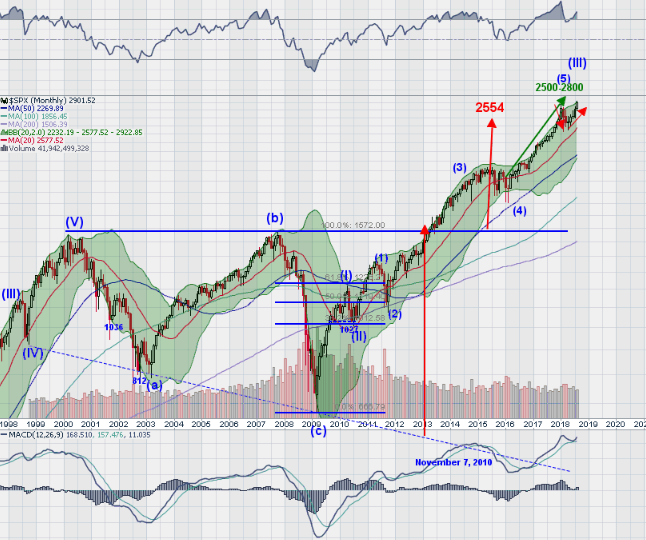

Last week’s review of the macro market indicators noted with the books closed on summer vacations and the short week, the equity markets saw some profit taking, but remained with strong long term charts. Elsewhere looked for Gold (GLD (NYSE:GLD)) to possibly pause in its downtrend while Crude Oil (USO (NYSE:USO)) slowly drifted higher long term. The US Dollar Index (DXY) was marking time sideways while US Treasuries (TLT) were biased to continue lower.

The Shanghai Composite (ASHR) and Emerging Markets (EEM) did nothing to change their downside trends. Volatility (VXX) had crept higher and was set up to slowly continue, keeping pressure on equity markets. The equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ), all reacted with moves lower on the week. The QQQ was the hardest hit and then the small caps with the SPY (NYSE:SPY) down less than 1%.

The week played out with Gold bouncing but falling to hold and falling back while Crude Oil continues to try to move up. The US Dollar continued in a tight range around 95 while Treasuries meandered lower. The Shanghai Composite also stayed on the path lower but Emerging Markets found support and stopped dropping.

Volatility eased, touching back to the August lows, reversing the bias to the upside for equities. The Equity Index ETF’s all responded accordingly by moving higher, led by the SPY and the QQQ with the IWM holding flat. Then Friday the “T” word forced them to give up some of their gains. What does this mean for the coming week? Lets look at some charts.

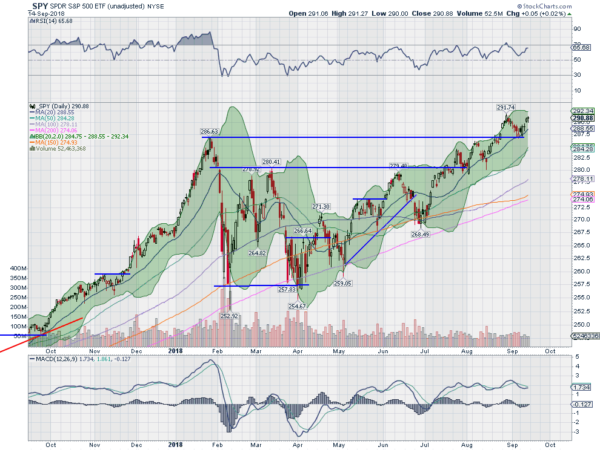

The SPY was pulling back from a new all-time high to retest the breakout level as the week started. It moved up off of that retest and the 20 day SMA Monday. Tuesday saw a second retest of the 20 day SMA and then a strong move higher. This continued to the end of the week, stopping just shy of the all-time high.

The daily chart shows the RSI rising in the bullish zone with some room while the MACD is starting to turn to a cross up and positive. The Bollinger Bands® are flat but there is room to the upside for a new high. A successful retest for now.

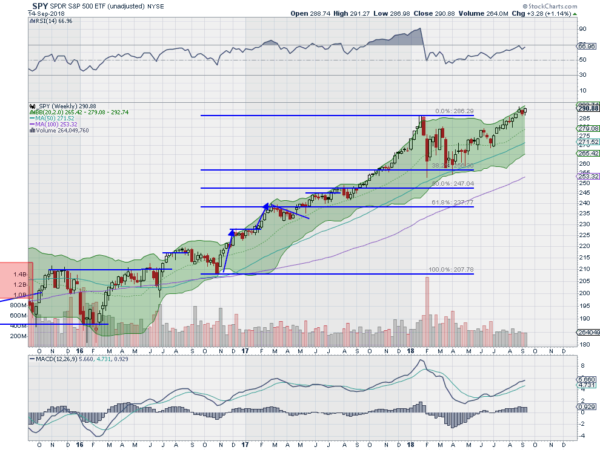

On the weekly timeframe a positive weekly move and new weekly high close. The RSI on this timeframe is headed back higher in the bullish zone with the MACD rising and positive, but well shy of the January peak. Price is also riding the Bollinger Bands higher. There is no resistance over 291.50. Support lower comes at 290 and 287.50 then 286 and 284 before 283. Short Term Consolidation in Uptrend.

Heading into September Options Expiration week the equity markets regained some swagger. Elsewhere look for Gold to consolidate in its downtrend while Crude Oil continues to drift higher. The US Dollar Index looks to continue to mark time while US Treasuries head lower in broad consolidation. The Shanghai Composite remains weak and looking for support while Emerging Markets may be finding some footing after a long downtrend.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. And after a digestive week they all firmed up with positive weeks to show renewed short term strength, to go along with the long term strength. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.