The State Of The Market

To be sure, stocks of almost all sizes, colors and shapes have been looking ahead to better days recently. Days when the COVID vaccination process has been completed. Days when social distancing is a distant memory. Days when you don't have to make sure you've got several masks stashed in each car. And days when the economy can return to some form of normalcy.

I think it is safe to say that while the "new normal" is likely to have some semblance of what normal once looked like, many things will be different going forward. For example, my guess is a lot more people will wind up working from home a lot more than they had in the past. I could go on and on here. But in short, I'm thinking that many of the habits that folks developed during the pandemic lockdowns are likely to stick around.

The key point on this first Monday of the new year, is the stock market appears to be betting that the new normal economy is going to look at least as good, if not better than, the old normal economy. Which, in turn, suggests that corporate profits should improve in lock step. In fact, the consensus estimate for S&P 500 operating earnings per share in 2021 is projected to be a new record high.

This, in and of itself, is quite a feat given the plunge in earnings that occurred in 2020. According to Ned Davis Research Group, 2020's EPS will come in at around $120.81, which is a far cry from 2019's $157.12. But the good news is that the consensus estimate suggests that operating earnings will improve to about $167 this year.

So, with earnings projected to hit all-time highs, it makes sense that the stock market would do the same, right?

However, the math here gets a little tough to follow – at least on a back-of-the-napkin analysis standpoint. For example, the S&P 500 gained 16.5% in 2020, while operating EPS went from $157.12 at the end of 2019 to $120.81 at the end of 2020. Yes, I get it. And I do understand that investors have decided to "throw out" 2020 and instead look past the forced economic shutdown to better days.

My problem is that stocks appear to be "pulling forward" much (if not all) of the good stuff that is supposed to happen on the earnings front in 2021. As such, I fear that at some point, reality may set in and stocks will have to either "correct" or rest a while to let earnings growth catch up to the already elevated prices.

So, given that Wall Street has a penchant for overdoing everything – in both directions – my guess is that the "looking ahead" party may rage a while longer. But, given that the earnings reality will eventually have to show up in order to justify the level of prices, my guess is that the stock market gains seen in 2021 are likely to be front-loaded.

Put another way, unless the economy and, in turn, earnings, surprise to the upside, I'm thinking the current good times will last until reality sets in and a correction ensues – maybe in late spring. From there, the market could easily become a see-saw affair until investors start to get a whiff of the next growth phase. Which, of course, will allow the cycle of "looking ahead" to continue.

We shall see. In any event, I think it is important to recognize that while the current run for the roses can certainly continue for some time, it has also increased the risk in the market. Remember, as the saying goes, trees don't grow to the sky.

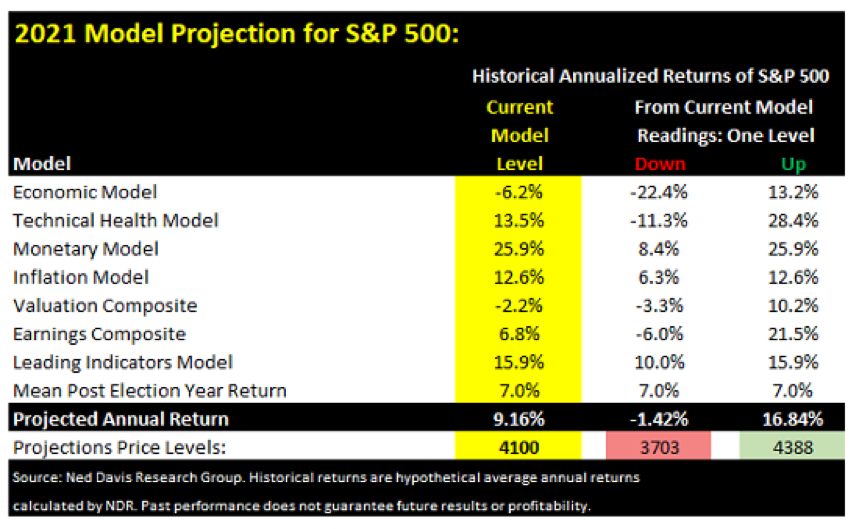

Update: 2021 'Just For Fun' S&P Projection

A couple weeks back, I provided my Just For Fun: 2021 Stock Market Projection. Based on the current readings of my market models, I projected that the S&P would close out 2021 at about 4000 (3998 to be exact). However, given that the market rallied another 2.5% since I made the projection, I figured I had best update my model. You know, so that this time next year, we can all have a good laugh!

Based on the year-end close of 3756, the new "proguesstimate" for the close of 2021 is a nice, round 4,100. See below for the details.

Now let's turn to the state of my favorite big-picture market models...

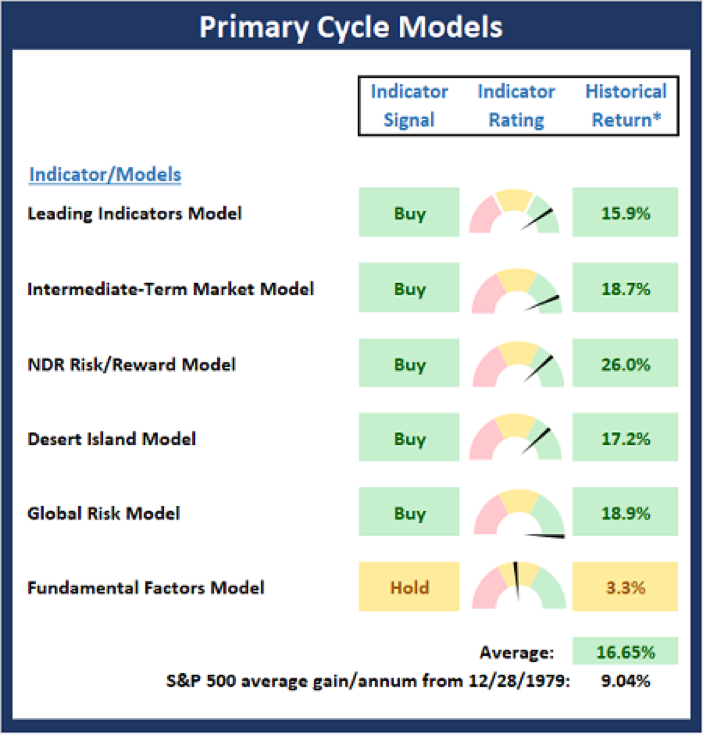

The Big-Picture Market Models

There are no changes to report on the Primary Cycle board this week. From my seat, the board tells me to favor the bulls and to utilize a "buy the dips" strategy whenever weakness occurs.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

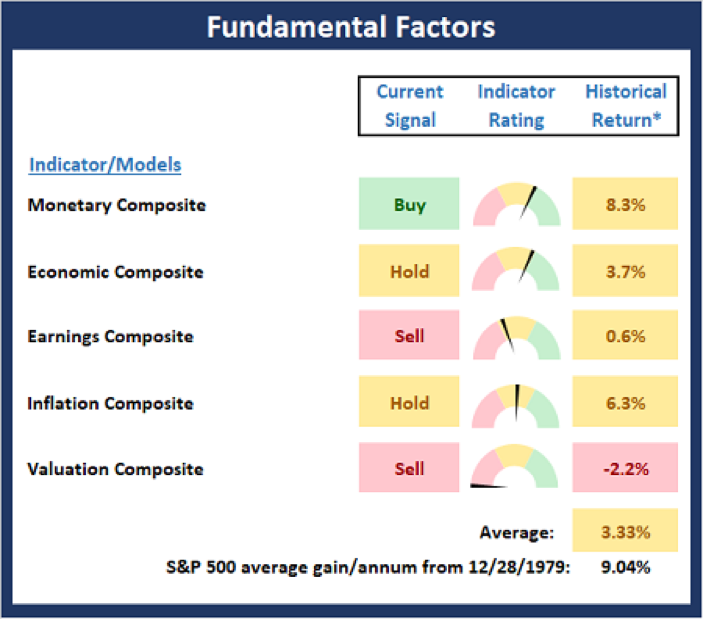

Fundamental Factor Models

While the market continues to look ahead to "shots in arms" and a return to economic normalcy, the Fundamental board reflects a weakening fundamental backdrop. From a near-term perspective standpoint, this means little-to-nothing. And it is important to remember that bull markets can run far beyond the fundamental settings. However, I believe the message from Fundamental Board is that risk is elevated.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

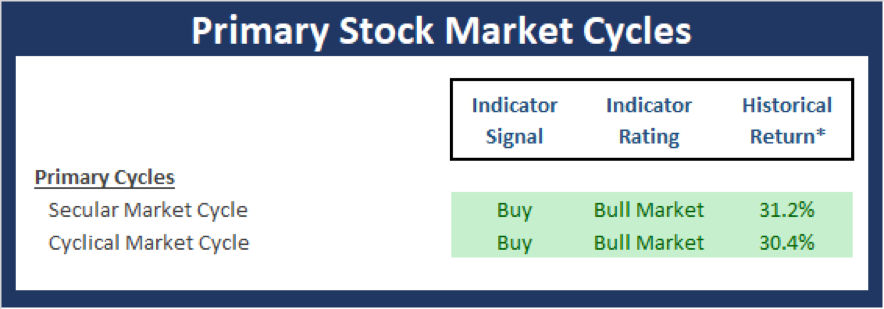

"Primary" Cycle History

While I don't often make portfolio adjustments based on the long-term trends in the stock market (aka the "primary cycles"), I have found over the years that checking in on state of the cycles and the weekly/monthly charts helps to keep the big-picture in perspective.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The Secular Market Cycle

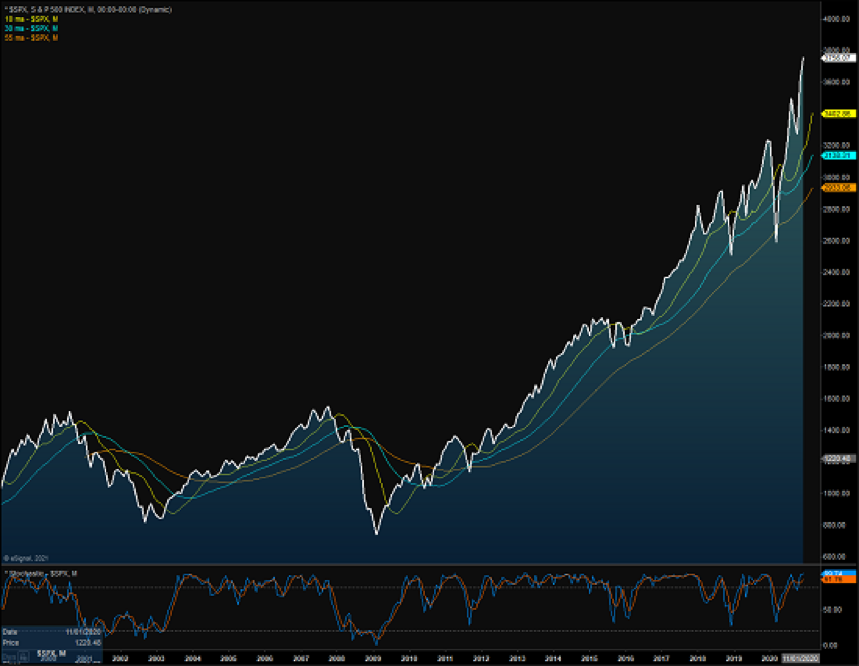

Below is a monthly chart of the S&P 500 Index illustrating the current cycle, which we estimate began on March 9, 2009.

S&P 500 - Monthly

Thought For The Day:

Never do business with anyone you can't trust.

-J.P. Morgan