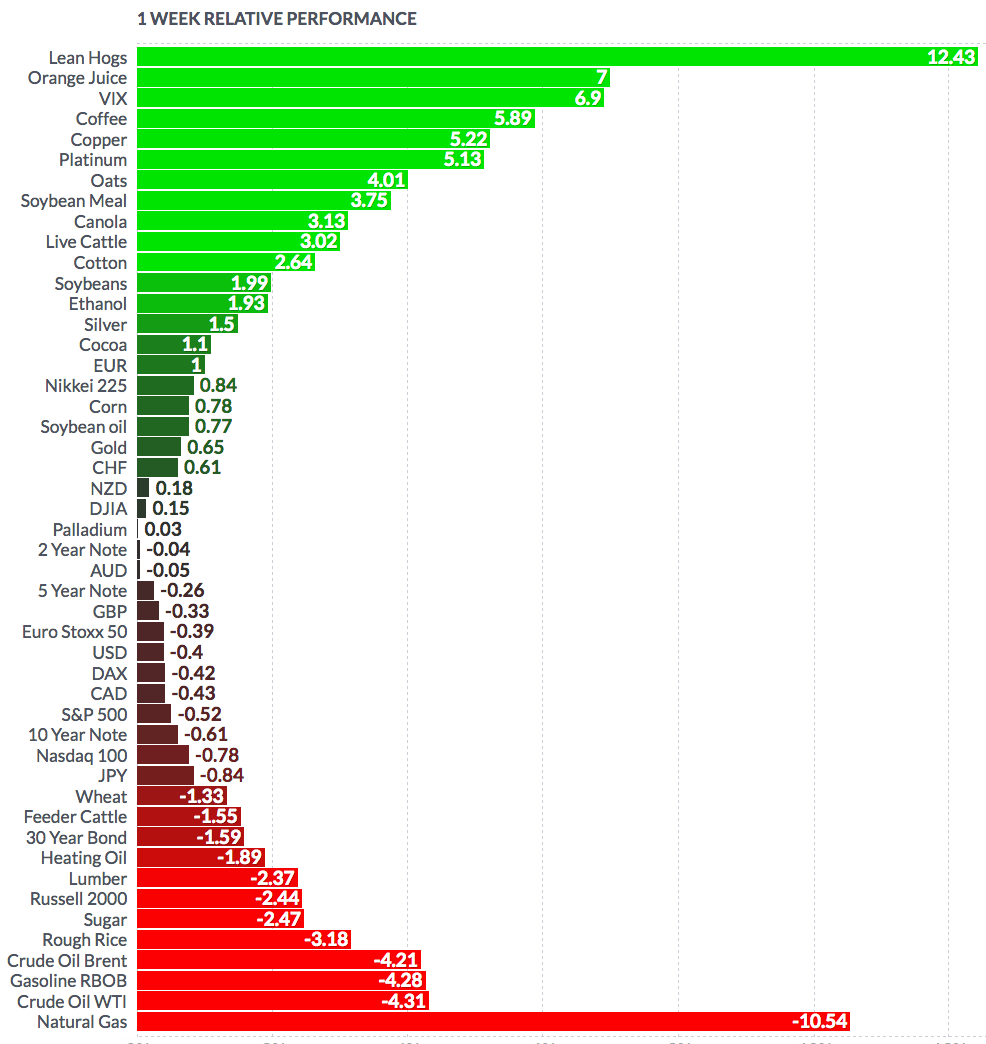

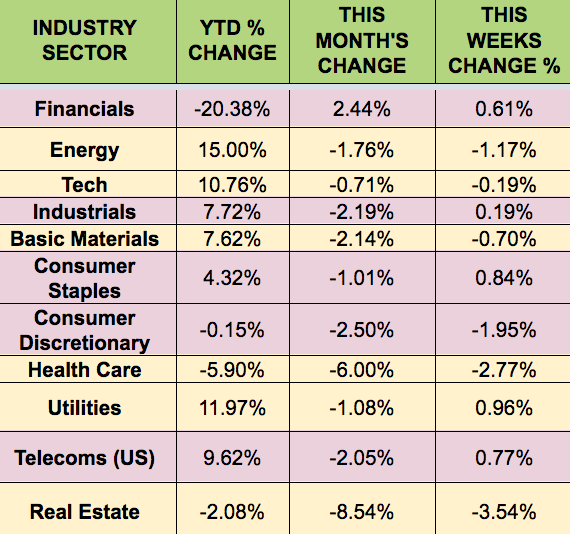

Sectors & Futures: Investors played defense this week – Utilities and Consumer Staples led, with Real Estate and Healthcare trailing. Healthcare sold off on fears of increased regulation from a Clinton victory.

Crude oil futures fell over 4% this week, as OPEC leaders didn’t come forth with any new agreement announcement. Meanwhile porkers led the way, up over 12%: