Last week’s review of the macro market indicators noted with Jackson Hole behind, that the markets were looking ahead to the Labor Day weekend at the end of the week with the equity markets improved, but still lacking strength. Elsewhere looked for gold to consolidate at 1300 in its uptrend while crude oil drifted higher slowly. The US dollar index remained weak and better to the downside while US Treasuries (TLT) were biased to continue higher.

The Shanghai Composite (ASHR) looked to continue higher after a big break out and Emerging Markets (EEM) were better to the upside working through long term resistance. VXX (NYSE:VXX) looked to remain low putting the bias back higher for the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their charts were all looking good on the longer timeframe but mixed in the shorter timeframe. The QQQ was the strongest and was consolidating, while the SPY continued to be at some risk for further pullback, and the IWM was reversing but the weakest, under its 200 day SMA.

The week played out with gold wasting no time consolidating and moving higher while crude oil started lower then found support finishing only slightly lower. The US dollar dropped lower and then recovered late in the week while Treasuries started the week higher but gave it all back ending near unchanged. The Shanghai Composite held the break out moving slightly higher while Emerging Markets pushed to near 3 year highs.

Volatility bounced early in the week but then settled back near the 10 level, keeping the bias higher for equities. The Equity Index ETF’s started the week flat to down Monday, then reversed Tuesday starting a 4 day march higher. The SPY (intraday) and QQQ made new all-time highs while the IWM closes in on its all-time high. What does this mean for the coming week? Lets look at some charts.

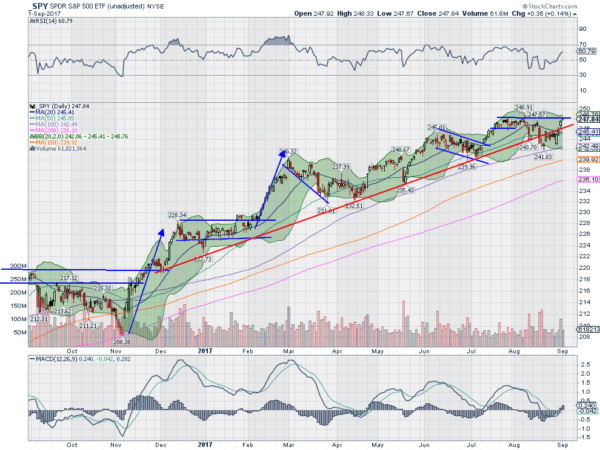

SPY Daily, SPY

The SPY was sitting on the 20 day SMA when it ended the prior week and it sat there on Monday as well. Tuesday it gapped lower but was bought all day long, creating a higher low and bringing it back to the 20 day SMA. It continued to move higher Wednesday up to the rising trend line, now acting as resistance. Thursday it broke over that and continued Friday with a gap up at the open and run to a new intraday high before pulling back to close 3 cents below the all-time high close.

It did make a new weekly high close though to go with the monthly high close on Thursday. One item to watch is that each day’s candlestick was smaller than the previous on the move higher. This is sometimes a sign of exhaustion. In this case the daily chart shows the RSI is rising and has a lot of upside room as it make a higher high. The MACD has also crossed up, and turned positive, a bullish signal.

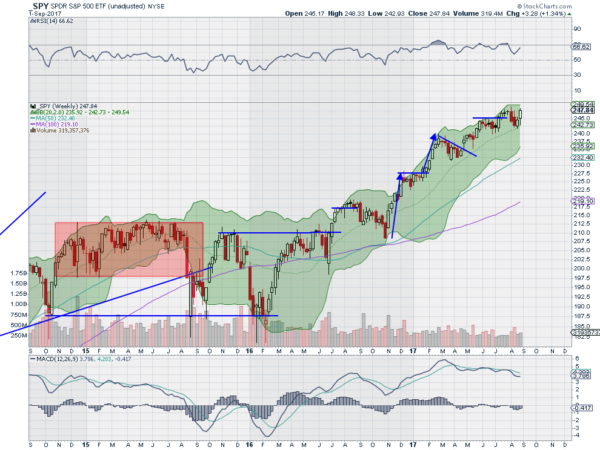

The weekly chart shows continuation of the bounce off of the 20 week SMA, confirming a higher low in a bullish rise. The RSI on this timeframe is rising and bullish with the MACD flat and turning back toward a cross up. There is resistance at 248 and then no price history to stop it. A new all-time high would reconfirm the uptrend. A Measured Move on the weekly chart would give a first target to 250. Support lower may come at 246 and 245 followed by 244 and 242 then 240. Short Term Uptrend, Watching for Long Term Uptrend Renewal Confirmation.

SPY Weekly, SPY

Heading into the Labor Day shortened week equities are looking stronger led by the QQQ. Elsewhere look for gold to continue in its uptrend while Crude Oil sustains a small bounce in the downtrend. The US dollar Index continues to move down with small bounces while US Treasuries are pulling back in their uptrend. The Shanghai Composite is strong consolidating a break out, ready to continue higher and Emerging Markets are rising and making 3 year highs.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are all recovering with the SPY gaining short term strength, nearing a trend resumption while the IWM heads higher short term in a rising channel. The QQQ breaking to new all-time highs looks the strongest. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my disclaimer page for my full disclaimer.