Steel Dynamics, Inc. (NASDAQ:STLD) announced plans to offer roughly $350 million total principal amount of debt securities in a transaction exempted from registration requirements per the Securities Act of 1933, subject to market and other conditions.

The company plans to use the net proceeds along with cash in hand to purchase all of its 6.375% senior notes due 2022, which commenced on Sep 6 in a tender offer. It will also repurchase, redeem or discharge any 2022 notes not purchased earlier and pay related fees and expenses.

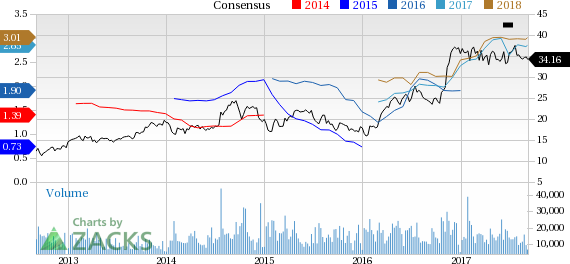

Price Performance

Shares of Steel Dynamics have inched up 0.7% in the last three months, significantly underperforming the industry’s 17.4% rally.

Q2 Performance

Steel Dynamics reported net income of $154 million or 63 cents per share in second-quarter 2017, compared to net income of $142 million or 58 cents recorded a year ago. The figure missed the Zacks Consensus Estimate of 65 cents.

Net sales in the quarter increased 18.1% year over year to $2,390.7 million, beating the Zacks Consensus Estimate of $2,344 million.

Auto Market & Public Sector Projects — Primary Catalysts

Steel Dynamics, during second-quarter earnings, provided optimistic views on macroeconomic and market conditions, which is anticipated to benefit steel consumption in domestic market in the future. The company believes that demand in the North American automotive steel market will remain steady although automotive production in the United States has peaked. It is also expecting growth in construction and energy sectors, especially for infrastructure projects in the public sector.

Steel Dynamics continues to generate robust cash flows and strengthen financial position. The company is well-poised for growth and to deliver shareholder value through strategic and organic growth opportunities.

Zacks Rank & Stocks to Consider

Steel Dynamics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are The Chemours Company (NYSE:CC) , Kronos Worldwide Inc (NYSE:KRO) and Smurfit Kappa Group plc (OTC:SMFKY) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Chemourshas an expected long-term earnings growth rate of 15.5%.

Kronos Worldwide has an expected long-term earnings growth rate of 5%.

Smurfit Kappahas an expected long-term earnings growth rate of 4%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

SMURFIT KAPPA (SMFKY): Free Stock Analysis Report

Steel Dynamics, Inc. (STLD): Free Stock Analysis Report

Original post

Zacks Investment Research