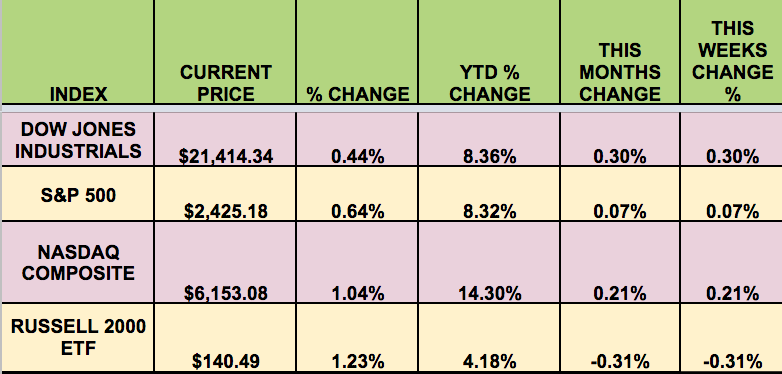

Markets: The market were saved by the bullish payrolls report this week, barrelling out of a deficit with big gains on Friday. Only the Russell small cap posted a weekly loss.

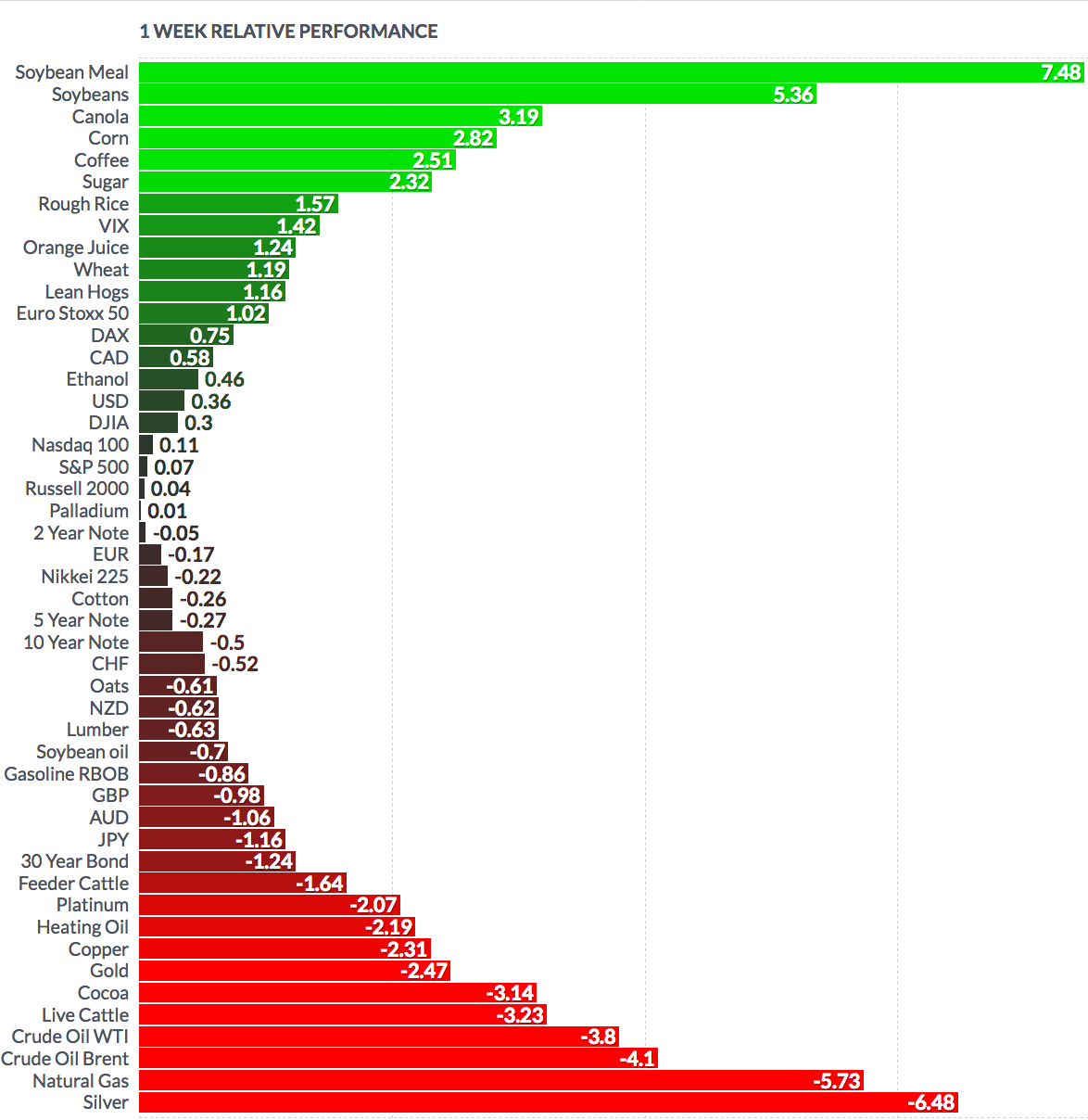

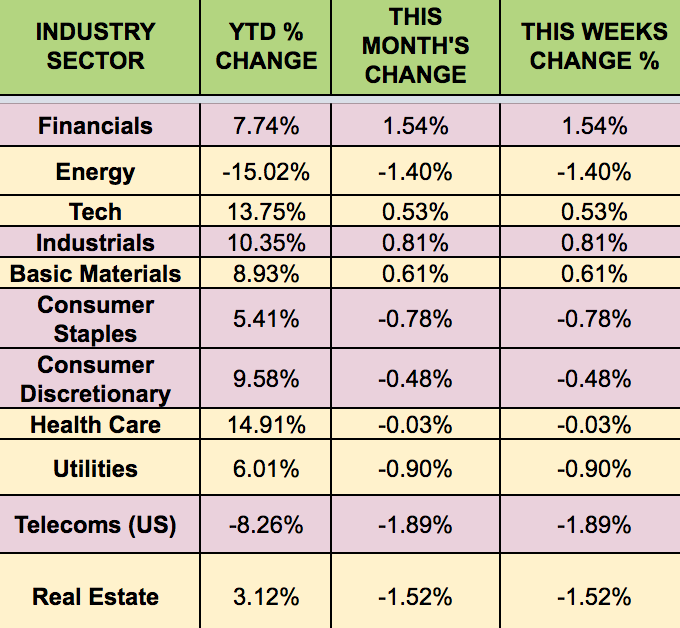

The struggling Tech sector, (the most-heavily weighted sector on the S&P 500), held on to make a modest gain this week, which saw crude futures fall -3.8%.

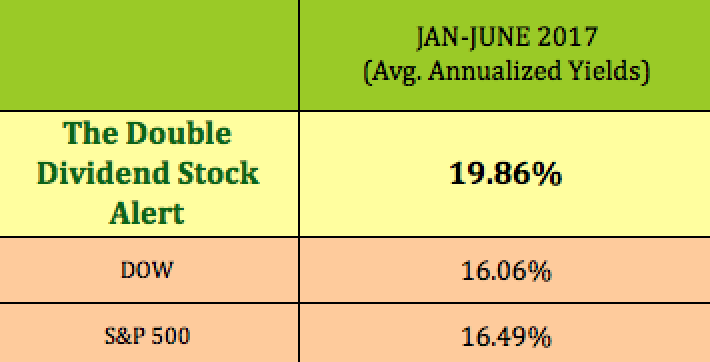

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: CNSL (NASDAQ:CNSL), MN (NYSE:MN).

Volatility: The VIX was flat this week, finishing at $11.19.

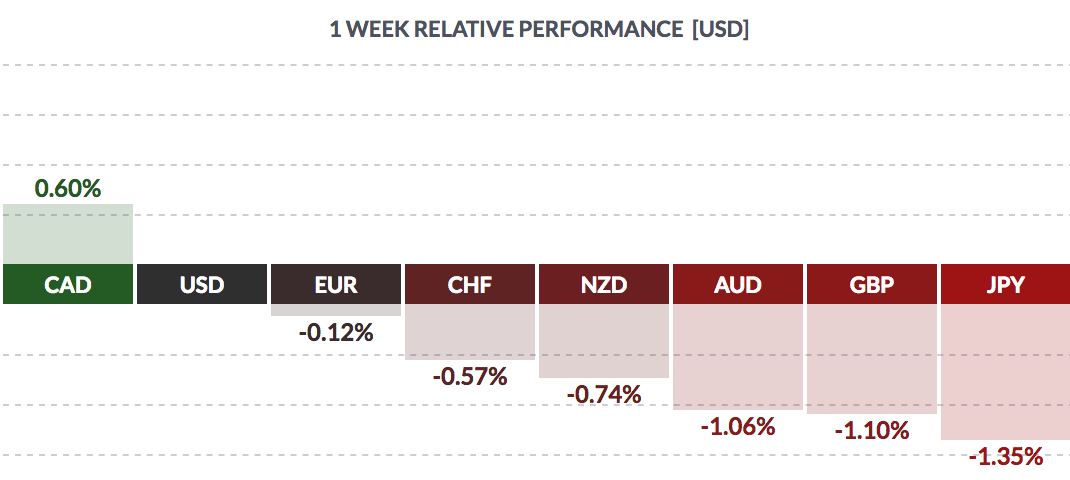

Currency: The USD rose vs. most other major currencies this week except for the loonie:

Market Breadth: 17 of the Dow 30 stocks rose this week, and 56% of the S&P 500 rose.

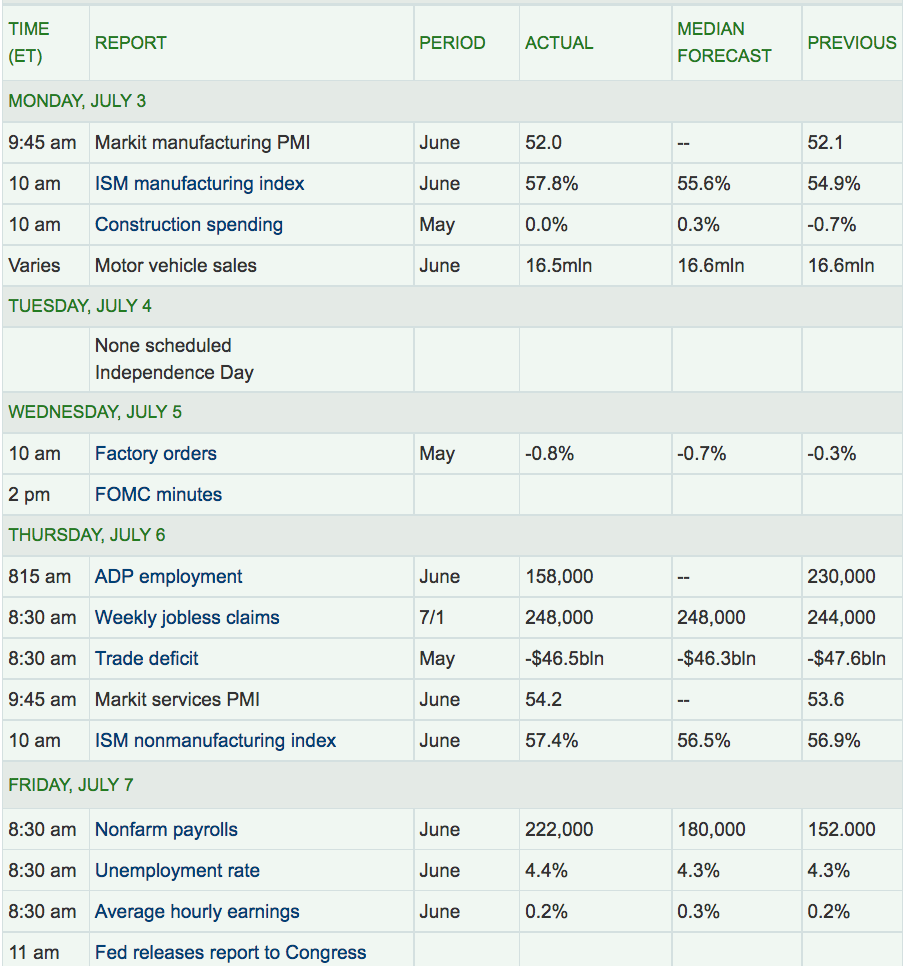

Economic News: The June non-farm Payrolls report surprised to the upside, coming in a 222K, vs. the 180K forecast, while May’s figure was revised upward to 152K. The unemployment rate ticked upward.

The ISM Mfg. Index logged its best number since 2014, at 57.8%.

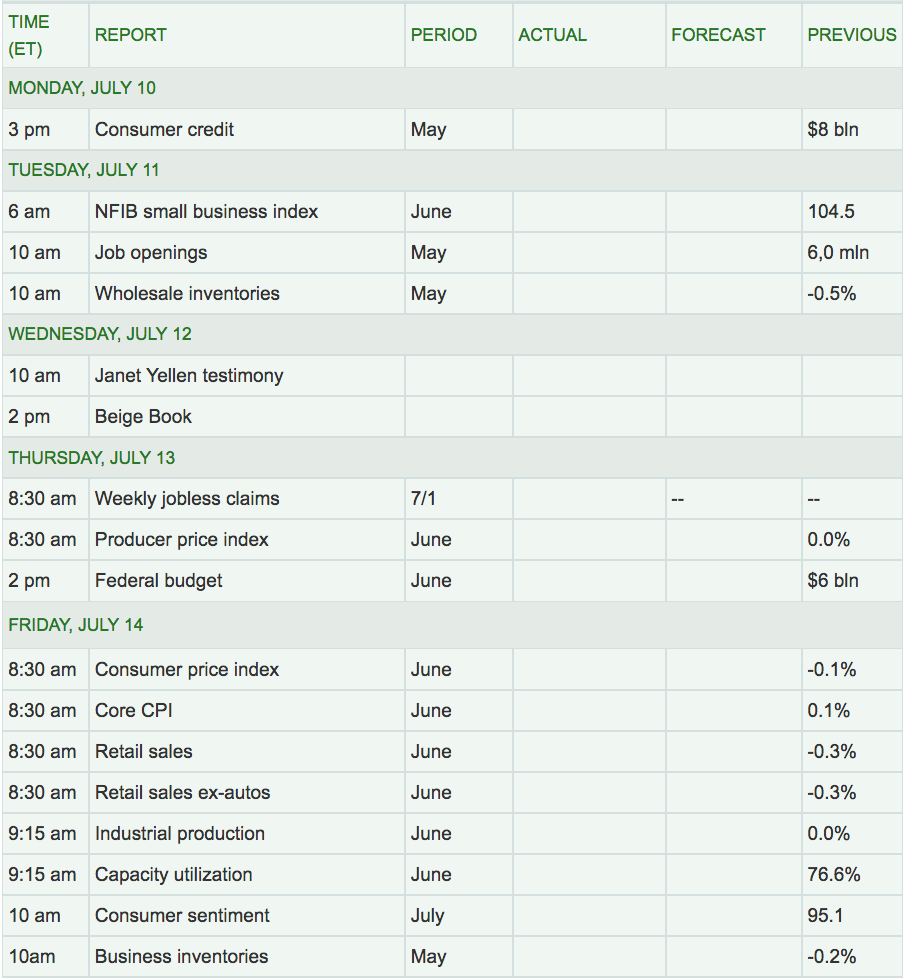

Week Ahead Highlights: Fed chief Yellen speaks before Congress. Q2 earnings season gets underway, with reports coming out from big banks. investors are paying attention to whether the tech sector can follow through with a recent gain and whether oil prices can pull out of a slump.

Next Week’s US Economic Reports: On The consumer will be back in the spotlight, with the Consumer Credit, and Sentiment reports due out, in addition to Retail Sales for June. We’ll get some inflation info on Friday the June CPI report.

Sectors & Futures: Financials led again this week, as Energy, Real Estate and Telecoms trailed.

WTI Crude futures fell -3.8% this week. Natural Gas also fell -5.73% in this week: