Statoil (OL:STL) ASA’s (NYSE:STO) reported adjusted earnings of 25 cents per ADR in third-quarter 2017, which beat the Zacks Consensus Estimate of 22 cents. The company incurred adjusted loss of 9 cents in the year-earlier quarter. The growth can be primarily attributed to higher liquids and gas prices, good operational performance and reduced underlying operating costs.

Total revenues increased 12.4% year over year to $13.6 billion.

Operational Performance

In the reported quarter, total equity production of liquids and gas grew 13.3% year over year to 2,045 million barrels of oil equivalent per day (MMBOE/d). The higher commodity prices aided increased gas yield. Additionally, lower turnaround activity, ramp-up of new fields along with continued strong operational performance aided the growth.

In the reported quarter, total entitlement production of liquids and gas increased 14% to 1,883 MMBOE/d. The upside was due to higher equity production, which was partially offset by the unfavorable impact of production sharing agreements (PSA).

Financials

Cash flow from operations was $13 billion in the first nine months of 2016 compared with $7 billion in the year-earlier period. Statoil maintained a strong capital structure. Net debt to capital employed at the end of the quarter was 27.8%. Organic capital expenditure was $6.7 billion in the first nine months of 2017.

Outlook

Statoil lowered its organic capital expenditure guidance from $11 billion to $10 billion and projects its exploration guidance at $1.3 billion. Organic production growth is expected to see a CAGR of 3% in the period 2016-2020, while organic production growth for 2017 is projected to be around 6% above the 2016 level. Statoil intends to achieve an additional $1 billion in efficiency improvements in 2017 with a total of $4.2 billion.

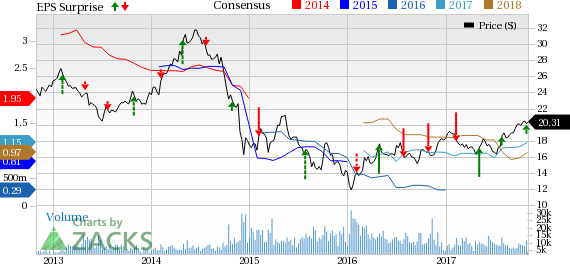

Q3 Price Performance

The pricing chart reveals that the company’s shares have outperformed the industry in the last three months. During this period, the company’s shares have returned 33.9% compared with the industry’s rally of 8%.

Zacks Rank & Key Picks

Currently, Statoil carries a Zacks Rank #1 (Strong Buy). A few other top-ranked players in the energy sector include Northern Oil and Gas Inc (NYSE:NOG) , ConocoPhillips (NYSE:COP) and Noble Midstream Partners LP (NYSE:NBLX) . All these stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northern Oil and Gas, based in Minnetonka, MN, is an independent energy company. The company delivered earnings surprise of 100.00% in the preceding quarter.

ConocoPhillips, based in Houston, TX, is a major global exploration and production (E&P) company. It delivered an average positive earnings surprise of 152.34% in the last four quarters.

Noble Midstream Partners, headquartered in Houston, TX, has diversified energy infrastructure properties. The company delivered positive earnings surprise of 30.67% in the preceding quarter.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Statoil ASA (STO): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

Noble Midstream Partners LP (NBLX): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Original post

Zacks Investment Research