I know it’s easy to say that Wednesday's market’s reversal was due to news of the new COVID strain in California. It fits with why the market reversed so harshly Intraday, and it is easy to explain. But that’s not the reason why the market fell so sharply yesterday.

Again, Jay Powell was in front of Congress, and again he said that it is appropriate to taper and to talk about tapering faster at the next meeting and getting it wrapped up a few months early.

He said this around 1 hr and 27 minutes into the testimony. Now, the actual talking in the meeting started around 10:10, which means that Powell said these words around 11:35ish, with the market peaking around 11:30. It wasn’t until 1:50 PM when the news “officially” broke of the strain in California. By that point, the S&P 500 was already down nearly 1.5% from its 11:30 high.

I’m not saying the COVID news had nothing to do with it, but COVID is only a tiny portion of what I think is going here. Is it astonishing that the new strain showed up in California? I’d be willing to bet it is here in NY too.

Fed Fund Futures

If the market was worried about COVID and the effects on the economy, why did the Fed funds futures for December 2022 spike by three bps, back to 61 bps? You’d think the odds of a rate hike would cause a fall.

High Yield

What the market is worried about is the Fed tapering faster than it wants them to taper. That’s it.

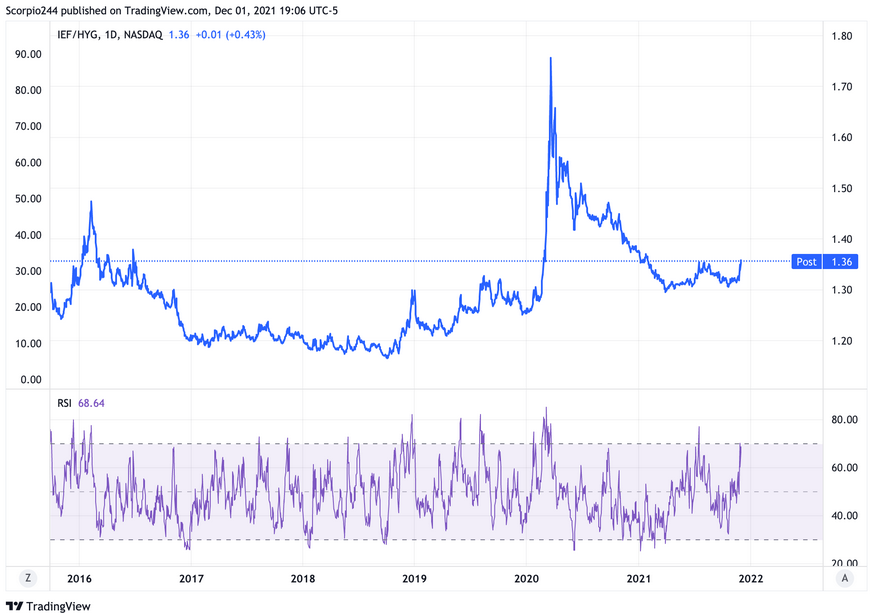

This plan of tapering is faster than expected, and that’s causing financial conditions to tighten. Just look at the iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG); it fell again Wednesday, and the ratio between the IEF and HYG was exploding higher.

The TLT/HYG ratio also broke out in a significant way, clearing a resistance level.

The problem is that the Fed is tapering, and it sounds like it will be much faster into slowing global growth, which on top of it, has another COVID variant. When the Delta virus and three-quarter GDP growth missed expectations by five full-percentage, the market didn’t even think twice about it; it rallied.

But now that the Fed is stepping away, suddenly COVID matters? It is not about COVID; it is about the Fed and what they plan to do. This selling will grow much worse; this will become about how much pain the Fed can endure.

It could easily be a 20% drop from the peak. The S&P 500 needs to fall nearly 10% to get back to the October lows from the highs before the joke seasonality rally started. Another 10% off of the October lows takes you back to 3,800.

S&P 500

The S&P 500 jumped by nearly 2% on the day, filling the gap created from Tuesday's sell-off. Once the gap was filled it resumed the prior trend and fell almost 3.1% from peak to trough.

The S&P 500 fell through support at 4,550 like it didn’t even exist as a support level. The next level of support doesn’t come until 4485, and then 4450, and then 4370. There is a massive gap that needs to be filled at 4,370.

Roku

If yesterday was about COVID, why did a stay-at-home “disruptor” like Roku (NASDAQ:ROKU) get destroyed, falling another 8.7% and nearly 60% off its July highs? Seems odd?

A drop in Roku probably has much more to do with the Fed and the taper; after all, it was the easy financial condition that allowed for Roku’s absurd valuation. At this point, $193 is its next level of support.

Amazon

If this was about COVID and more “lockdowns,” why did “dead money for the past one and a half plus years,” Amazon.com (NASDAQ:AMZN) drop nearly 2% on the day? And is now probably on its way to $3,300.

DJ Internet Index ETF

If this was about COVID, why did the high-flying First Trust Dow Jones Internet Index Fund (NYSE:FDN) fall by 3.4%? This ETF had risen by more than 130% off the March 2020 lows due to COVID. So now COVID isn’t suitable for it? It has a nice triple top too. It is probably going to $208 too.

DocuSign

If this was about COVID, why did DocuSign (NASDAQ:DOCU) fall 6.3%, and now probably looking to fill the gap at $199?

Meta Platforms (Facebook)

Meta Platforms (NASDAQ:FB) got crushed too, and is now falling out of the rising wedge and probably on its way to $300.

It was about the Fed and the market re-pricing risk, and suddenly none of these stocks looked so attractive anymore. Nor does the entire market, for that matter.