Was the decline in the first quarter of 2020 a “Black Swan” event? In my 40-years in the business, I don’t think I’ve ever heard the phrase, “this was a Black Swan event” so frequently used.

Was the virus and resulting quarantine a “Black Swan” event? Yes! Should the decline in stocks have been a surprise to stock bulls? I humbly don’t think so and we have been sharing numerous bearish divergences since January of 2019.

What is the truth that the 4-pack above was telling? Fewer and fewer stocks had been holding up the markets for nearly 12-months, as each of these ratios peaked in January of 2019, not January of 2020. These falling ratios were sending a bearish divergence message to stocks for over a year.

Did something like this ever happen in the past, well ahead of a 50% decline in stocks? Yes.

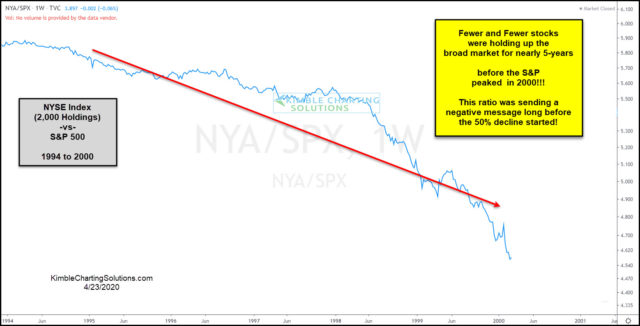

I watched this bearish divergence take place in the late 1990s, prior to the S&P 500 falling 50%.

The NYSE/SPX ratio was sending a bearish message to the broad market, well ahead of the peak in 2000. The 4-pack above was sending the same message to stock bulls for nearly 12-months prior to the peak!

Is the rally of late suggesting the low is in place or is it nothing more than a counter-trend rally in a larger bear market? Watch these ratios going forward, as they often send the truth about the health of the broad markets.