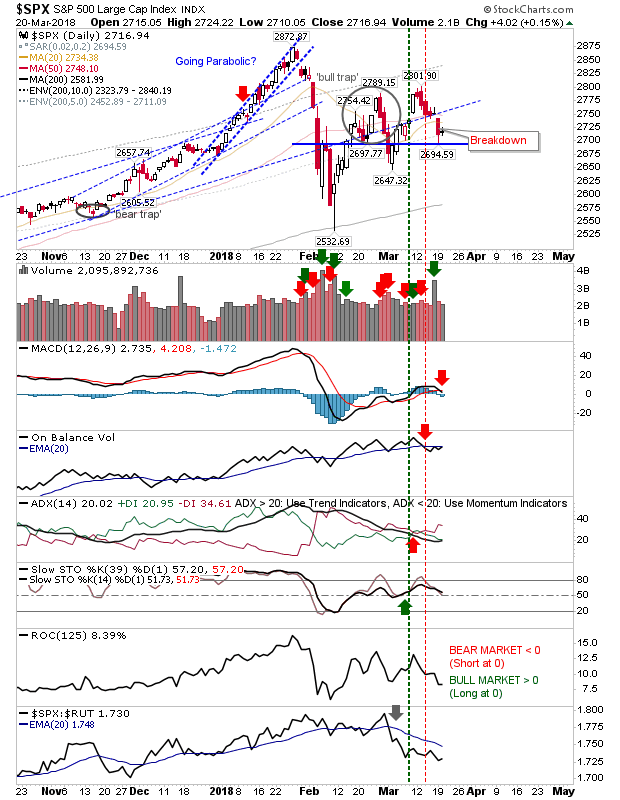

The good news for bulls yesterday was the lack of follow-through on the selling. An argument could be made for a bullish harami doji in some key indices with stops on a loss of Monday's lows.

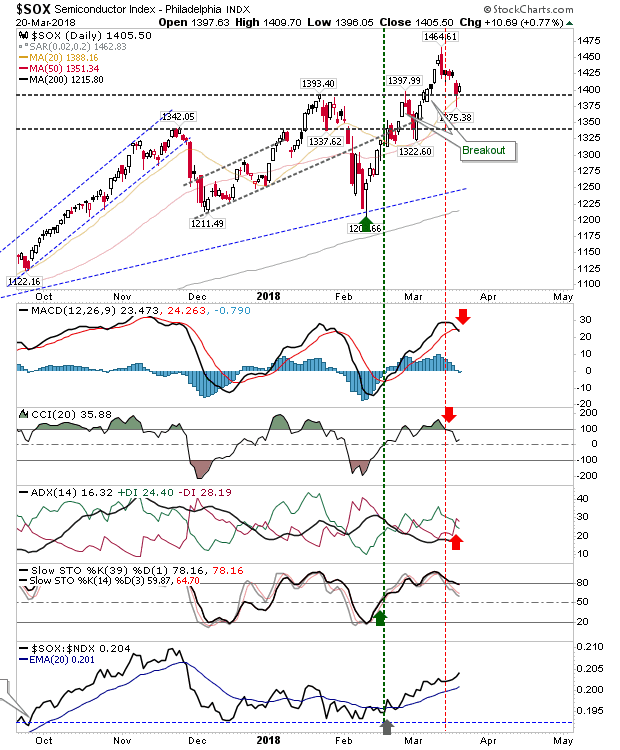

The Semiconductor Index held on to breakout support in what looked to be a successful defense by traders. It looked like it could still be a pullback buying opportunity. There was a MACD trigger 'sell' which was a follow-through from Friday—leaving only stochastics in the green. However, relative performance remains in bulls' favor. Long opportunities at 1,395 support with stops on a loss of 1,375.

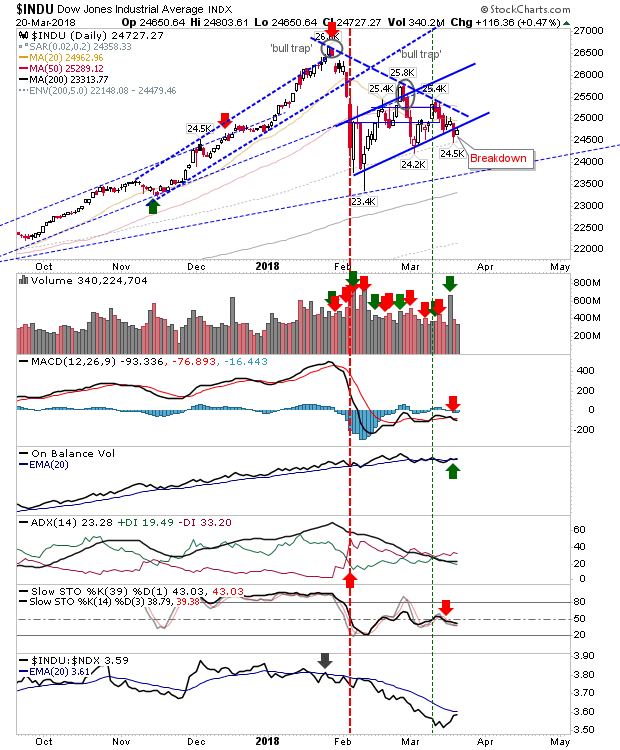

The Dow Jones still has to reverse Friday's breakdown and is holding to the MACD 'sell' trigger. Shorts can play this index with risk measured on a close above 25,000.

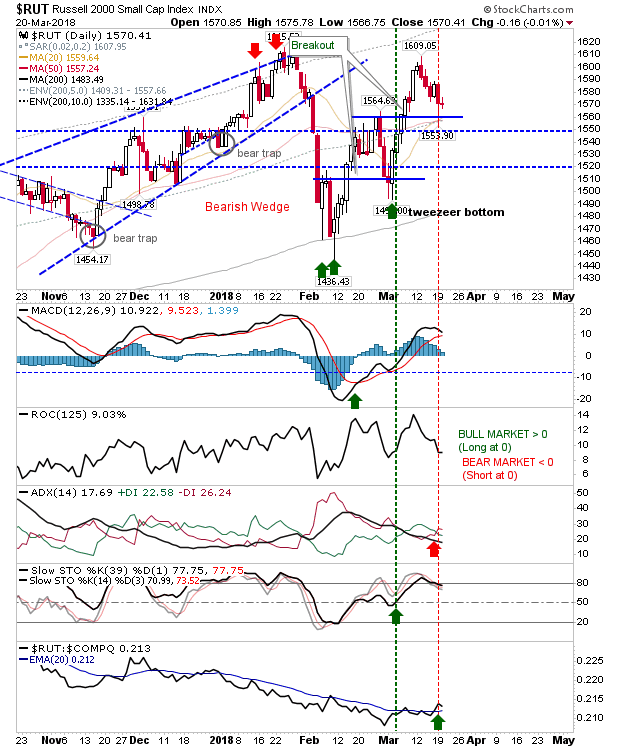

The Russell 2000 didn't fall to challenge 1,560 or converged 20-day and 50-day MAs, but did finish with a bullish harami cross which itself is a potential buying opportunity.

For today, stick with the current strategy; longs focus on the Rusell 2000 and Semiconductors, shorts focus on the Dow Industrials.