A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators suggested, heading into the last week of 2014, the equity markets looked positive, with a possible major rotation into small caps under way.

Elsewhere looked for Gold (SPDR Gold Trust (ARCA:GLD)) to hold between 1180 and 1200 in its downtrend while Crude Oil (United States Oil Fund (NYSE:USO)) built a base near 55. The US Dollar Index (UUP) looked to continue higher while US Treasuries (iShares Barclays 20+ Year Treasury (ARCA:TLT)) were biased lower in the short run, within their uptrend. The Shanghai Composite (db X-trackers Harvest China (NYSE:ASHR), MarketVectors China (NYSE:PEK) sat at resistance but with a strong look and could just keep moving up while Emerging Markets (iShares MSCI Emerging Markets (ARCA:EEM)) were biased to the upside in their downtrend.

Volatility (iPath S&P 500 Vix Short Term Fut (ARCA:VXX)) looked to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ), despite the moves higher. Their charts looked solid as the SPY sat at all-time highs and the QQQ at 14 year highs. The IWM might be breaking a 14 month range to the upside, which would trigger a major rotation into small caps.

The week saw Gold play according to plan, holding in a range, while Crude Oil continued to leak and threatened the base. The US Dollar continued a drift higher while Treasuries broke the down channel and rose. The Shanghai Composite held at the highs while Emerging Markets met some resistance and pulled back.

Volatility probed higher, closing the gap from 2 weeks ago before finding resistance. The Equity Index ETF’s halted their bounce after making new all time closing highs in the SPY and IWM, before the QQQ led them all lower the rest of the week. What does this mean for the coming week? Lets look at some charts.

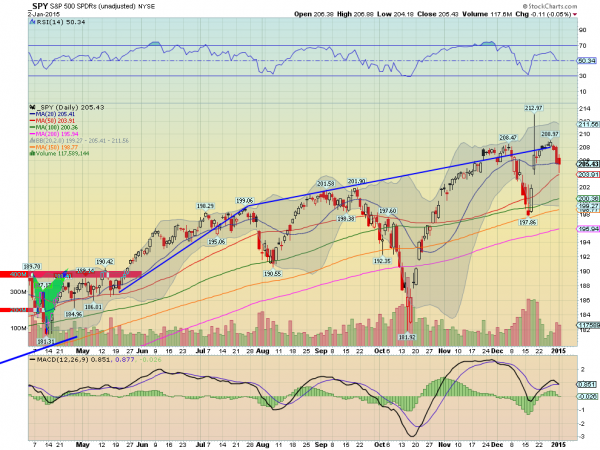

SPY Daily, SPY

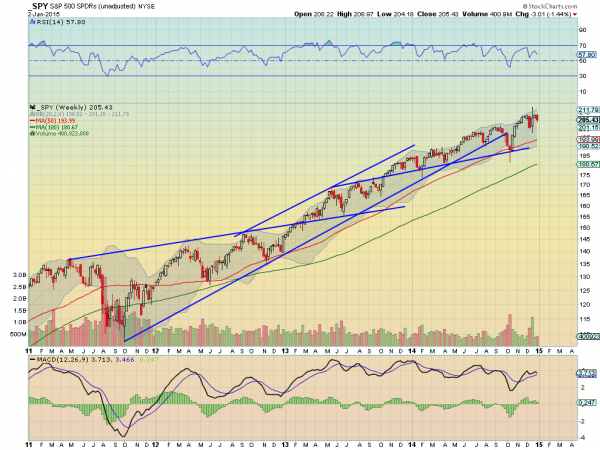

SPY Weekly, SPY

The SPY started the week making a new all-time high close on Monday and that was as good as it gets. It fell the rest of the week with a sharp drop New Year’s Eve that continued into the first trading day of 2015. Friday did see a Hammer print though, with a lower shadow that nearly touched the 50 day SMA.

The RSI on the daily chart turned back lower after cracking into the bullish zone but remains over the mid line for now, while the MACD is about to cross down. These support more downside in the short run. The settlement Friday near 205.50 is making that level important now as it has come into play twice before. Once as resistance in November and then as support to start December.

The weekly chart shows a bearish engulfing candle. This also pulled the RSI down, making a lower high, while the MACD is flat. There is resistance at 205.70 and 206.80 followed by 208.97. Support lower may come at 204.30 and 202.25 followed by 200 and 197.85. Possible Pullback in the Uptrend.

Starting the first full week of 2015 week, the equity index ETF’s look as though they may continue to the downside. Elsewhere look for Gold to continue in its tight range while Crude Oil continues lower. The US Dollar Index looks strong and should continue higher while US Treasuries are biased higher, and on the edge of a breakout. The Shanghai Composite continues to look strong but very overbought while Emerging Markets are weak and biased to the downside.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves lower this week. Their charts show a downside bias with the QQQ leading the way and the IWM the strongest, possibly confirming a rotation from one to the other. The possible reversal candles Friday could always kick in and the indexes move higher though. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.