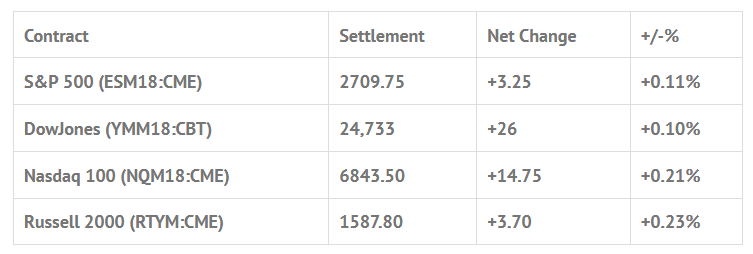

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed higher: Shanghai Comp +0.85%, Hang Seng +1.40%, Nikkei +0.15%

- In Europe 6 out of 12 markets are trading higher: CAC +0.11%, DAX -0.12%, FTSE +0.22%

- Fair Value: S&P +0.06, NASDAQ +8.90, Dow -31.99

- Total Volume: 1.0mil ESM, and 607 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the Weekly Bill Settlement, Lael Brainard Speaks 8:00 AM ET, Jobless Claims 8:30 AM ET, Philadelphia Fed Business Outlook Survey 8:30 AM ET, Randal Quarles Speaks 9:30 AM ET, Bloomberg Consumer Comfort Index 9:45 AM ET, Leading Indicators 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Fed Balance Sheet & Money Supply 4:30 PM ET, and Loretta Mester Speaks 6:45 PM ET.

S&P 500 Futures: #ES Quiet But Firm #VIX Expo

Yesterday, after and overnight pullback down to 2703.75 on Globex, the S&P 500 futures rallied up to an early morning high of 2718.50, with only 177,000 ES traded. On Wednesday mornings 8:30 CT open, the ES traded 2711.50, down ticked to 2710.75, and then rallied up to 2716.25 before dropping down to 2709.50. From there, the futures rallied up to a lower high at 2714.00, and then sold off 10.25 handles down to 2703.75.

Once the low was in, the futures rallied up to 2718.00, pulled back a little, then double topped at 2718.00. After the push to the highs the ES sold off down to 2711.00 at 11:56, and at 12:15 had traded back up to 2716.75. The next move was back down to 2708.50, and a few minutes later back up to 2717.00, as the MiM went to over $500 million to buy. The futures then pulled back down to 2712.50 before rallying back up to 2716.50.

In the final hour of the trading day the MiM began to weaken, pulling down below $500 million to buy, then down to $325 million to buy at the reveal, as the actual MOC came in at $300 million to buy. The ESM traded weak into the close, breaking down to 2708.00, and was at 2708.75 on the 3:00 PM CT cash close, before going on to settle at 2709.75 on the 3:00 PM futures close, up +3.00 handles on the day, or +0.11%.

In the end, the ES is running in place. It sells off a little, rallies, then fails late in the day. While we still think higher prices, our gut feeling is that it will only take another bad headline, and the ES still sell off quickly. Bottom line, I like the markets, but don’t trust the markets.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.