Last week’s review of the macro market indicators noted the joy in the equity markets that was there when the week started, faded to just a subtle fist pump at the end of the holiday shortened week. Elsewhere looked for gold (GLD (NYSE:GLD)) to continue in its uptrend while Crude Oil (USO (NYSE:USO)) pulled back in its move higher. The US dollar index (DXY) continued to melt down while US Treasuries (TLT) were biased to the upside.

The Shanghai Composite (ASHR) was pausing in its break out and Emerging Markets (EEM) were biased higher also consolidating at long term resistance in their uptrend. Volatility (VXX) looked to remain low keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their charts showed some short term retrenchment as they hit highs, while the long term rising trend remained unperturbed.

The week played out with gold finding resistance and pulling back to support while Crude Oil resumed its path to the upside. The US dollar put in a Dead Cat bounce while Treasuries got smacked down lower. The Shanghai Composite held at its recent highs while Emerging Markets did the same.

Volatility gapped down and kept falling, keeping the bias higher for equities. The Equity Index ETF’s all moved higher on the week, with the SPY and QQQ making new all-time highs and the IWM rising to within 2 points of its high. What does this mean for the coming week? Lets look at some charts.

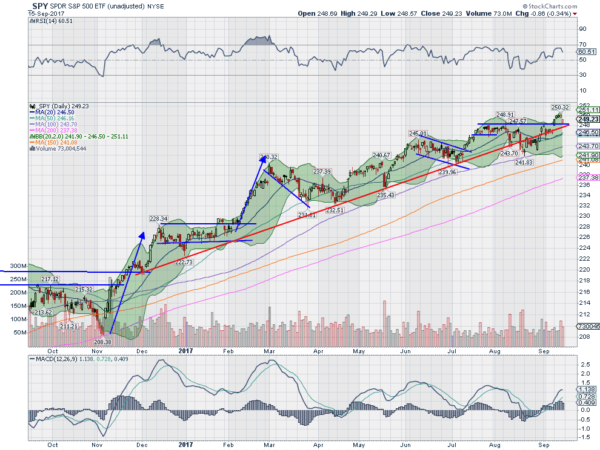

SPY Daily

The SPY gapped up to start the week closing at a new all-time high Monday. It did it again Tuesday with a smaller gap up and then made a marginally higher close Wednesday as well. Thursday’s candle had an inside real body and then Friday it opened lower after opening ex-dividend. It ended the week above the initial gap up and over the prior resistance that had held it for 2 months. The daily chart shows the push higher and roll accompanied by a similar move by the RSI. The MACD also moved higher and the Bollinger Bands® opened higher.

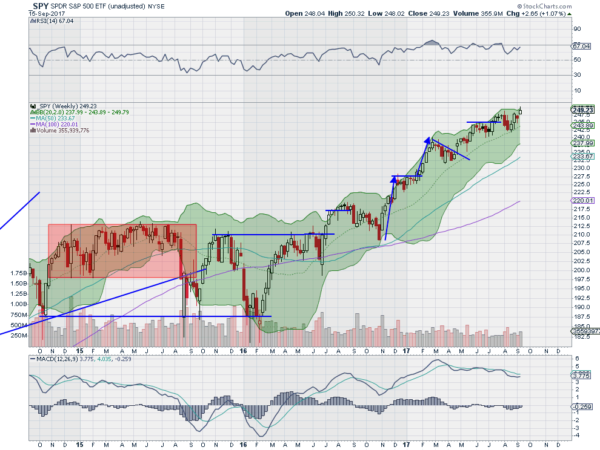

On the weekly chart the first thing to note is the Bollinger Bands opening. This timeframe also has the RSI bullish and rising while the MACD is flat and trying to run up towards a cross. There is no resistance over 250 and perhaps with the options expiration out of the way it can flex higher. Support lower sits at 248 and 246 followed by 245 and 244. Continued Uptrend.

SPY Weekly

As September Options Expiration comes to a close the equity markets look strong but with some short term rotation to small caps. Elsewhere look for gold to pause in the pullback in its uptrend while Crude Oil continues higher. The US dollar index continues to lose ground while US Treasuries pause in their uptrend. The Shanghai Composite and Emerging Markets are marking time short term as they grind through resistance in long term uptrends.

Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show strength in the longer time frame for all three. In the short term the IWM is benefiting from some rotation, seemingly at the expense of the QQQ and SPY. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.