South Korea's June inflation print is low, but this is actually a regional issue

Despite higher oil prices, Korean inflation remains subdued.

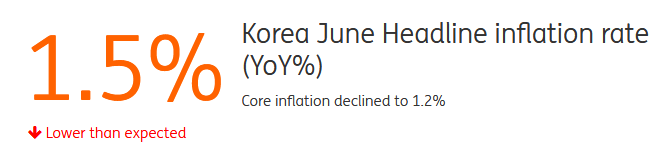

Korean consumer price inflation (CPI) for June rose 1.5%, unchanged from May, though the core rate of inflation slowed to 1.2% from 1.3%. The price level actually declined by 0.2%MoM. and looking at the underlying contributors would almost certainly have delivered an even lower inflation figure had it not been for the effect of rising crude oil prices pushing up vehicle fuel costs.

Perhaps this is just as well because over the coming months, the Korean won's weakness could suck in a little more inflation, as could other Asian currencies, all of which have been weak in recent months.

Ordinarily, this might have us responding by forecasting more rate increases from the regional central banks, and adding in some weaker domestic demand as these rates bit down on spending. In some economies, notably the balance of payment deficit economies of Indonesia, Philippines and India, rates have indeed been rising. Indeed, the Indonesian Finance Minister recently remarked that this would weigh on growth and that this would be tolerated. To do otherwise would simply suck in more imports and worsen the external balance...which is the original reason for the currency weakness. These three economies also have higher prevailing inflation rates than their Asian neighbors. Though none of them, in my view, have a particularly severe inflation issue currently.

Elsewhere, Asia is lucky that inflation is really not a problem at all for policy setters. On the contrary, before this recent episode of currency weakness, the lack of inflation was one of the most obvious features of Asian economies, despite reasonable growth.

In other words, there is a buffer here. Currencies can weaken further if the trade war intensifies, as I believe it will, and for most of the regional economies. And inflation may tick up a little. But this need not result in any offsetting action. Korea, for example, does not look like it will need to trouble its central bank for any tighter policy until next year. For now, that view remains fairly safe.

RBA - no hike today, tomorrow, and maybe next year

The RBA meets today, in what many will imagine will be a really uneventful meeting. No change in policy, no hints about a probable future move in policy and little new to say on the economy, will likely sum up this meeting. But there is an outside chance (a very, very small one) that RBA Governor Lowe will take a leaf out of the RBNZ's book, and add in two-way risk to the rate outlook.

I think this would be more likely to occur if the AUD were stronger now than 0.733 rate and weakening. It would also be more likely if the economy were notably weaker - recent data have been mixed, but by no means bad. So I would say it is very unlikely that Lowe will follow Orr's example. But for an otherwise hugely uneventful meeting, this is perhaps the only likely avenue for a market surprise.

Content Disclaimer:The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. For our full disclaimer please click here.