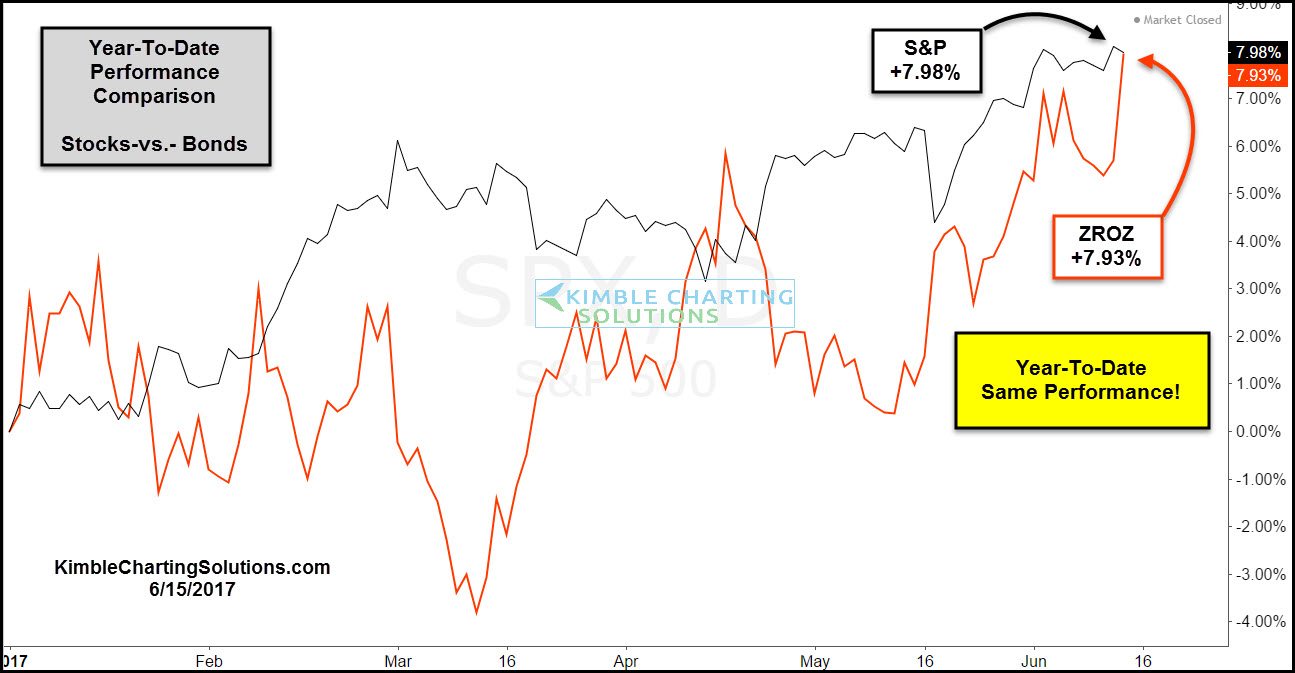

When it come to performance so far this year, would one be better off owning the S&P 500 or Long-Term Zero coupon bonds? Below compares the S&P 500 to PIMCO Year Zero Coupon bonds (NYSE:ZROZ). So far this year, both have done well and pretty much have the same returns!

Below looks at the Stock/Bond ratio (SPX/ZROZ), using the two assets from above. The ratio in our humble opinion, could be creating an important pattern, that could impact stocks and bonds.

The ratio put in a high back in 2014 and when it broke support at (1), bonds out performed stocks by a large percentage for the next year. Moving forward to the past few months, the ratio could be creating a topping pattern (head & shoulders top) at the same highs at it hit in 2014, at line (2).

A dual support test is in play at (3) above, that needs to hold to send a bullish message to the ratio and stocks. If support would give way at (3), it could be suggesting that bonds could out perform stocks for a period of time.

The Power of the Pattern is of the opinion that what happens at (3), could send an important message about portfolio construction going forward.