Last week’s review of the macro market indicators suggested, closing out the 3rd Quarter, that the equity indexes were in retrench mode but without major damage yet. Elsewhere looked for Gold (SPDR Gold Trust (ARCA:GLD)) to bounce around and a possible rise in the downtrend while Crude Oil (United States Oil Fund (NYSE:USO)) had a similar read with a reversal in the works, maybe. The US Dollar Index (PowerShares db USD Index Bullish (NYSE:UUP)) remained on fire, and maybe a little too hot in need of a rest while US Treasuries (iShares Barclays 20+ Year Treasury (ARCA:TLT)) were moving higher. The Chinese Market (iShares FTSE/Xinhua China 25 Index (ARCA:FXI)) remained strong and looked to go higher while Emerging Markets (iShares MSCI Emerging Markets (ARCA:EEM)) were biased to the downside. Volatility (Volatility S&P 500) looked to remain subdued but with a risk higher keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). The indexes themselves were looking better to the downside in the short run, with the IWM near support and the QQQ strong on the longer scale with the SPY likely to see a bit more downside.

The week played out with Gold probing probing the 1200 level before pushing through Friday and ending down while Crude Oil could not make a higher high and fell back. The US Dollar continued its move higher while Treasuries also continued higher, but failed to fill the gap. The Shanghai Composite inched higher early but then took the rest of the week off for holidays, while Emerging Markets seem to have found a bottom. Volatility spiked but remained at non-panic levels, and then pulled back. The Equity Index ETF’s started the week continuing the downtrend but all found some footing Thursday and gained back some of the pullback Friday, with the SPY and the QQQ posting Hammer reversals and the IWM bouncing at the bottom of the 2014 channel. What does this mean for the coming week? Let's look at some charts.

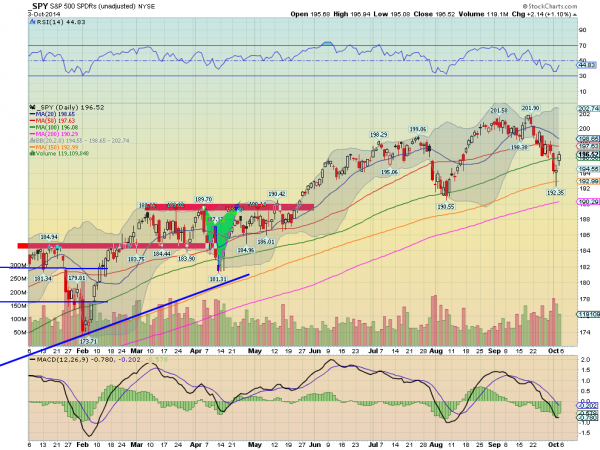

SPY Daily, SPY

SPY Weekly, SPY

The SPY started the week consolidating over the 100 day SMA before dropping lower Wednesday. Thursday printed a Hammer reversal candle though and it was confirmed higher Friday with a move back over the 100 day SMA. This created a higher low and makes for a target of 203.30 on a Measured Move higher. The RSI is turning back up but remains below the mid line and the MACD is leveling in its fall. The indicators need to keep turning up to give more comfort in the price reversal. The weekly view shows a doji print at the rising trend support. A possible reversal. The RSI on this timeframe is falling but in the bullish zone and the MACD is falling. Not so much strength on this timeframe. There is resistance at 198.30 and 199 before 200 and 201.90. Support lower comes at 194 and 191.20 before 190.50. Cautious Short Term Reversal Higher in Long Term Uptrend.

As the calendar turns to October the equity markets look to have weathered a pullback, but are still not totally out of trouble. Elsewhere look for Gold and Crude Oil to continue their pullbacks. The US Dollar Index and US Treasuries look to continue to move higher. The Shanghai Composite is strong and looks good for more upside while and Emerging Markets are biased to the downside with the possibility of a bounce. Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all printed short term reversals higher, but look weaker on the longer timeframe. Play the reversals with caution for this week. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.