The trading volatility in Bitcoin is delivering a healthy number of extremes. These accumulating extremes are helping me build associations between Bitcoin price action and Google search interest in the cryptocurrency. The latest round of extremes delivered some eye-opening associations which could help traders in the bear future.

This week, on January 15th, Bitcoin made a very extreme move by briefly cracking the $10,000 level and completing a 50% and more decline from its all-time high. For about 10 minutes, Bitcoin traded close to the $9300 level before buyers rushed in to send the cryptocurrency quickly over $10,000 again. The abiding catalysts came from fresh news about potential crackdowns from South Korean and China.

Bitcoin’s incredible run-up stalled a month ago and produced a subsequent 50% sell-off from all-time highs.

Bitcoin bounced along the $10,000 level going into U.S. trading hours before cracking that psychological level of support. Buyers quickly moved in after that event.

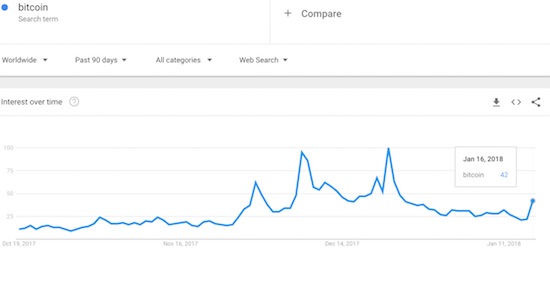

Preceding the most extreme components of Bitcoin’s sell-off were surges in Google searches on “Bitcoin.” In an earlier post, I pointed out how jumps in Google search interest marked off a top and then a bottom in Bitcoin trading action. Search interest in Bitcoin experienced a rapid decline after the December bottom and signaled waning interest in trading. Sure enough, Bitcoin’s recovery quickly stalled out and hit its last peak just over $17,000 on January 5th.

Search interest in Bitcoin quickly went into a lull after Bitcoin bottomed out in late December. The big drop in Bitcoin on January 15th, woke up search interest the next day.

When I use Google Trends for assessing extremes, I look for a surge of search interest at a price extreme to signal an imminent reversal of the price extreme. This time around, traders flipped the script.

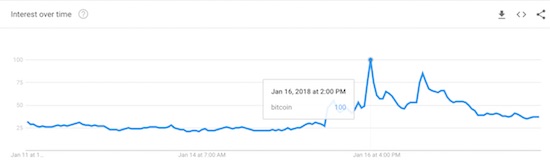

Zooming to the hour-by-hour search action reveals a close correlation that surprised even me and encouraged me even though the correlation was in the opposite order I would expect. Hourly search interest surged to a peak at 2pm Eastern on January 16th. A little over three hours later, Bitcoin swooned to its first test of the $10,000 level; that test succeeded. However, search interest surged to another hourly peak at 7am the next day. A little over three hours later, Bitcoin made its final swoon to the current local low of $9300.

At the hourly level, Bitcoin search interest surged twice and both times around 3 hours ahead of a big pullback in price.

It is possible to back into an explanation and consider that traders were scrambling for information on government crackdowns, found bad news, and proceeded to sell until all motivated sellers exhausted themselves. We may never know the underlying reasons. Instead, we just have the correlations which still suggest that Bitcoin price extremes and Bitcoin search extremes go hand-in-hand. Perhaps search extremes without a price extreme should flag a warning signal for sellers and a “get ready” signal for eager buyers. Regardless, the price extremes reversed relatively quickly when associated with search extremes.

In other words, the evidence continues to grow that Google search trend behavior is a meaningful barometer of Bitcoin trading. If more corroborating data piles up, I will look to find similar patterns in other highly liquid cryptocurrencies.

In the meantime, I will be watching for signs of the durability of this latest Bitcoin bottom. If search interest wanes quickly, I will expect the recovery phase to fizzle relatively quickly like last time. If search interest remains robust, I will accordingly expect the recovery period to last longer.

Be careful out there!

Full disclosure: no positions