Last week’s review of the macro market indicators noted the equity markets had finished their worst week and deepest correction since the February and March pullbacks. Elsewhere looked for Gold (GLD (NYSE:GLD)) to rise in the short term while Crude Oil (USO (NYSE:USO)) pulled back in its uptrend. The US Dollar Index (DXY) continued to mark time sideways while US Treasuries (TLT) were bouncing in their downtrend.

The Shanghai Composite (ASHR) looked weak as it made 4 year lows and Emerging Markets (EEM) were preparing to reverse their downtrend. Volatility (VXX) looked to remain elevated keeping the bias lower for the equity index ETF’s SPY, iShares Russell 2000 (NYSE:IWM) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed short term trend changes to the downside and were close to longer term trend changes as well. The IWM was now over 11% off its high and looking the worst, while the QQQ had bounced after dropping more than 10%. The SPY (NYSE:SPY) also bounced, after a smaller 8% pullback.

The week played out with Gold holding its gains but not advancing while Crude Oil continued the pullback. The US Dollar found support and moved slightly higher in consolidation while Treasuries drifted lower. The Shanghai Composite continued lower before a bounce Friday while Emerging Markets held at their lows.

Volatility retreated but remained above the complacent range, taking some pressure off of equities. The Equity Index ETF’s moved like a roller coaster during the week, rising early, pulling back Thursday only to bounce Friday morning before another sell off in the afternoon. This brought them all very close to flat on the week. What does this mean for the coming week? Lets look at some charts.

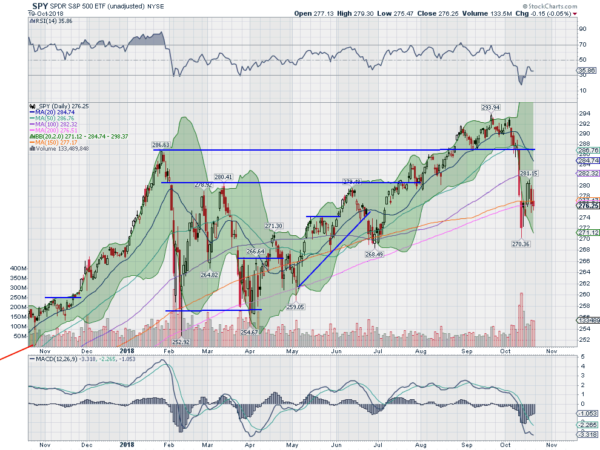

SPY Daily, SPY

The SPY had bounced after its first major pullback since February as the week began. It started to move higher early in the week and continued to a top Wednesday. Thursday saw it pullback hard though, ending at the 200 day SMA. It tried again early Friday but could not hold up and fell back to the 200 day SMA again Friday.

The daily chart shows the makings of support and consolidation building. Or it is a bear flag waiting for the next leg down. The RSI is trying to move up in the bearish zone while the MACD is leveling after the drop and turn to negative. If it holds and continues up, it will have made a higher low again.

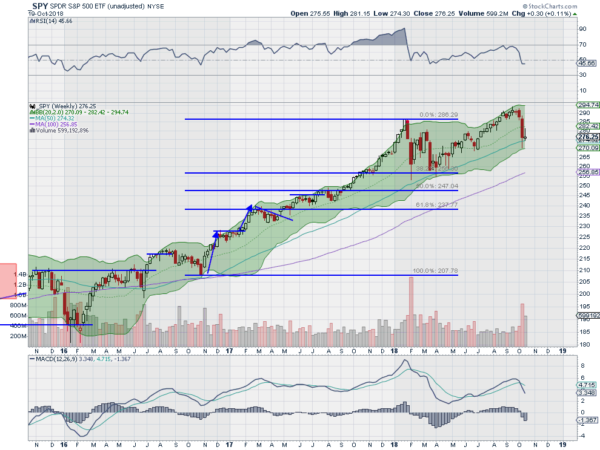

The weekly chart shows the near doji holding over the 50 week SMA. That is the same support area that led to the start of the run higher from March until the end of September. The RSI is stalling as it dropped below the mid line and still in the bullish zone, while the MACD is falling but positive. There is support lower at 274.50 and 272.50 then 271.40 and 269. Resistance above comes at 277.50 and 279 then 280 and 281 before 284. Possible Pause in Pullback.

SPY Weekly, SPY

As the October Options Expiry passes equities saw a week of failed hopes as they rose off of the lows only to fall back by the end of the week. Elsewhere look for Gold to move higher while Crude Oil continues lower in the short term. The US Dollar Index shows no signs of moving out of consolidation while US Treasuries are moving back lower. The Shanghai Composite continues to look awful as it makes new 4 year lows while Emerging Markets may be pausing in their downtrend.

Volatility pulled back slightly but remains above the longer term steady levels, keeping some pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts still show damage and little effort to get out of it. Short run reversals at the end of the week will likely bring on more bearish sentiment over the weekend. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.