Perhaps as long as China is cutting rates and Europe is buying asset-backed securities – and as long as the U.S. maintains its policy of zero percent interest rates – investors can ignore traditional risk in stock assets. Then again, contrarian assessments suggest that participants are closing in on euphoric extremes and credit spreads are beginning to widen again.

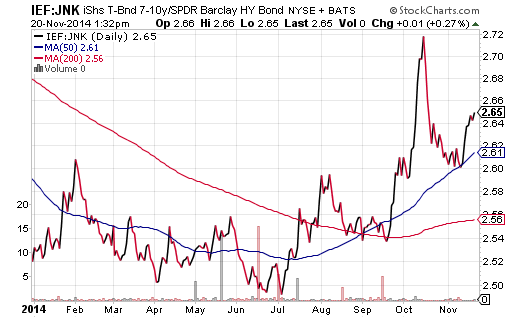

Consider the preference investors have shown for investment grade government debt over comparable high-yielding corporate bonds. While spreads hit a peak at the bottom of the mid-October stock correction, they stabilized near early October levels. Lately, they’ve been creeping higher. This is easily visualized in the iShares 7-10 Year Treasury ETF (ARCA:IEF):SPDR Barclay High Yield Bond (ARCA:JNK) price ratio below.

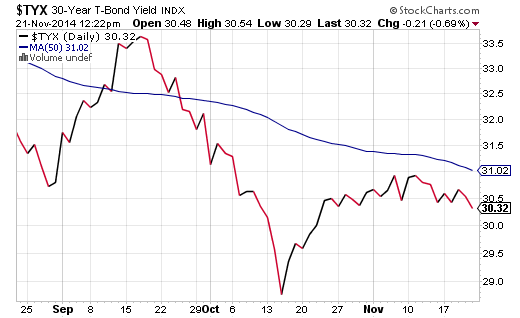

Still another way of investigating investor appetite for risk is to look at the U.S. 30-Year Treasury yield. When stocks rapidly corrected from the mid-September stock highs (9/18) to the mid-October stock lows (10/16), the S&P 500 fell 9.8% on an intra-day basis. The heralded benchmark has since gone on to set all-time records. In complete contrast, the 30-year yield approximated 3.35% at the September stock peak.

With stocks recovering all of their correction losses – with investor surveys expressing remarkably high levels of bullish, “risk-on” optimism – why have bond yields failed to revisit the levels that they had previously occupied? On the contrary. The 30-year yield has settled in around 3.03% for an entire month – 30 basis points lower than before the October swoon.

In truth, long-term Treasuries have been a success story throughout 2014. Better yet, those who recognized the premises behind my year-long call for falling rates benefited handsomely with funds such as Vanguard Extended Duration Treasury ETF (NYSE:EDV) and/or Pimco 20+ Zero Coupon US Treasury ETF (NYSE:ZROZ). It is not that I have been wearing a bearish equity cap; rather, I proposed a barbell approach that combined long-dated Treasury ETFs on the left and larger-capitalization stock ETFs on the right, including iShares USA Minimum Volatility ETF (NYSE:USMV), SPDR Select Health Care ETF (ARCA:XLV) and iShares S&P 100 (NYSE:OEF). I had been less inclined to load up on assets along the “handle of the barbell” such as high-yield bonds. The risk-adjusted performance of the approach is self-evident.

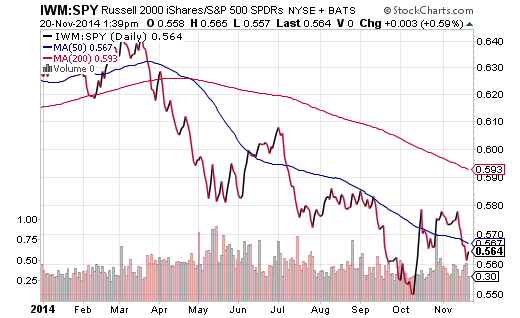

Perhaps ironically, widening credit spreads is not the only cautionary sign for stocks. In September, high-yield bond losses had been accompanied by emerging market stock declines, commodity price depreciation and small-cap underperformance. Emergers and commodities may be bouncing back due to rate cut stimulus in China – its first in two years. However, small-cap underachievement via iShares Russell 2000 Index ETF (ARCA:IWM) has reappeared here in November. (See the price ratio below.)

Again, I am not calling for a bearish retreat. We may see an increase in volatility. We may see end-of-the year window dressing. We may even see a rush to get involved by retail investors with too much cash on the sidelines.

Nevertheless, I believe it is critical to have an exit strategy and/or a beneficial hedge to reduce the risk of a crack in one’s stock armor. The barbell approach using long-dated Treasuries has been an effective hedge throughout the year. In fact, long maturity bonds of this nature are part of the FTSE Multi-Asset Stock Hedge Index that I recently developed and introduced. Another means for tackling stock uncertainty is through the disciplined use of stop-limit loss orders and trend analysis.

Keep in mind, hold-n-hope only looks good near the top of the mountain. Stocks may be a primary wealth-building ticket, but the math behind 50% bear market disasters adversely impacts one’s ability to maintain a standard of living in retirement. Financial freedom is rooted in eliminating the big loss.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.