The Flat-Bottomed Ascending-Top Megaphone

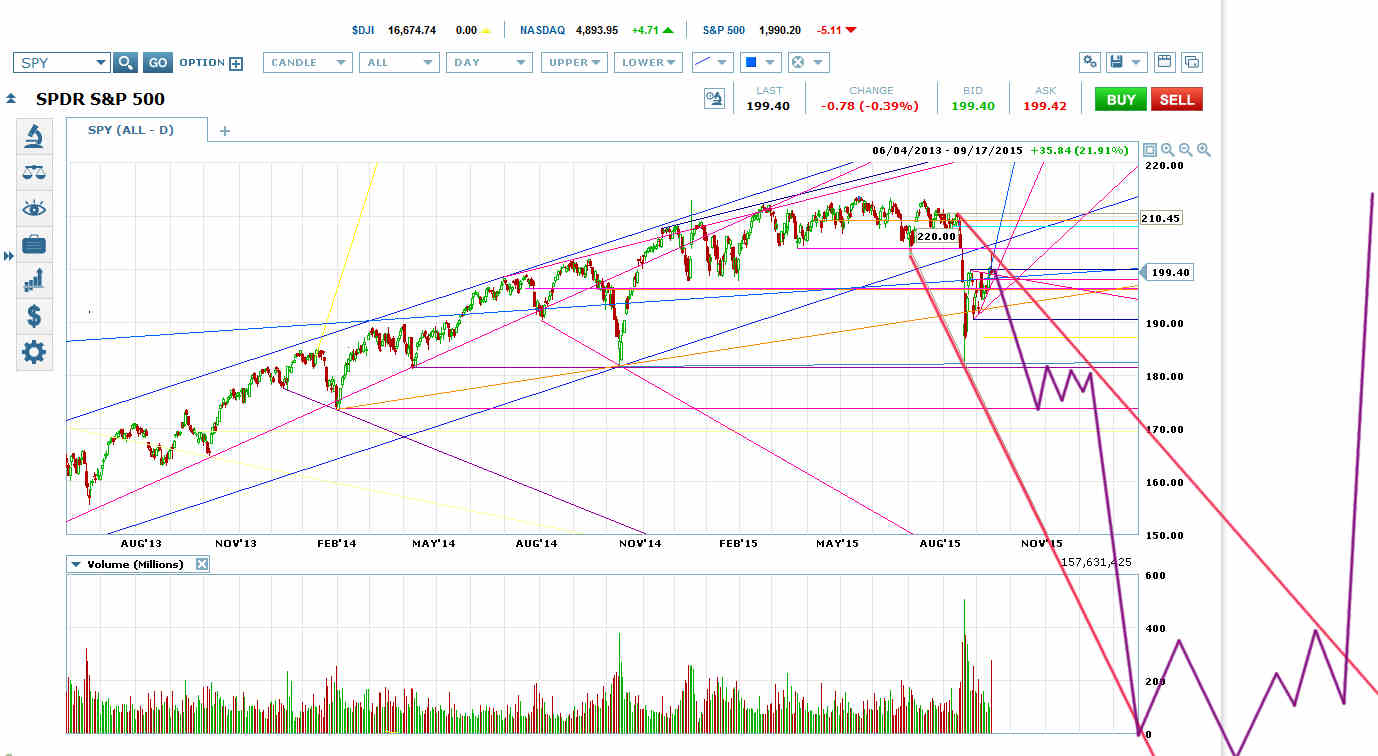

I keep posting that SPDR S&P 500 (NYSE:SPY) has a flat-bottomed rising-top megaphone on its chart (red).

The reason I keep talking about it is because: 1) 2/3 of the time they break out the bottom after putting in a right shoulder bounce like the one that probably topped today, and 2) what happens after that breakout gives you strong information about what’s coming up next.

The 5% Rule and a New All-Time High

The technical target upon breakout from a flat-bottomed megaphone is the height of the formation subtracted from the bottom, or a little below 150 on SPY.

But of course not all breakouts get to their target, and in some cases a failed breakout is a strong set-up to get long.

The most important trading rule about flat-bottomed megaphones is that when they break out through the bottom, but fail to drop 5% or more from the bottom before recrossing the bottom. They are a favorite to take out the formation high.

The lowest low of the flat-bottomed megaphone on SPY is the April 11, 2014 low of 181.31. A drop of at least 5% would require SPY to take out 172.24.

So if SPY breaks out through the formation bottom, but fails to take out 172.24 before recrossing that bottom, its target upon recrossing the bottom would be a new all-time high.

The NYMO Lower Low and the Potential Falling Megaphone Set-Up

The single strongest trading set-up on the SPY chart remains the NYMO close below -100 on August 24. NYMO closes below -100 are almost always followed by a lower low, with the bounce before the lower low typically topping within a month of the NYMO close below -100.

A breakout through the bottom of the flat-bottomed megaphone would of course take out the August 24 low.

What taking out the August 24 low would also do is confirm a falling megaphone formation on the SPY and ES charts. SPY and ES would be heading into what is typically the biggest, fastest wave of the formation.

The Big Crash Scenario

A classic falling megaphone puts in a final wave down to and through the formation bottom. The longer it fools around with retraces and sideways moves on the way down, the lower it has to go to reach the formation bottom.

The price then typically re-enters the formation and puts in a lower low for the head of an inverse H&S before moving up to tag the formation top. It then bounces off the formation top into a right shoulder and breaks out into a strong, fast retrace to at least the level of the top touch on the formation top.

The Mini Crash into a New All-Time High Scenario

Falling megaphones can also run out of steam in the formation middle. In the green scenario above, SPY finds support at the February 3, 2014 low of 173.83. It then breaks out of the falling megaphone and recrosses the bottom of the flat-bottomed megaphone.

Because SPY would have recrossed the megaphone bottom before taking out 172.24, it would be a favorite to put in a new all-time high.

The Symmetrical Megaphone Top Scenario

If SPY takes out 172.24 within its falling megaphone, then re-crosses the bottom of its flat-bottomed megaphone without having reached at least its 150 target (and there’s a strong target further down at 125), it’s likely morphing its flat-bottomed ascending-top megaphone into a classic, symmetrical megaphone top.

By taking out 172.24, SPY would no longer have a target of a new all-time high upon reentering the flat-bottomed megaphone. Instead the target would become the VWAP of the potential symmetrical megaphone top at roughly 196.50.

SPY would usually put in a topping formation with a neckline at the megaphone VWAP before breaking out downwards from the symmetrical megaphone top. The topping pattern would usually complete the retrace to the falling megaphone target.

The Delayed Lower Low Scenario

Sometimes ES will put in a lower low after a hard move down, but SPY won’t. I can’t find any examples of this after a NYMO close below -100, but if it happens, what you’d tend to see is a move back to roughly the high before the retest of the low (usually a bit higher) and then another move down for SPY to put in a lower low.

SPY’s next moves would depend on exactly how much of a lower low it put in.

This scenario is unlikely because of the NYMO close below -100 and because flat-bottomed megaphones usually put in very simple right shoulders.