On May 30, we issued an updated research report on U.S. based automotive replacement parts provider, Standard Motor Products Inc. (NYSE:SMP) .

Standard Motor topped earnings and revenue expectations in the first-quarter of 2017.

Standard Motor remains focused on cutting production costs, which should lend support to its results. The company announced to shutter its facility in Grapevine, TX and relocate the diesel injection operations to existing facilities in Greenville, SC, which is the center of excellence for gas injection products.

Moreover, the Temperature Control operation segment will be shifted to Reynosa, Mexico, where the company has highly efficient operations in the field. In addition, the company will move its coil operation from Greenville to the main coil manufacturing location in Bialystok, Poland. It expects to generate pre-tax savings of $6–$7 million after completion of these restructuring actions by 2017.

The company also believes that acquisition of General Cable’s automotive ignition wire business (“GC wire”) will both support its aim of emerging as the top ignition wire supplier as well as enhance its bottom line within a year. The acquisition contributed to a double digit rise in the company’s revenues in the last reported quarter and should boost sales and margins moving ahead.

Standard Motor also has promising long-term business prospects, which allow it to deploy capital effectively. In Feb 2017, Standard Motor’s board approved an increase in dividend to 19 cents per share from 17 cents. With this, the company increased dividend for eighth consecutive years. In the same month, the board also approved a share repurchase of $20 million under the new share repurchase policy. These capital deployment measures are expected to boost shareholder value.

Moreover, the company is not significantly exposed to the cyclical nature of the automotive industry since it is primarily focused on the aftermarket as a leading player there.

Demand for repair products is expected to rise, thanks to growth in the used-vehicles market and an increase in the average age of automobiles in the U.S. Additionally, low gas prices are prompting a rise in automobiles usage, thus increasing the number of miles traveled. This should support the company’s results.

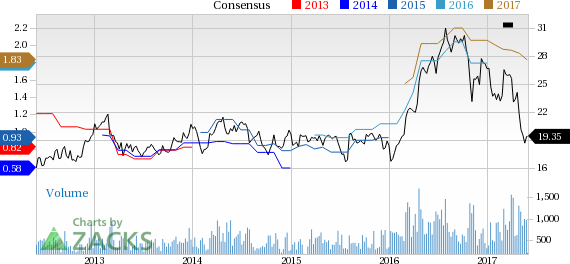

The company has also outperformed the Zacks categorized Auto/Truck Replacement Parts industry in last three months. Its shares have declined 2% during the period compared to industry’s loss of 3.8%.

Standard Motor currently carries a Zacks Rank #2 (Buy).

Stocks to Consider

Other well placed companies in the auto space include Dana Incorporated (NYSE:DAN) , Allison Transmission Holdings Inc. (NYSE:ALSN) and Ferrari N.V. (NYSE:RACE) . All stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Dana has an expected long-term growth rate of 3%.

Ferrari has an expected long-term growth rate of 14.1%.

Allison Transmission has an expected long-term growth rate of 11%.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Dana Incorporated (DAN): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Standard Motor Products, Inc. (SMP): Free Stock Analysis Report

Original post

Zacks Investment Research