State Auto Financial Corporation (NASDAQ:STFC) reported fourth-quarter 2017 earnings of 40 cents per share, missing the Zacks Consensus Estimate by 14.89%. Moreover, the bottom line declined 13% year over year.

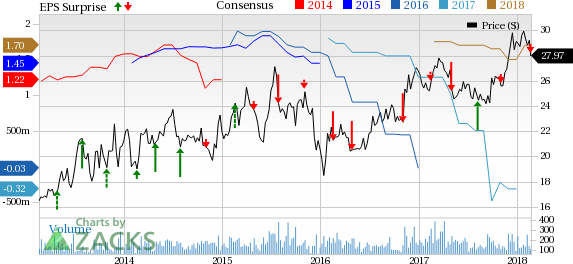

State Auto Financial Corporation Price, Consensus and EPS Surprise

The quarter experienced lower premiums at Specialty and Commercial insurance. However, the same at Personal increased. Also, the combined ratio improved.

Operational Update

Total operating revenues of $342 million slid 0.9% year over year on 1.6% lower premiums. Net investment income increased 8.3% year over year to $22.3 million.

Net written premium decreased 2.1% year over year, attributable to lower Commercial and Specialty net written premiums. The downside is partially offset by an increase in Personal net written premium.

Commercial net written premium slipped 1.4% while specialty plunged 51%. The fall was primarily because of actions taken to improve commercial auto profitability and a reduction in workers’ compensation due to softening market conditions during the quarter under review. Specialty was affected by the decision to exit specialty business.

Net written premium for Personal grew 19.1%, driven by rate actions taken to improve the profitability in personal auto and a higher level of new business policies for the fourth quarter.

Total expenses declined nearly 2% year over year to $325 million on lower losses and loss expenses.

Combined ratio improved 40 basis points (bps) year over year to 100.9% in the reported quarter.

Full-Year Highlights

State Auto Financial incurred loss of $1.26 per share from operations, wider than the year-ago loss of 6 cents.

Revenues of $1.4 billion inched up 1.1% over the figure recorded in 2016.

Financial Update

State Auto Financial exited 2017 with total cash of $91.5 million compared with $51.1 million at year-end 2016.

Debt balance remained flat at $122.1 million as of Dec 31, 2017 with the level at year-end 2016.

Book value per share decreased 2.4% from year-end 2016 to $20.76 as of Dec 31, 2017.

Return on equity was (1.2%) in 2017 against 2.4% in 2016.

Net cash from operating activities was $67.9 million in 2017, down nearly 40.2% year over year.

Zacks Rank

State Auto Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported fourth-quarter earnings so far, the bottom line of The Progressive Corp. (NYSE:PGR) , The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) beat the respective Zacks Consensus Estimate.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

State Auto Financial Corporation (STFC): Free Stock Analysis Report

Original post

Zacks Investment Research