Last week’s review of the macro market indicators suggested, as the calendar turned to November that the equity markets were looking higher. Elsewhere looked for Gold (SPDR Gold Trust (ARCA:GLD)) to continue lower while Crude Oil (United States Oil Fund (NYSE:USO)) consolidated, watching for a reversal. The US Dollar Index (PowerShares db USD Index Bullish (NYSE:UUP)) looked to continue higher to new multi-year highs while US Treasuries (iShares Barclays 20+ Year Treasury (ARCA:TLT)) were biased lower in consolidation. The Shanghai Composite (SSEC) and Emerging Markets (iShares MSCI Emerging Markets (ARCA:EEM)) were biased to the upside with China looking very strong. Volatility (VXX) looked to remain subdued after the pullback keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Their charts showed great strength on the weekly timeframe with some potential exhaustion signals in the short run.

The week played out with Gold pushing lower before a bounce Friday while Crude Oil started lower but held and bounced back to finish the week steady again. The US Dollar took another leg higher while Treasuries may be coming in for a landing. The Shanghai Composite consolidated sideways this week while Emerging Markets pulled back mildly. Volatility continued to drift lower back to its pre-spike range. Against this backdrop the Equity Index ETF’s moved in place over the week with the exception of the SPY which drifted higher. What does this mean for the coming week? Lets look at some charts.

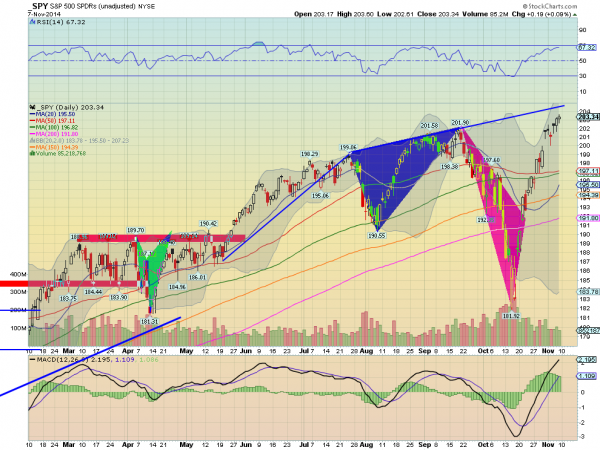

SPY Daily, SPY

SPY Weekly, SPY

The SPY started the week where it left off the prior week, printing small topping candles. By Wednesday that topping look was drifting higher and Thursday and Friday ended the week a bit stronger to the upside. Another new all-time high close, in fact 4 of them this week. The daily chart shows the rising trend resistance nearby over head around 204.50 and support to continue towards that level from the rising and bullish RSI and the rising MACD. On the weekly chart the continuation higher printed a smaller candle to the top of the Bollinger Bands®. The RSI continues to rise and the MACD is about to cross up. There is no resistance higher and over 204.50 the 138.2% extension of the last down leg targets 209.53. Support lower comes at 201.80 and 200 followed by 199 and 198.30. Continued Uptrend.

Heading into next week, the equity markets look healthy but maybe a bit extended on the short term basis. Elsewhere look for Gold to possibly reverse higher in its downtrend while Crude Oil may also be ready for a reversal of trend higher. The US Dollar Index may continue to consolidate in its uptrend while US Treasuries consolidate the move lower at support. The Shanghai Composite looks like it could take a breather from its run higher while Emerging Markets are continued to be biased to the downside. Volatility looks to remain subdued after the spike higher keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their individual charts show the IWM and QQQ consolidating in the short run while the SPY inches higher, but all 3 better to the upside in the intermediate trend. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.