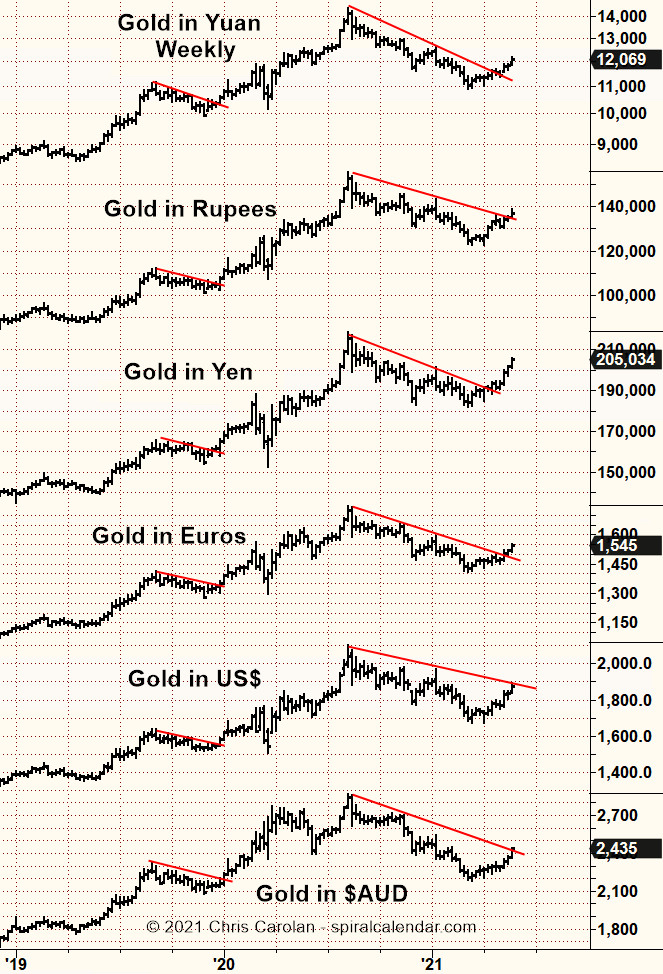

Gold has set up a very strong confluence pattern across multiple foreign currencies recently. This upside confluence pattern suggests that gold has now moved into a much stronger bullish price phase compared to various currency pairs. This upside move in precious metals aligns very well with my broad market cycle phase research. I urge traders/investors to start paying attention as we transition into this new longer-term cycle phase.

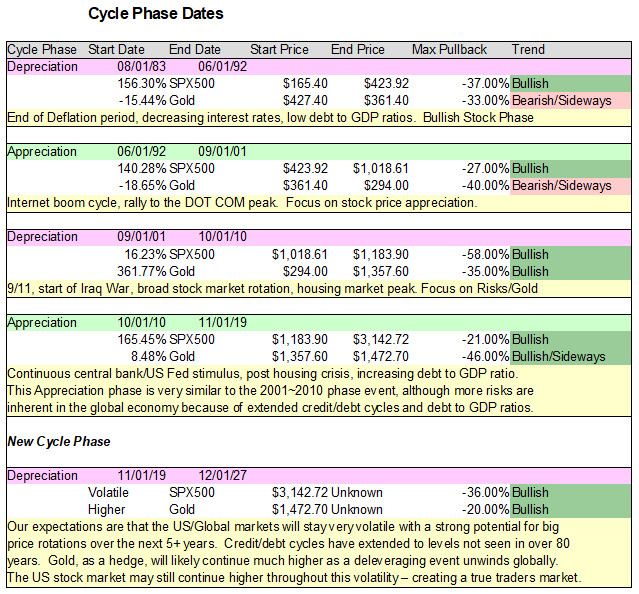

Recently, my team and I published a series of articles related to these longer-term cycle phases and how they related to the current market trends. The biggest concept we want to highlight is that we’ve transitioned away from an Appreciation cycle phase and into the early stages of a Depreciation cycle phase. Often, near this type of transition, the global markets experience a unique type of Excess Phase Peak. This type of price pattern happens because traders/investors are slower to identify the end of a trend and often attempt to continue the Thrill/Euphoric phase of the previous market trend – until the markets prove them wrong.

You can review some of our most recent research posts about these topics here: US Dollar Breaks Below 90 – Continue To Confirm Depreciation Cycle Phase; Bitcoin Completes Phase #3 Of Excess Phase Top Pattern – What Next? and; What To Expect – A Critical Breakout Warning For Gold, Silver & Miners Explained.

Stock Market Cycles

The custom graphic shown below highlights the phases of typical market trends through various stages of market trends. My team and I believe we have crossed the peak level (or are very near to that crossover point) and have begun to move into the Complacency and Anxiety phases of the market trend. As suggested, above, the psychological process for traders/investors at this stage is to hope and plan for the never-ending bullish price trend while the reality of the market trend suggests a transition has already started taking place and the market phase has shifted.

Our research suggests the last Appreciation phase in the market took place from mid/late 2010 to mid/late 2019. That means we started a transition into a Depreciation cycle phase very near to the beginning of 2020. Our belief that a moderate price rotation is pending within the markets stems from the excess phase rally that took place after the COVID-19 virus event. We’ve witnessed the sideways price trend in precious metals over the past 8+ months which suggested that global traders were confident an economic recovery would take place (eventually). Yet, the question before everyone is, as we move away from an Appreciation cycle phase and into a Depreciation cycle phase, what will that recovery look like? Can we expect the recovery to be similar to levels seen in the previous Appreciation cycle phase? Let’s take a look at how these phases translated into trends in the past.

Appreciation and Depreciation Cycle Phases

The first Depreciation cycle phase (1983~1992) took place after an extended deflationary period where the debt to GDP was rather low comparatively. It also took place within a decade or so after the US moved away from the Gold Standard. The strength in trending we saw in the US stock market was directly related to the decreasing interest rates and strong focus on credit/equities growth throughout that phase.

The second Depreciation cycle phase (2001~2010) took place after the DOT COM rally prompted a huge boom cycle in equities and as a series of US/global events rocked the US economy. First, the September 11, 2001 attack in New York, and second, by the engagement in the Iraq War. Additionally, the US Fed was actively supporting the US economy after the 9/11 terrorist attacks, which prompted many American’s to focus on supporting a stronger US economy. This, in turn, prompted a huge rally in the housing market as banks and policies supported a large speculative rally (FOMO) in Real Estate.

The current Depreciation cycle phase (2019~2027+) comes at a time where the US Fed has been actively supporting the US/global economy for more than 11 years and after an incredible rally in Real Estate and the US stock market. Additionally, a new technology, Crypto currencies, has taken off throughout the world as an alternate, decentralized, asset class – somewhat similar to how the DOT COM rally took off. As we’ve seen this incredible rally in global equities, Cryptos, commodities and other assets over the past 7+ years, we believe the last Appreciation cycle phase is transitioning into an Excess Phase Peak (see the Euphoria/Complacency phases above), which may lead to some incredibly volatile price trends in the future.

You may be asking yourself, “how does this translate into precious metals cycles/trends?” after we’ve gone through such a longer-term past cycle phase review…

The recent upside price trends in precious metals are indicative of two things; fear and demand. First, the economic recovery and new technology are increasing demand for certain precious metals and rare earth elements (such as battery and other technology). Second, the move in Gold and Silver recently is related to credit, debt, economic and cycle phase concerns. As we’ve seen Bitcoin move dramatically lower and as we start to move into a sideways price trend in the US stock market, there is very real concern that the past price rally has reached an intermediate Excess Phase Peak.