Last week’s review of the macro market indicators suggested, heading into the last full week of the year that the equity markets were seeing weakness. Elsewhere looked for Gold (SPDR Gold Trust (ARCA:GLD)) to continue its short term uptrend while Crude Oil (USO) continued the trend lower, but with perhaps a short term bounce. The US Dollar Index (UUP) looked to move sideways in the uptrend while US Treasuries (iShares Barclays 20+ Year Treasury (ARCA:TLT)) were biased higher.

The Shanghai Composite (PEK) was finally consolidating its strong move in the uptrend while Emerging Markets (iShares MSCI Emerging Markets (ARCA:EEM)) looked to continue their fall lower. Volatility (iPath S&P 500 Vix Short Term Fut (ARCA:VXX)) looked to remain slightly elevated in the low zone keeping the short term bias lower for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). The SPY and QQQ looked weakest and had room to pullback more while the IWM was consolidating but at the bottom of the range, so also vulnerable.

The week played out with Gold losing ts strength and falling back to 1200 while Crude Oil started lower but then consolidated most of the week. The US Dollar moved slightly higher to a new multi-year high while Treasuries made a new high before they pulled back.

The Shanghai Composite resumed its push higher while Emerging Markets may have finally bottomed. Volatility spiked early in the week but pulled back quickly. The Equity Index ETF’s all started the week lower before bouncing and finishing strong. With the IWM at new 5 month highs and the SPY and the QQQ recovering most of their recent losses.

What does this mean for the coming week? Lets look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

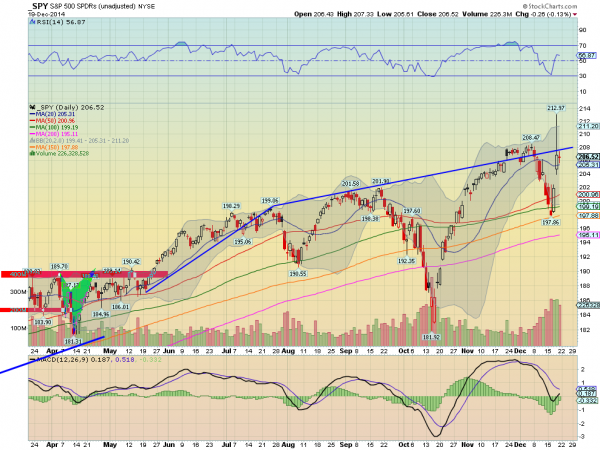

SPY Daily, SPY

SPY Weekly, SPY

The SPY started the week heading lower, a continuation of the prior week. By Tuesday it had reached the 150 day SMA and printed an Inverted Hammer. This caused controversy as technically this is a reversal candle, if confirmed the next day higher, but many cite Bulkowski stating that it acts as continuation 65% of the time.

Turns out it was a reversal candle as it did confirm higher the next day with a long white candle back to the topping range. Thursday reinforced the move with a gap up and run higher, leaving a long upper shadow from a massive sweep buy near the close. Friday ended the week with a doji, indecision. All this left the price right back at the extension of the rising trend resistance that it briefly exceeded before the quick fall. The daily chart shows the RSI bounced off of the technically oversold level at 30 and is now near a move back into the bullish zone, while the MACD is turned back up and quickly approaching a bullish cross up. Volume since it bottomed has also been quite heavy.

The weekly chart shows a candle with long shadows on both ends, but still a bullish engulfing candle. The RSI on this timeframe is moving back higher without even touching the mid line while the MACD has stopped its fall and is turning up as well. There is resistance at 206.80 and 208.47 before 212.97. There is also a Measured Move to 224.41. Support lower may come at 205.70 and 204.35 followed by 203.25 and 202.30 before 200. Continued Uptrend.

Heading into the Holiday shortened week for Christmas, the Santa Claus Rally seems to have begun for equities. Elsewhere look for Gold to continue to bounce in its downtrend while Crude Oil gains some footing. The US Dollar Index is making another leg higher while US Treasuries also look towards all-time highs.

The Shanghai Composite continues its move higher but requires a cautious stance from a momentum perspective while Emerging Markets are reversing higher. Volatility looks to remain subdued again and may fall keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Both the SPY and QQQ look to retest their prior highs and the IWM its all-time high. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.