While Bitcoin (BTC) holds its recent low confirmed by a jump in Google search activity, I decided to look to see whether Google Trends correlated with another cryptocurrency.

Stellar is a relatively new entrant on the scene. The cryptocurrency made a big splash at the beginning of the year by rocketing into the top 10 of cryptos in market cap. Two weeks ago, on January 17, 2018, I happened to watch a fascinating CNBC interview with Joyce Kim, co-founder and managing partner of SparkChain Capital and a creator of Stellar. The interview was much more raw and brutally honest than I expected. KIm’s commentary has stuck with me ever since, so I occasionally check in on Stellar’s performance.

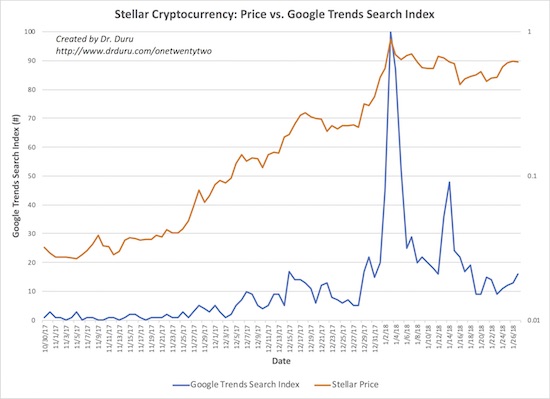

It turns out that Stellar provided a great proof point for using Google Trends to assess crypto price action. When Stellar made its big splash on January 3, 2018, search volume surged to an all-time high at the same time Stellar also surged to an all-time high. Now looking backward, I can conclude that Stellar confirmed a top on that day.

Stellar reached a price extreme (a run-up to an all-time high) alongside an extreme increase in search interest in Stellar.

As a reminder, I use an extreme increase in the search index from Google Trends to flag a likely change in direction for price action that is also at an extreme. My definition of “extreme” is loose, but in Stellar’s case the steepness of the rise in the search index is clearly indicative of an extreme. I used the search term “Stellar cryptocurrency” assuming that anyone searching for information on Stellar would need to modify the search with “cryptocurrency” to eliminate a lot of other irrelevant results. The left vertical axis in the chart is the search index; Google scales the index from the maximum search count and sets a value of 100 at that point. The right vertical axis is the price of Stellar in log-scale.

Note that the top in Stellar is far from disastrous at this point. The cryptocurrency is now meandering looking for its next catalyst. Whenever that occurs, I will be back to looking at search behavior to continue building on my knowledge base of how Google Trends correlates with the price action of cryptocurrencies.

In her interview, Kim admitted to her minority position in the crypto community as someone who does not put much value in crypto trading. The short clip below is worth watching. I also provide a loose transcript of some of her key responses.

“The protocol use cases will always surpass whatever the financial values are for it…I am in the minority in that I don’t think that the token will become the money of the future for every single person for every transaction.”

Use case for Bitcoin:

“At present most people use it as a savings system – that I am not too bullish on as a reason to get involved in the space…One use case I am excited about is supply chain…for small farmers (of coffee beans)…a lot of the trading volume right now is detached from logic…the future is completely and utterly unpredictable right now.”

Be careful out there!

Full disclosure: no positions