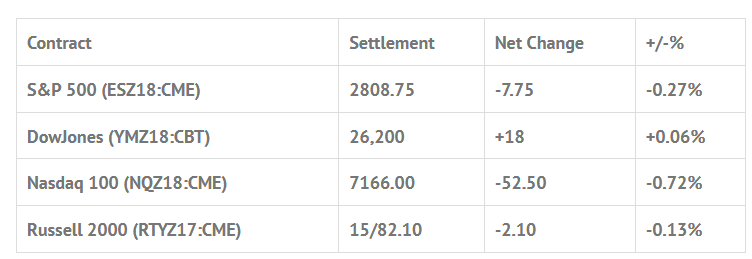

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed lower: Shanghai Comp -1.39%, Hang Seng -2.39%, Nikkei -1.05%

- In Europe 12 out of 13 markets are trading lower: CAC -0.87%, DAX -0.49%, FTSE -0.85%

- Fair Value: S&P +0.80, NASDAQ +9.46, Dow -8.43

- Total Volume: 1.31mil ESZ & 373 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes PPI-FD 8:30 AM ET, John Williams (NYSE:WMB) Speaks 8:30 AM ET, Patrick Harker Speaks 8:50 AM ET, Randal Quarles Speaks 9:00 AM ET, Consumer Sentiment 10:00 AM ET, Wholesale Trade 10:00 AM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: The Powell Put Works Again

After the quietest overnight session since September, the S&P 500 futures opened Thursday’s regular session at 2804.50. The morning low was made two ticks lower at 2804.00, followed by a chop higher up to the 2813.25 morning high, and then a retest of the open before traveling up to the 2815.25 high of day at 11:30.

The afternoon saw a move down to the 2804.00 low of day just ahead of the FOMC announcement, and then a bounce to the afternoon high of 2812.25 heading into 1:30. From there, the ES fell in an orderly fashion, making a low of day at 2795.00, but then rallied into the close of the 1:00 hour.

The final hour saw a bounce to 2805.50, and then a selloff down to 2796.50, before printing 2803.25 on the 3:00 cash close, and settling the day at 2807.25, down -7.00 handles, or -0.25%, after trading as high as 2810.75 following the cash close.

The overall tone of the day was the back and fill that we predicted after a big day up, and the fact that every FOMC day since Powell took over has closed in the red. The other side of it is that the markets are returning to a normal calm after the October volatility.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.