Last week’s review of the macro market indicators suggested heading into the first full week of October that the indexes had again dodged a bullet and ended the week on strength. Elsewhere looked for gold (NYSE:GLD) to continue to consolidate in its downtrend, while crude oil (NYSE:USO) consolidated in its downtrend. The US dollar index (NYSE:UUP) looked to mark time as it consolidated its move higher, while US Treasuries (NYSE:TLT) were biased higher in the short term.

The Shanghai Composite (NYSE:ASHR) looked to continue to consolidate in its trend lower, while Emerging Markets (NYSE:EEM) were biased to the upside in broad consolidation after their move lower. Volatility (NYSE:VXX) looked to remain elevated but moving back toward normal levels, easing the headwind for the equity index ETFs NYSE:SPY, NYSE:IWM and NASDAQ:QQQ. The indexes themselves all looked good in the short term while they consolidated in the intermediate term.

The week played out with gold probing the upper end of the consolidation and ending the week peeking over the top, while crude oil broke its consolidation to the upside. The US dollar drifted lower, while Treasuries reversed course and started lower. The Shanghai Composite gapped higher after a week off and held, while Emerging Markets continued their move higher.

Volatility continued lower, edging back to normal ranges. The Equity Index ETFs all continued higher off of the last Friday charge, with the SPY and the IWM leading the charge and the QQQ better, but lagging them. What does this mean for the coming week? Lets look at some charts.

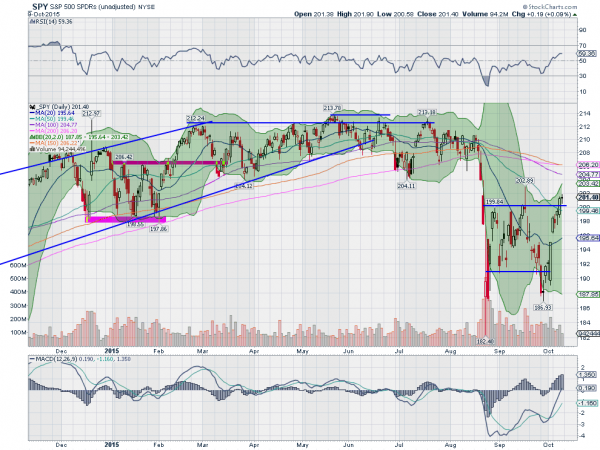

The SPY came into the week following a strong Marubozu to close the prior week. Big hopes for more upside and it did not disappoint. Monday the SPY gapped higher and an inside day Tuesday got some worried. But Wednesday it continued higher and a strong day Thursday pushed through prior resistance. Friday held above that resistance, but printed a doji candle, signaling indecision.

After the big 7.7% move higher, many will look at the doji as a reversal but it can resolve either way. And the RSI on the daily chart continues higher, now on the edge of the bullish zone with the MACD strong and rising, supporting continuation. So does the rising Bollinger Band®.

On the weekly chart, the Marubozu candle for the week confirms the Hammer from last week as a reversal higher and calls for more. The RSI on this timeframe is now moving higher steeply and near the mid line, with the MACD turning up from an extreme level that matched the low in 2011. There is resistance above at 202 and 204.40, followed by 206.40 and 208.40. Support lower comes at 200 and 199.5 followed by 198 and 196 before 193.40. Continued Upward Price Action.

Heading into October Options Expiration week, the equity markets are looking stronger, but have not all sent the all clear signal yet. Elsewhere look for gold to continue its short term uptrend while crude oil does the same, but might encounter resistance. The US dollar index has a short term bias lower for the week in the broad consolidation, while US Treasuries are biased lower short term as well.

The Shanghai Composite looks to continue in consolidation, while Emerging Markets are biased to the upside. Volatility looks to return to more normal levels relieving the downward bias on the equity index ETFs SPY, IWM and QQQ. Their charts all show strength continuing into next week, but with the SPY the strongest followed by the QQQ and then the IWM on the longer term look. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.