Industrial tool maker Stanley Black & Decker Inc. (NYSE:SWK) reported impressive results for second-quarter 2017, with positive earnings and sales surprises of 2.6% and 1.9%, respectively.

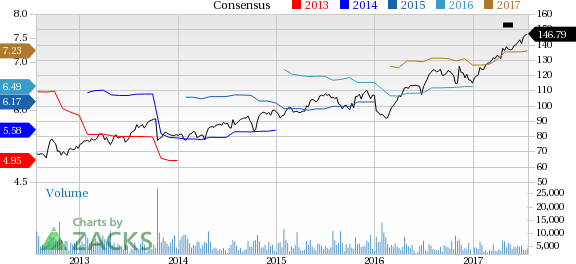

Earnings, excluding acquisition related charges and others, of $2.01 per share topped the Zacks Consensus Estimate of $1.96. It also surpassed the year-ago quarter tally of $1.84 by 9.2%.

The company’s organic sales grew roughly 6% as 8% gain from volume growth was partially offset by 1% negative price impact and 1% adverse impact of foreign currency translation. In addition to organic growth, acquisition gains were 7% while divestitures had negative 3% impact. Combining these impacts, net sales in the quarter jumped 10% year over year to $3.229 billion. Also, sales were above the Zacks Consensus Estimate of $3.17 billion.

Segmental Revenues

Stanley Black & Decker reports revenues under three market segments. A brief discussion on the segments’ quarterly results is provided below:

Tools & Storage generated revenues of $2,259.5 million, up 17% year over year and represented 70% of net revenue in the quarter. Volume growth added 9% to sales growth while acquisitions had a positive 11% impact. These were partially offset by negative impacts of 1% from foreign currency translation, 1% from price and 1% from divestitures.

Industrial segment’s revenues, accounting for roughly 15.4% of net revenue, came in at $496.3 million, up 7.2% year over year. The growth was triggered by volume gains of 9%, partially offset by adverse currency impact of 2%.

Revenues from Security, roughly 14.7% of net revenue, decreased 11.9% year over year to $473.7 million. Favorable price impact of 1%, acquisition gain of 2% and volume gain of 1% were more than offset by 2% negative impact of forex losses and 14% negative impact of divestitures.

Margins

In the quarter, Stanley Black & Decker’s cost of sales grew 10.4% year over year, accounting for 61.7% of quarter’s net sales versus 61.5% in the year-ago quarter. Gross margin declined 20 basis points (bps) to 38.3% as benefits from volume growth and improved productivity was offset by adverse impacts of price, commodity inflation and currency.

Selling, general and administrative expenses increased 9.5% year over year while as a percentage of revenues, it dipped 10 bps to 22.6%.

Balance Sheet & Cash Flow

Exiting the second quarter, Stanley Black & Decker had cash and cash equivalents of $539.5 million, above $378 million in the previous quarter. Long-term debt (net of current portions) was roughly flat at $3,817.4 million.

In the quarter, Stanley Black & Decker generated net cash of $256.5 million from its operating activities, decreasing 48.3% year over year. Capital spending totaled $122.2 million versus $78.7 million in the year-ago quarter. Free cash flow was $134.3 million compared with $417.7 million in the year-ago quarter.

During the quarter, the company paid cash dividends of approximately $86.5 million and repurchased shares worth $2.1 million.

Outlook

For 2017, Stanley Black & Decker increased its earnings forecast to $7.18−$7.38 per share from the previous projection of $7.08−$7.28, primarily on the back of benefits accrued from higher organic revenue growth, operational excellence and acquired assets. Also, the revised guidance represents year-over-year growth of 10–13%.

Free cash flow conversion is predicted to be 100%.

Zacks Rank & Stocks to Consider

With a market capitalization of $22.5 billion, Stanley Black & Decker currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the machinery industry include Atlas Copco AB (OTC:ATLKY) , Dover Corporation (NYSE:DOV) and Parker-Hannifin Corporation (NYSE:PH) . While Atlas Copco sports a Zacks Rank #1 (Strong Buy), both Dover Corporation and Parker-Hannifin carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Atlas Copco’s earnings estimates for 2017 and 2018 were revised upward in the last 60 days. Also, its earnings are anticipated to grow roughly 15% in the next three to five years.

Dover Corporation’s earnings estimates for 2017 and 2018 were revised upward in the last 60 days. Also, the company pulled off an average positive earnings surprise of 1.62% for the last four quarters.

Parker-Hannifin reported an average positive earnings surprise of 14.94% for the last four quarters. Also, earnings expectations for fiscal 2018 improved over the past 60 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Stanley Black & Decker, Inc. (SWK): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Atlas Copco AB (ATLKY): Free Stock Analysis Report

Original post

Zacks Investment Research