A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators suggested, as the calendar turned to October the equity markets looked to have weathered a pullback, but were still not totally out of trouble. Elsewhere looked for Gold (SPDR Gold Trust (ARCA:GLD)) and Crude Oil (United States Oil Fund (NYSE:USO)) to continue their pullbacks. The US Dollar Index (PowerShares db USD Index Bullish (NYSE:UUP)) and US Treasuries (iShares Barclays 20+ Year Treasury (ARCA:TLT)) looked to continue to move higher. The Shanghai Composite (SSEC) was strong and looked good for more upside while and Emerging Markets (iShares MSCI Emerging Markets (ARCA:EEM)) were biased to the downside with the possibility of a bounce. Volatility (VIX) looked to remain subdued, keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Their charts all printed short term reversals higher, but looked weaker on the longer timeframe. Play the reversals with caution for the week. Use this information as you prepare for the coming week and trad’em well.

“Play the reversals with caution for the week”. That was an understatement. The week played out with Gold probing lower and finding support at 1200 before rebounding to end the week up while Crude Oil just kept falling. The US Dollar finally found some resistance and pulled back while Treasuries marched higher. The Shanghai Composite continued its move up while Emerging Markets had a bounce, but of the dead cat variety. Volatility moved up and spiked to a key level before pulling in. The Equity Index ETF’s probed higher early Monday but then resumed their moves lower, with the SPY and the QQQ making 2 month lows, while the IWM a new 52 week low. What does this mean for the coming week? Lets look at some charts.

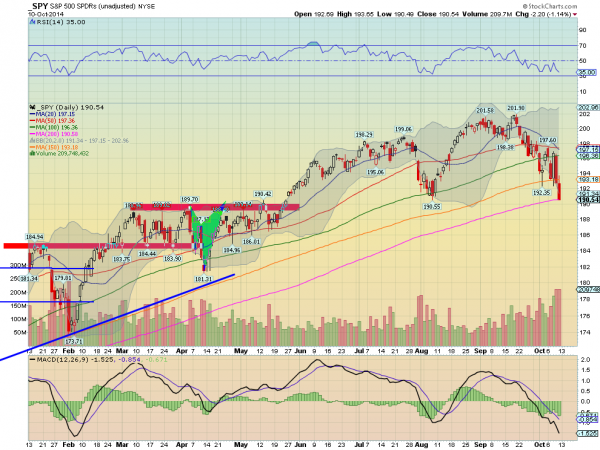

SPY Daily, SPY

SPY Weekly, SPY

The SPY started the week higher, touching the 50 day SMA, only to pullback immediately, breaking the 100 day SMA Tuesday and pausing at the 150 day SMA. Friday continued lower though with a long red candle finishing on the lows at the 200 day SMA. The last time it was at the 200 day SMA was in November 2012. Volume has been building on the sell off as well. The daily chart shows the RSI in the bearish range and the MACD falling. These support more downside price action. On the weekly view the trend from October 2011 was broken to the downside but the damage is not nearly as severe as it looks on the daily chart. The price is sitting on the lower Bollinger band where it has not been since November 2012 but still above the 50 week SMA. The RSI is falling but remains in the bullish zone while the MACD is falling calling for more downside. There is support here at 190.50 and then 190 and 188.25 followed by 186.40 and 185. Resistance higher stands at 192.60 and 194 followed by 196.50 and 198.30. Long Term Uptrend in Jeopardy, Downside Bias.

Heading into October Options Expiration the picture for the equity markets looks gloomy. Elsewhere look for Gold to bounce in its downtrend while Crude Oil continues lower. The US Dollar Index is strong and biased higher along with US Treasuries. The Shanghai Composite is also looking at heading higher while Emerging Markets are biased to the downside. Volatility is on the cusp of a break out higher putting equities at risk. The charts of the Index ETF’s, SPY, IWM and QQQ, show that as well, with the IWM starting a downtrend while the SPY and QQQ are also biased lower in the short run, but look stronger in the longer timeframe. This week could prove crucial for equities. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.