Norwegian energy giant Statoil (OL:STL) ASA (NYSE:STO) has entered into an agreement with Argentina’s leading energy company, YPF, to jointly explore for hydrocarbons in the Bajo del Toro block in the Neuquén Basin onshore Argentina.

The initial agreement was inked between companies in Geneva, wherein Statoil will enter as a partner in the Bajo del Toro exploration permit in the Neuquén Basin. The company will hold a 50% participating interest. The remaining interest will be retained by YPF, the operator.

As a consideration, Statoil shall identify YPF’s past cost incurred in the block and 100% of the expense of certain future activities in the block. The Bajo del Toro exploration block signifies Statoil’s entry into Argentina.

Spread over an area of 157 square kilometers, the Bajo del Toro exploration permit is located in the Neuquen Basin in the west-central part of Argentina. The Vaca Muerta formation is the main target in the basin. The parties intend to close the final agreements in the next few months. Preceding to closing of the deal, the agreements need the approval of the Neuquen provincial authorities.

In 2016, Statoil signed a technical study agreement with YPF for map exploration of opportunities in a large area of the continental slope offshore Argentina.

In spite of the weakness in oil and gas prices, Statoil has increased its drilling plan for 2017 by about 30% compared with 2016. This raises optimism and is likely to boost shareholder value as well. The company is making constant efforts to increase its footprints globally through profitable and high-quality resources. Statoil’s competence and experience aids it immensely to fulfill its strategy.

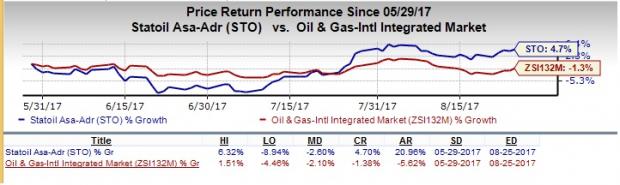

Moreover, over the last three months, shares of Statoil have gained 4.7% compared with the industry’s decline of 1.3%.

Currently, Statoil carries a Zacks Rank #3 (Hold). A few better-ranked players in the energy sector include TransCanada Corporation (TO:TRP) , Transmontaigne Partners LP (NYSE:TLP) and Range Resources Corporation (NYSE:RRC) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Headquartered in Calgary, Canada, TransCanada is a midstream energy firm in North America. The company posted an average positive earnings surprise of 4.06% over the last four quarters.

Transmontaigne, headquartered in Denver, CO, involves in transporting and storing refined petroleum products. The firm posted an average positive earnings surprise of 6.60% over the last four quarters.

Based in Fort Worth, TX, Range Resources is an independent oil and gas company, engaged in the exploration, development and acquisition of U.S. oil and gas resources. The company’s 2017 earnings are estimated to grow 1587.17%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Statoil ASA (STO): Free Stock Analysis Report

TransMontaigne Partners L.P. (TLP): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Original post

Zacks Investment Research