Last week’s review of the macro market indicators saw as the books were closed on August, Equity investors and traders were saying good riddance. Elsewhere looked for Gold ($GLD) to pause in its uptrend while Crude Oil ($USO) worked a short term bounce in its downtrend. The US Dollar Index ($DXY) continued to be strong while US Treasuries ($TLT) consolidated in their uptrend.

The Shanghai Composite ($ASHR) continued a short term move higher in the downtrend while Emerging Markets ($EEM) consolidated in the downtrend. Volatility ($VXXB) looked to remain slightly elevated keeping some pressure on the equity index ETF’s. The $SPY and $QQQ continued to look stronger than the $IWM as they consolidated in a pullback while the IWM showed signs of leaking lower.

The week played out with Gold breaking to the upside but then ending little changed while Crude Oil started lower but rebounded and ended the week on the plus side. The US Dollar found resistance and pulled back while Treasuries took a dive out of consolidation late in the week. The Shanghai Composite continued higher toward resistance while Emerging Markets broke consolidation to the upside.

Volatility retested last week’s highs before dropping to 5 week lows, reversing the pressure on equities and putting a wind at their back. The Equity Index ETF’s stared the week drifting lower but then gapped up Wednesday and followed that with another gap Thursday and held to end the week up. This resulted in the SPY (NYSE:SPY), IWM and QQQ all breaking recent consolidation ranges. What does this mean for the coming week? Let’s look at some charts.

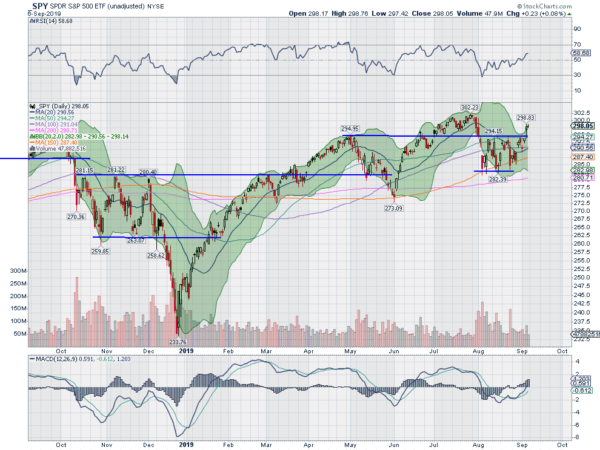

SPY (NYSE:SPY) Daily, $SPY

The SPY (NYSE:SPY) came into the week sitting just below the 50 day SMA and at the top of a consolidation range that built through August. It pulled back Tuesday, finding support at the 20 day SMA and then gapped higher Wednesday. A second gap Thursday was followed by consolidation Friday.

This confirmed a break above the August consolidation zone and a higher low to go with the higher high at the end of July. The daily chart shows the RSI rising into the bullish zone with the MACD crossed up and now positive. The Bollinger Bands® have also opened higher to allow a move.

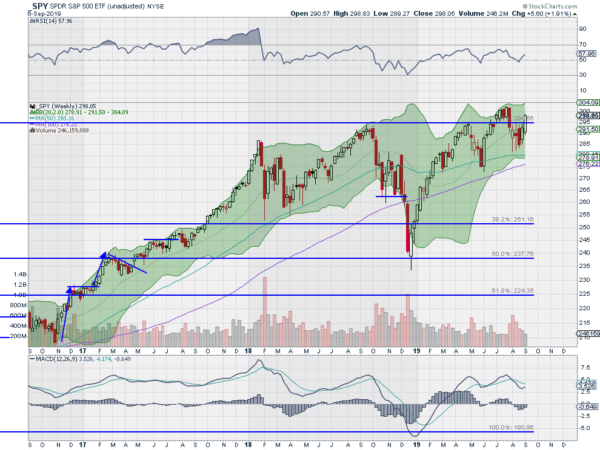

The weekly chart shows the strong candle higher over the 2018 and April highs. The RSI is rising off of the mid line in the bullish zone with the MACD positive and moving to cross up. There is resistance at 298.80 and 300 then 301 and 302. Support lower comes at 296.50 and 294.50 then 292.50 and 290. Renewed Uptrend.

SPY (NYSE:SPY) Weekly, $SPY

With the first week of September in the books equity markets are seeing a resurgence. Elsewhere look for Gold to pause in its uptrend while Crude Oil slowly drifts lower. The US Dollar Index is also drifting, but to the upside while US Treasuries pullback in their uptrend. The Shanghai Composite and Emerging Markets have both reversed to the upside and look to continue higher.

Volatility has eased and looks to remain very low changing the bias to higher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. The SPY and QQQ both broke ranges to issue buy signals while the IWM continues to churn in a wide consolidation. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.