The last seven days have been a great example of how confusing the relationship between the economy and stock prices can be.

Economic reports are constantly pushing the markets up and down, but what makes it particularly confusing is that sometimes good economic news is bad news for stock prices. And at other times, good economic news is good for stocks.

The Friday before last, the jobs report was stronger than expected (good news), and the market opened significantly lower and then traded higher.

This last week had two inflation reports that were better than expected (good news), and the market opened higher both times but in one case traded higher from the open (Wednesday, CPI), and in the other traded lower from the open (Thursday, PPI).

How can the average person know what to believe?

So if you're frustrated by the market's reactions to the economic news, it's not your fault.

It's not always easy.

And for that reason, we use mechanical (no human subjective analysis) models to alert us to potential trend shifts. We also employ proprietary signature trading indicators to alert us to prospective trend shifts.

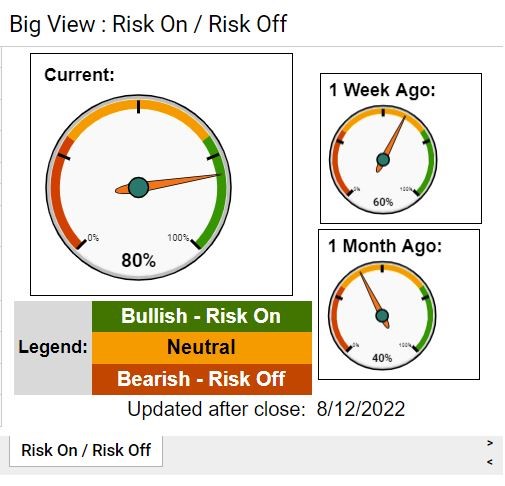

One example of this is our Risk Gauge.

After a short shift into a neutral stance, Thursday and Friday's move higher in the SPY pushed it back into a bullish reading, suggesting more strength over the short to intermediate term.

As seen in our Big View service, the Risk On / Risk Off Gauge is now bullish, making the environment conducive for risk-taking for the time being.

This gauge is based on five inter-market relationships in our Big View Premium service and is intended to alert and confirm changes in trend strength.

Several other Big View indicators are looming, and one to quickly mention is lower trading volumes. We are more or less drifting upwards with less trading volume.

This may or may not be signaling an end to the current rally, which began in mid-June.

Investors continue to price a vaccine-fueled solid economic recovery and applaud the mild inflation CPI and PPI reports earlier this week.

The stock market rounded off another intense week with a low-volume surge on Friday.

The major US indexes extended their weekly winning run to four weeks. The S&P 500 ended the week at 3.3%, slightly more than the QQQs or IWM. Larger trading volumes are needed to fuel the rally, and we will be watching next week's trading volumes diligently.

The week's gains were also partially fueled by expectations that the Federal Reserve would continue to support the economy with less aggressive Fed tightening in the coming months.

Looking at a specific asset, gold prices have drifted higher. The yellow metal has always been considered an excellent hedge against economic uncertainty.

Inflation fears and global geo-political tensions have driven gold's rise in recent weeks, while the overall stock market has recently largely downplayed these same concerns.

The market's overall tone remains buoyant despite a few percolating issues, like volume and safe haven assets rising. It is important to remember that volatility is a normal part of markets and should be expected.

The answer is to have a portfolio that can weather the ups and downs and make money despite volatility or as a result of volatility.

ETF Summary

S&P 500 (SPY) 429.30 now resistance with support at 423

Russell 2000 (IWM) 201.77 the resistance with support at 197.78

Dow (DIA) 339.20 resistance and support at 335.26.

Nasdaq (QQQ) 333.4 1st level of resistance and support at 326.60.

KRE (Regional Banks) 67.96 resistance, support level at 66.82.

SMH (Semiconductors) 241.30 resistance and support at 236.20.

IYT (Transportation) 248.53 resistance and support at 246.41.

IBB (Biotechnology) 133.34 resistance point and 132.15 is support.

XRT (Retail) 71.99 resistance point and with support is at 69.96.