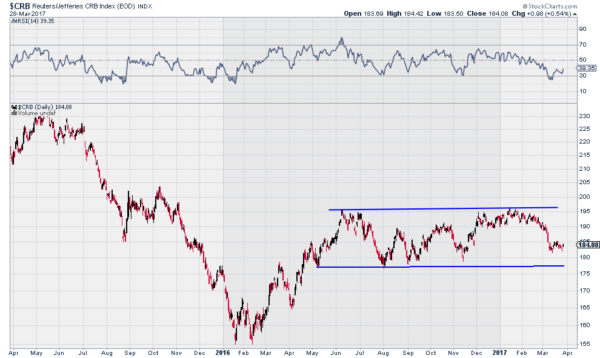

A month ago I wrote here about how, from a commodity perspective, that inflation expectations were already in check. The CRB Index had leveled and it was questionable if the Fed needed to raise rates. The Bond market and specifically Fed Funds Futures market disagreed, nearly fully pricing in a hike. A couple of weeks later they did raise rates, with only one dissenter on the FOMC.

Come forward to today and the CRB Index is off 5% from a month ago. And Fed Governors are still biased towards 2 or 3 more rate hikes this year. Of course that is data driven. The Fed needs to keep a staunch stance, but the market seems to view the data a bit differently. From this it should not surprise that Bond prices have risen since the rate hike.

Will this continue longer term? That is the million dollar question. Bonds sold off sharply the last Quarter of 2016. But they have been moving in a tight range ever since. This includes the recent run up after the rate hike. They sat at the bottom of the range, starting to break down, the day before the hike. The move higher has still not tested the top of the range. From a broader perspective, Bonds have not really moved higher, just marked more time. What will be the catalyst that moves them out of the range?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.