A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators suggested, heading into the Holiday shortened week for Christmas, the Santa Claus Rally had begun for equities. Elsewhere looked for Gold (SPDR Gold Trust (ARCA:GLD) to continue to bounce in its downtrend while Crude Oil (USO) gained some footing. The US Dollar Index (UUP) was making another leg higher while US Treasuries (iShares Barclays 20+ Year Treasury (ARCA:TLT)) also looked towards all-time highs.

The Shanghai Composite (ASHR, PEK) continued its move higher but required a cautious stance from a momentum perspective while Emerging Markets (iShares MSCI Emerging Markets (ARCA:EEM)) were reversing higher. Volatility (iPath S&P 500 Vix Short Term Fut (ARCA:VXX)) looked to remain subdued again and might fall keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Both the SPY and QQQ looked to retest their prior highs and the IWM its all-time high.

The week played out with Gold probing lower before rebounding to end the week near flat while Crude Oil continued to build a base at 55. The US Dollar continued slightly higher while Treasuries found trouble overhead and pulled back, building a down channel or a bull flag.

The Shanghai Composite bounced off of resistance but quickly rebounded while Emerging Markets continued a slow drift higher, in either a rising channel or bear flag. Volatility fell back and is finding support. The Equity Index ETF’s continued their drift higher with the SPY and the QQQ back near their recent highs and the IWM approaching all-time highs.

What does this mean for the coming week? Lets look at some charts.

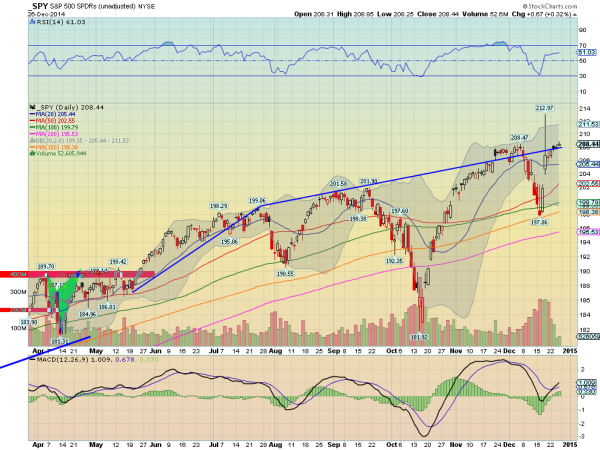

SPY Daily, SPY

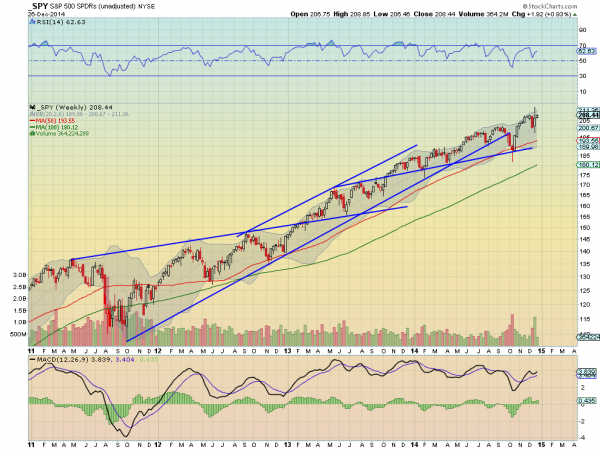

SPY Weekly, SPY

The SPY started the week confirming the Spinning Top doji from Friday to the upside and then followed through Tuesday and Wednesday. It settled the short session Wednesday at resistance from the prior high earlier in the month. Friday closed the week with another move higher and a new all-time high closing level.

The week was very quiet and a tight range at resistance, which will have many talking about a top again. But the RSI continued to make progress higher and stayed over 60 in the bullish range, while the MACD crossed up and continued higher on the daily chart. Moving out to the weekly chart also shows a push higher. The RSI on this timeframe continues to move up and the MACD is also turning back up, and will avoid a cross down.

There is resistance higher at 208.85 and 212.97, with Fibonacci extensions to 209.53 (138.2%), 211.89 (150%) and 214.25 (161.8%) as possible targets higher. There is also a Measured Move to 224 above all that. Support lower may come at 206.80 or 205.70 followed by 204.35 with an open gap below that to 202.34. Continued Upward Price Action with Possible Consolidation.

Heading into the last week of 2014, the equity markets look positive, with a possible major rotation into small caps under way. Elsewhere look for Gold to bounce hold between 1180 and 1200 in its downtrend while Crude Oil builds a base near 55. The US Dollar Index looks to continue higher while US Treasuries are biased lower in the short run, within their uptrend.

The Shanghai Composite sits at resistance but with a strong look and could just keep moving up while Emerging Markets are biased to the upside in their downtrend. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves higher. Their charts look solid as the SPY sits at all-time highs and the QQQ at 14 year highs. The IWM may be breaking a 14 month range to the upside, which could trigger a major rotation into small caps. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.