A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators noted that heading into the weeks before the election equity markets looked stable long term and mixed in the short run with the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) leading and the SPY (NYSE:SPY) falling. Elsewhere looked for gold to continue to press higher short term while Crude Oilcontinued to show its strength. The US Dollar Index was also strong moving higher while US Treasuries were bouncing short term in their downtrend.

The Shanghai Composite continued to drift higher while iShares MSCI Emerging Markets (NYSE:EEM) marked time in consolidation. iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX) looked to remain subdued and falling, adding a tailwind to the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). They were mixed short term though with the QQQ moving higher, the IWM flat and the SPY at risk for more downside.

The week played out with Gold slowly riding the 200 day SMA higher all week while Crude Oil pulled back slightly. The US Dollar met some resistance and pulled back Friday while Treasuries gapped lower and held. The Shanghai Composite started the week with a bang to the upside then slowly gave some back the rest of the week while Emerging Markets moved lower in consolidation.

Volatility made bottom on Monday and rolled higher all week, ending in the normal range. The Equity Index ETF’s played out as they looked coming into the week Monday with the QQQ moving higher, SPY sideways and IWM lower. By Tuesday tough they had all turned lower and continued the rest of the week. What does this mean for the coming week? Lets look at some charts.

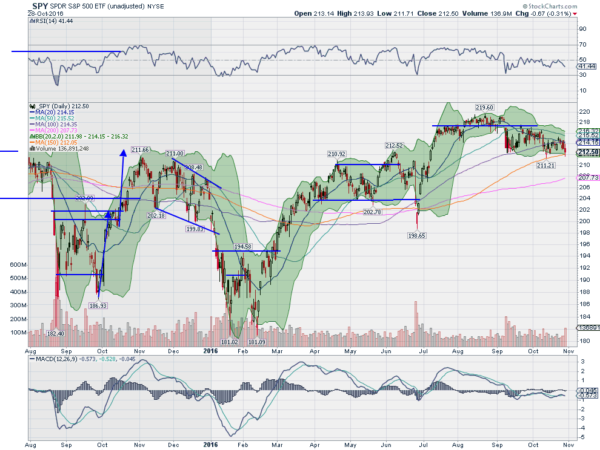

SPY Daily

The SPY started the week with a move back over the 20 day SMA Monday. It had not been there for two weeks and was a welcome sight. But it did not last. It fell back Tuesday and Wednesday. Thursday saw it open again over the 20 day SMA but sell off all day, finishing at the low. Friday then continued lower.

It sounds horrible but looking at the daily chart shows all of this happened in less than a 4 point range. It ended at the support that has been in place since the gap down in September. The RSI on the daily chart is falling too, and at the edge of a move into the bearish zone, while the MACD is rather flat but curling for a cross down.

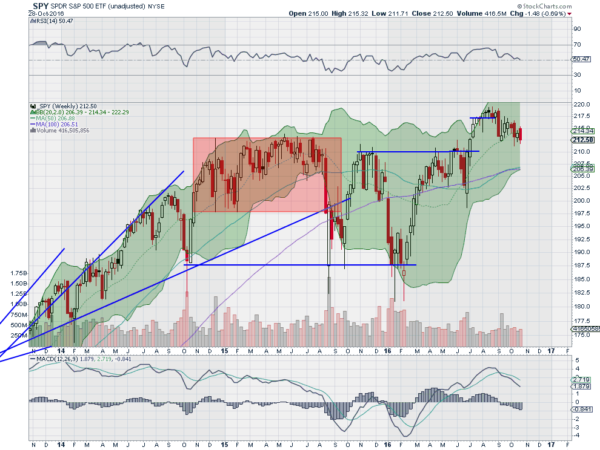

The weekly chart shows a bearish engulfing candle. Not what bulls want to see. There is also continuation of the bull flag. The RSI on the longer timeframe is falling but at the mid line while the MACD is falling but positive. There is support at 212.50, where it sits, and 210.20 followed by 209 and 207.50. Resistance above may come at 214 and 215 followed by 215.70 and 217. Consolidation with a Short Term Bias Lower.

SPY Weekly

Heading into the last week full week before the election the equity markets continue to look troubled on the short timeframe, with the weakness starting to leak into the longer timeframe for the small caps. Elsewhere look for Gold to drift higher while Crude Oil continues the short term move lower. The US Dollar Index looks ready for consolidation or a pullback short term while US Treasuries are biased lower.

The Shanghai Composite looks to continue to drift higher as Emerging Markets are biased to the downside in consolidation. Volatility looks to remain in the normal range but creeping up so adding a headwind for the equity index ETF’s SPY, IWM and QQQ. Their charts also show short term weakness with the IWM the weakest as it falls and the SPY next but the QQQ still holding near all-time highs. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.