A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators suggested, heading into the week, heading into the last week of October the equity markets looked to have nearly fully recovered from the Droptoberfest™ selloff. Elsewhere looked for Gold (SPDR Gold Trust (ARCA:GLD)) to resume its downtrend while Crude Oil (USO) consolidated with a bias to turn lower. The US Dollar Index (UUP) remained strong but digesting its recent gains while US Treasuries (iShares Barclays 20+ Year Treasury (ARCA:TLT)) were biased lower. The Shanghai Composite (SSEC) seemed to be in short term pullback mode while Emerging Markets (iShares MSCI Emerging Markets (ARCA:EEM)) consolidated in the downturn with signs of a possible reversal higher. Volatility (iPath S&P 500 Vix Short Term Fut (ARCA:VXX)) looked to to have settled back into the lower range putting the wind at the back of the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Their charts showed great strength in the prior week and no reason for it to stop this week.

The week played out with Gold pushing lower ending the week below support while Crude Oil continued to consolidate. The US Dollar saw strength and moved higher while Treasuries consolidated. The Shanghai Composite found support and launched higher while Emerging Markets started a move higher. Volatility continued lower, nearing another trigger. The Equity Index ETF’s all continued higher and ended the week with the QQQ at 14 year highs, and the SPY just pennies away from an all-time high. Even the IWM had a strong week ending at nearly a 2 month high. What does this mean for the coming week? Lets look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

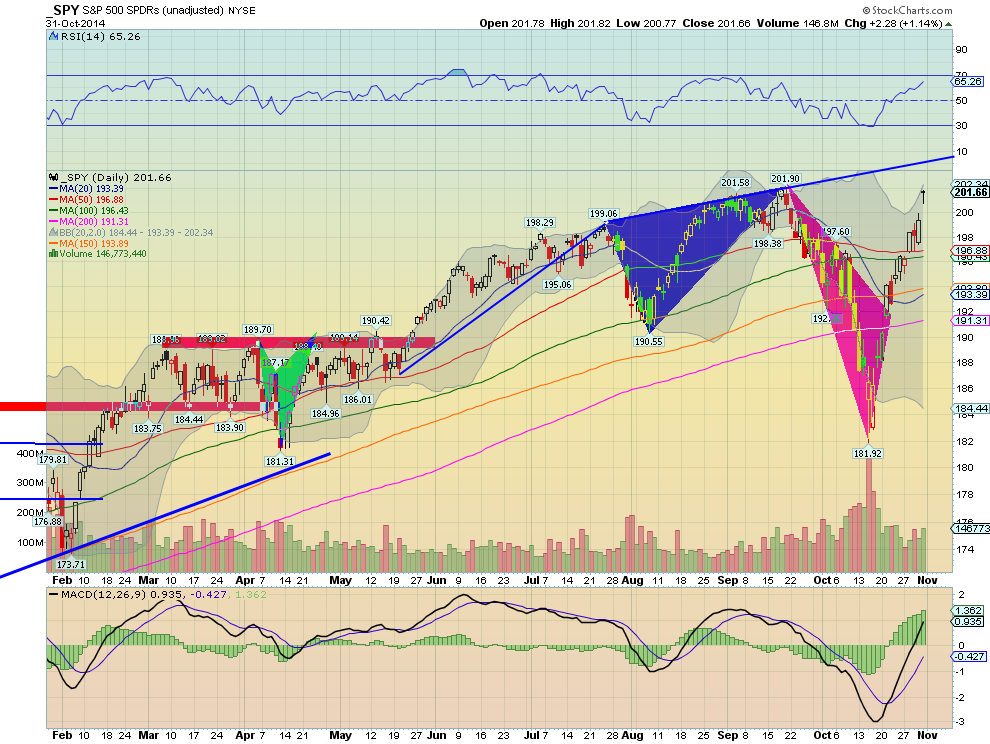

SPY Daily, SPY

SPY Weekly, SPY

The SPY started the week with an inside candle under the 100 day SMA getting many thinking a lower high may be in. But Tuesday came and opened with a gap up over that 100 day SMA and the 50 day SMA, printing a bullish Marubozu candle. Wednesday brought a Spinning Top doji, a sign of indecision as the FOMC statement was released. Again short term sentiment got a little cautious. Thursday followed with another strong bullish engulfing candle higher and Friday ended the week with a big gap up and a Hanging Man doji nearly at the all-time high. A move lower Monday would confirm a reversal and a possible double top. Confused yet? The RSI on the daily chart has not been confused and just keeps rising as does the MACD giving a bullish bias from the momentum indicators. The weekly chart is also a much clearer picture. The Marubozu from the prior week that confirmed the Hammer reversal higher, saw a follow through week with another Marubozu. The RSI on this timeframe is back in the bullish zone with a MACD that has turned back up and is headed for a bullish cross. There is resistance at 201.90 and then the trend line at 204.50. Support lower comes at 200 and 199 followed by 198.30 and 196.50. There are a couple of open gaps nearby below now as well. Continued Upward Price Action.

As the calendar turns to November the equity markets are looking higher. Elsewhere look for Gold to continue lower while Crude Oil consolidates, watching for a reversal. The US Dollar Index looks to continue higher to new multi-year highs while US Treasuries are biased lower in consolidation. The Shanghai Composite and Emerging Markets are biased to the upside with China looking very strong. Volatility looks to remain subdued after the pullback keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show great strength ion the weekly timeframe with some potential exhaustion signals in the short run. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.