A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators suggested, heading into another holiday shortened week, that the equity markets still looked a bit vulnerable to more pullback. Elsewhere looked for Gold to continue its uptrend while Crude Oil consolidated in the downtrend. The US Dollar Index looked to continue higher along with US Treasuries (ARCA:TLT). The Shanghai Composite looked to resume its move higher despite being very overbought while iShares MSCI Emerging Markets (ARCA:EEM) continued to consolidate in a bear flag in the downtrend.

CBOE Volatility Index looked to remain low but creeping higher making a headwind for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Their charts showed differing reactions with the iShares Russell 2000 Index (ARCA:IWM) consolidating in the top of its year long range, and the SPY trying to reverse a pullback, while the QQQ was biased lower in the short run. Longer term the SPY and QQQ remained in uptrends while the IWM consolidated.

The week played out with Gold continuing higher to test 1300 for the first time in 5 months while Crude Oil continued to consolidate at the lows. The US dollar struck out to the upside again while Treasuries made new highs and then consolidated. The Shanghai Composite found a bottom in the pullback and revered to the highs while Emerging Markets finally broke above the resistance that held them for a month.

Volatility continued to pullback from the latest spike but remained above the 200 day SMA. The Equity Index ETF’s reacted to the upside but at differing rates. While the IWM drifted up, the QQQ had a solid strong trend and the SPY trended too until pausing Friday. What does this mean for the coming week? Lets look at some charts.

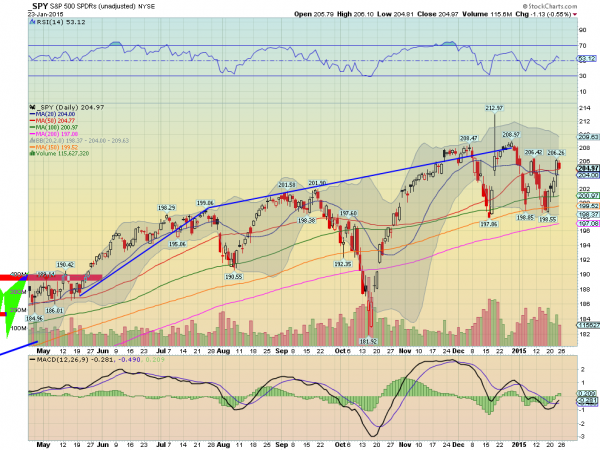

SPY Daily:

The SPY had a good week, recovering the losses from last week. The consolidation Friday held over the 20 and 50 day SMA’s, but with an inside day, or Harami. There is a mixed view from the momentum indicators as the RSI struggling to get through the mid line while the MACD is crossed up and rising. This fits well with the consolidation that is seen in the weekly chart.

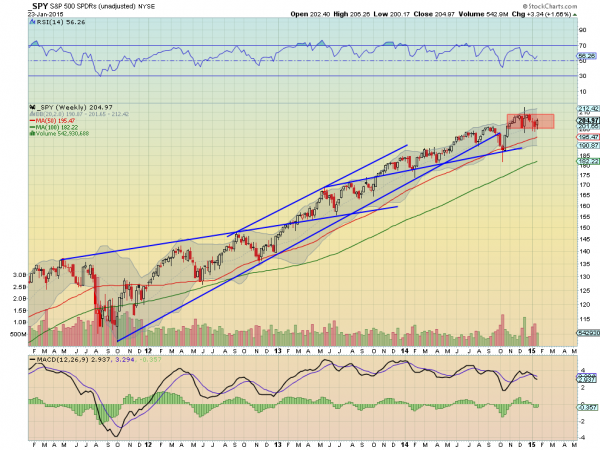

SPY Weekly:

The range from October continues with the RSI holding in the bullish zone, over the mid line and the MACD crossed down. A mixed momentum bag on this timeframe as well. There is resistance at 206.40 and 209 before the spike to 212.97. Over 209 would trigger a Measured Move to 227. Support lower comes at 204.20 and 202.30 followed by 200 and 198.60. Consolidation in the Uptrend.

Heading into the last week of January the equity markets are churning, but at different paces. Elsewhere look for Gold to continue in its uptrend while Crude Oil continues lower. The US dollar index also looks to continue higher while US Treasuries consolidate in the uptrend. The Shanghai Composite is taking a breather in its uptrend but Emerging Markets are breaking higher, at least in the short term.

Volatility looks to remain low but drifting gently higher over time slowing the wind at the back of the equity market. The equity index ETF’s are reacting differently to these factors. The IWM is continuing its consolidation but with sings it may break higher, while the SPY consolidates in its uptrend, perhaps passing the baton to the small caps. The QQQ has been acting mostly like the SPY but looks much stronger, with a possible break of a bull flag higher brewing. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.