The Stock Exchange is all about trading. Each week we do the following:

- Discuss an important issue for traders;

- highlight several technical trading methods, including current ideas;

- feature advice from top traders and writers; and,

- provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review:

Our previous Stock Exchange asked the question: Do You Trade the 50-Day Moving Average? We noted this metric is used by so many traders that it often serves as a magnet, then support or resistance. But when something sends it through, it hits a lot of stops (for example, the S&P 500 and Nasdaq had been skipping along the top of their 50-Day moving averages for a year, until the uptick in volatility started in February). If you missed it, a glance at your news feed will show that the key points remain relevant.

This Week: How Do You Handle A Losing Streak?

If you’ve been trading long enough, you’ve undoubtedly experienced a losing streak at some point. And the important question is, how do you handle it? Do you make adjustments or stick strictly to your plan? One important key is to not get frustrated and start making silly mistakes such as inappropriate position sizing or risk taking. This is where the psychology of trading comes in (i.e. the classic forces of fear and greed, for example).

The relationship between trading and psychology is a frequently covered topic across financial markets because the two are often so very interconnected. For example, Adam Grimes penned an excellent article earlier this week titled “Thinking about Thinking: Probability and Psychology in the Markets.” In it, Grimes looks at a few practical ways in which psychology can cause brains to “misfire” when we’re trading, particularly with regards to strings of losses. He explains what is obvious to many (i.e. “a string of winners can easily lead to overconfidence and to taking too much risk on the next trade”), but he also explains the less obvious:

“Evolution probably favored cognitive development of paranoia, pattern recognition even when patterns are false, and immediate action.”

It’s an interesting 1,100 word read if you have a few minutes.

One reason traders build trading models (such as the ones we use later in this report) is to help avoid many of the common psychological errors that human traders make (another reason is because models can sift through lots of data much more efficiently than humans). However, as the Reformed Broker points out in his article from Wednesday (“Fear and Greed are Undefeated”):

“Even if a fund is quantitative, rules-based and emotionless in how it operates, the investor flows coming and going into the funds will be as emotionally driven as they are everywhere else.”

It’s a good point, and interesting to think about. He goes on to give an example using CTA investments, whereby he points out an unfortunate case of investors chasing hot money only to wind up disappointed. There was a similarly interesting article in the Wall Street Journal a few months ago (The Morningstar Mirage) whereby the authors tried to poke holes in Morningstar’s popular star ratings because they’re based simply on past performance, and there’s a tendency for mean reversion among top performers (i.e. what outperformed last period, tends to underperform this period). The WSJ article wasn’t exactly fair to Morningstar (or successful in its critique), but it’s another fun read, nonetheless.

Regarding our own trading models, we know, from testing, what to expect. And this helps us hang in there during the inevitable bad streak. It also helps if performance remains strongly positive in periods of relative underperformance, especially considering the returns have a lower correlation with the market, a powerful risk-reducing diversification benefit.

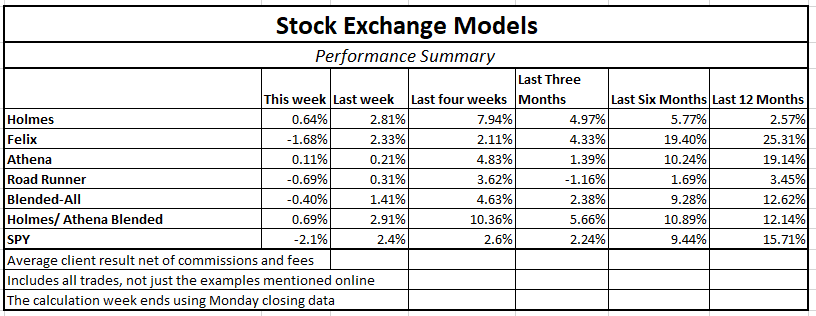

Model Performance:

Per reader feedback, we’re continuing to share the performance of our trading models.

And as alluded to earlier, we find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

And for these reasons, I am changing the “Trade with Jeff” offer at Seeking Alpha to include a 50-50 split between Holmes and Athena. Current participants have already agreed to this. Since our costs on Athena are lower, we have also lowered the fees for the combination.

If you have been thinking about giving it a try, click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

This week’s Stock Exchange is being edited by Blue Harbinger; (Blue Harbinger is a source for independent investment ideas).

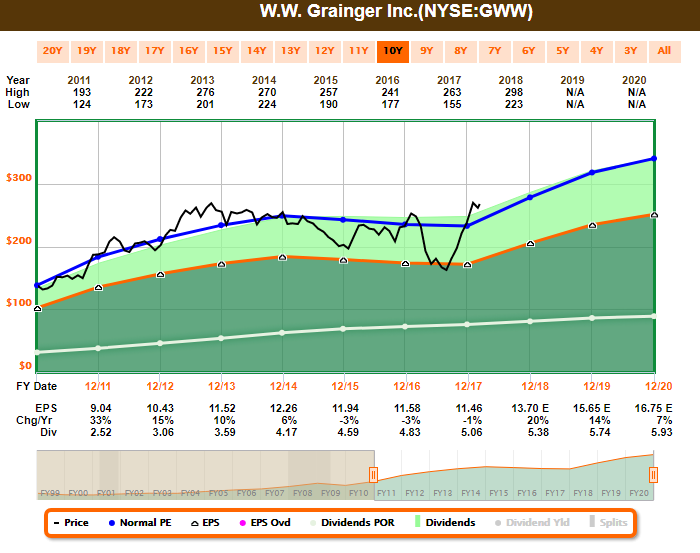

Holmes: I recently purchased WW Grainger (NYSE:GWW) on March 1st, when it was down. What do you think of this stock?

Blue Harbinger: Grainger is a distributor of maintenance, repair and operating (“MRO”) supplies to businesses and institutions, and the company has increased its dividend every year for more than 45 years in a row. Here is a look at the Fast Graph.

Holmes: That’d be interesting if I was a dividend growth investor, but I am technical model, and I typically hold my positions for about six weeks.

BH: Well, Grainger announces earnings in a little over 5-weeks, so I’m sure you are aware of that because earnings announcement can cause the price to move significantly. By the way, why did you buy Grainger?

Holmes: I am well-aware of the upcoming earnings announcement. And I like these shares because I am a “dip-buyer,” and Grainger’s dip over the last week is the sort of set up I like to see.

BH: Honestly, this looks like a really boring company to me. It’s a low beta stock and the company was founded back in 1927. The shares have perked up a little since you purchased, perhaps because investors liked what Grainger said at the Raymond James Institutional Investor conference back on March 6th. I’m surprised you bought this one, Holmes, but I do see the dip you’re talking about. I’ll check back with you on this one in about 6-weeks.

Holmes: Thanks. How about you, Road Runner, what do you like this week?

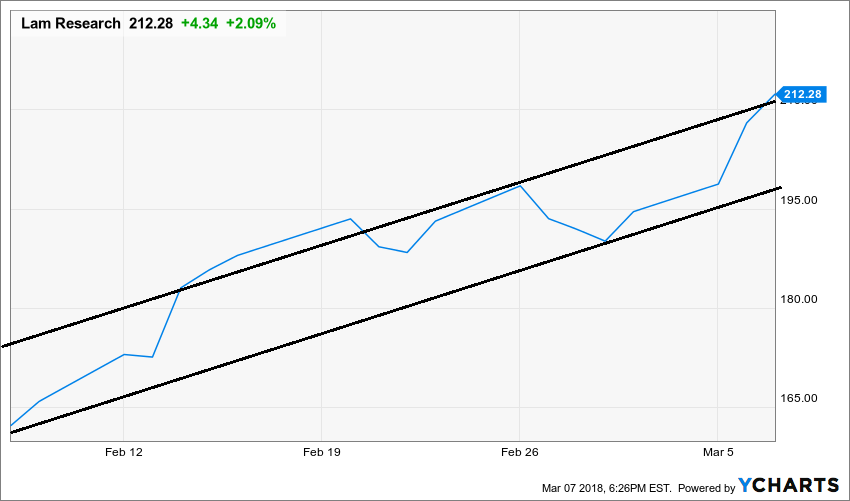

Road Runner: I bought Lam Research (NASDAQ:LRCX) on 3/1. What do you think?

BH: The shares are up since you bought, so nice job. Why did you buy?

RR: I like to buy stocks at the low end of a rising channel, as LRCX was back on 3/1 when we bought, as shown in the following chart.

BH: I actually like that purchase, but I’m partial to the semiconductor industry, in general. I still think that old story about computers eventually taking over the world has merit, and the computers are going to be powered by semiconductor chips. It’s already happening with all the artificial intelligence, self-driving vehicles, and the Internet of Things.

Road Runner: Interesting. You haven’t been working a little too hard lately, BH, have you? And if the computers do take over the world, I’ll be out of this trade long before then. I typically hold for about four weeks.

BH: Thanks. Interesting trade, Road Runner. And by the way, we wrote about man versus machine in this Stock Exchange Series a few months ago: Stock Exchange: What Can Traders Learn From Poker AI?

Road Runner: Earlier in this report we covered cognitive paranoia—re-read it.

BH: Thanks Road Runner. How about you, Felix—what have you got this week?

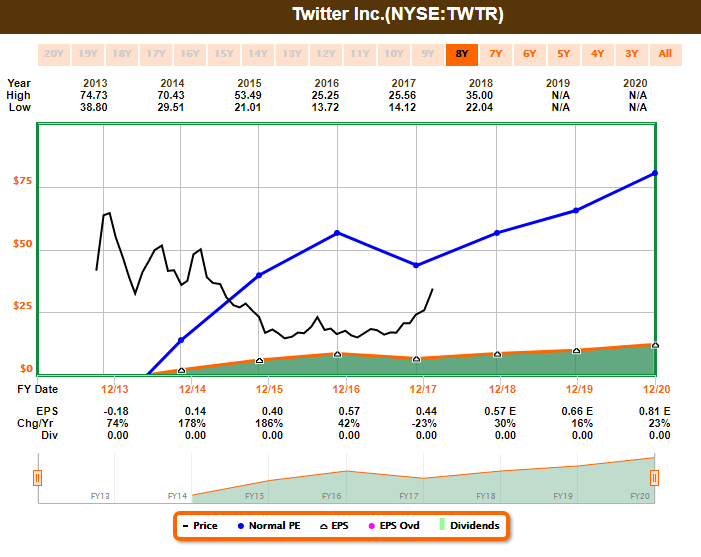

Felix: I bought Twitter Inc (NYSE:TWTR) on 3/5. I am a momentum trader. What do you think?

BH: Twitter is certainly a momentum stock lately. I seem to recall Athena also bought Twitter back on 2/22. Per Twitter’s recent earnings announcement, it’s nice to see the company finally turning a GAAP profit for the first time. However, I don’t think this company is growing fast enough to get excited about. According to the earnings release, fourth quarter revenue grew by only 2% year over year, and net margins are only 12%. Plus, it makes me a little uncomfortable that CEO Jack Dorsey is also the CEO of Square (NYSE:SQ). I question his focus. And honestly, I like Square’s business and growth potential much more. Here is a look at the Fast Graph for Twitter.

Felix: I typically hold my positions for about 66-weeks, which is significantly longer than the other traders.

BH: Good luck. Anything else for us this week?

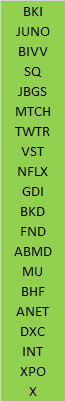

Felix: Yes, here is my ranking of the top stocks in the Russell 1000 Large Cap index:

BH: Thanks for sharing. Lots to talk about in that ranking. I see you like Square Inc (NYSE:SQ), semiconductor industry company Micron Technology Inc (NASDAQ:MU), and US Steel (NYSE:X)—Jeff has covered the steel tariff twice in the last week:

Felix: Thanks. How about you, Oscar—what do you have to share?

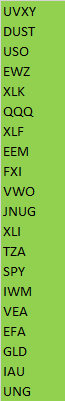

Oscar: This week I am sharing my top 20 ranking of the high volume ETF universe.

BH: I see you have the Ultra VIX Short Term Futures ETF (NYSE:UVXY) ranked at the top of your list. Those volatility-based ETFs are tricky, especially with that spike in the VIX a month ago that surprised me, and a lot of others too. I know you are a momentum trader, and you typically hold for about 6-weeks. I’ll keep an eye on UVXY, as well as a few others on your list. Thanks for sharing.

Conclusion:

No one gets their trades right all of the time. The trick is to make more money on your winners than you lose on your losers. And the matter of accomplishing that can be inhibited if you let the psychology of a losing streak get in your way. All serious traders have experienced a string of losing trades at some point. And it is critically important to understand the common causes of psychological “misfires” that can result (e.g. fear, greed), so you are prepared to deal with them and ultimately return to growing your profits.

Background On The Stock Exchange:

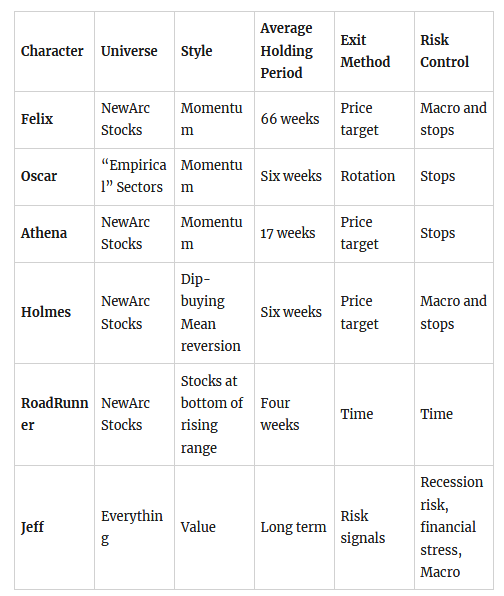

Each week, Felix and Oscar host a poker game for some of their friends. Since they are all traders, they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check out Background on the Stock Exchange for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am usually the only human present and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities.

Stock Exchange Character Guide:

Getting Updates:

Readers are welcome to suggest individual stocks and/or ETFs to be added to our model lists. We keep a running list of all securities our readers recommend, and we share the results within this weekly “Stock Exchange” series when feasible. Send your ideas to “etf at newarc dot com.” Also, we will share additional information about the models, including test data, with those interested in investing. Suggestions and comments about this weekly “Stock Exchange” report are welcome.