Sterling Construction Company, Inc. (NASDAQ:STRL) has been awarded a $26.6 million project in Frisco, TX. Texas Sterling Construction Co. (“TSC”) — a subsidiary of Sterling Construction — was the apparent low bidder for this City of Frisco Main Street project.

Scope of the project work involves the widening of a three-mile section of Main Street from Farm to Market Road 423 (FM 423) to Dallas Parkway from four lanes to six lanes, in a bid to ease traffic congestion and make driving conditions safer. TSC will also work on the development of the road’s storm drainage.

In addition, the above discussed project includes the entire preliminary infrastructure for future underground electric transmission lines, as well as more than 14,000 linear feet of water distribution lines utilizing TSC’s competence in both municipal road construction and underground water transmission.

As of second-quarter end, Sterling Construction’s total backlog was $923 million, up 13.9% year over year. This excluded $76 million of projects, where the company was apparently the lowest bidder but the contract had not yet been signed.

Sterling Construction anticipates improvements in the value of bid opportunities over the second half of the year. The company also believes progress in its base business, strategic pick of projects and increase in backlog will stoke growth.

Further, Sterling Construction’s acquisition of Tealstone Construction will help it expand in adjacent markets with higher-margin project opportunities. The buyout will also likely provide it with a strong market position in residential and commercial concrete construction.

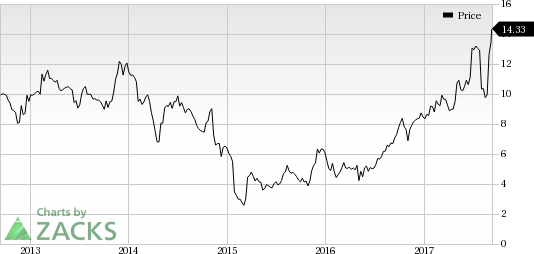

In the past year, Sterling Construction has significantly outpaced the industry with respect to price performance. The stock has soared 106.2%, substantially outperforming 9.3% growth recorded by the industry.

Sterling Construction currently sports a Zacks Rank #1 (Strong Buy).

Other similarly-ranked stocks in the construction sector include MasTec, Inc. (NYSE:MTZ) , NVR, Inc. (NYSE:NVR) and Owens Corning (NYSE:OC) . You can see the complete list of today’s Zacks #1 Rank stocks here.

MasTec has expected long-term earnings growth rate of 14%.

NVR has expected long-term earnings growth rate of 14.9%.

Owens Corning has expected long-term earnings growth rate of 14.8%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Owens Corning Inc (OC): Free Stock Analysis Report

MasTec, Inc. (MTZ): Free Stock Analysis Report

Sterling Construction Company Inc (STRL): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

Original post

Zacks Investment Research