Last week’s review of the macro market indicators suggested heading into the shortened Thanksgiving Holiday week, that the equity markets had moved strongly higher, maybe a bit too fast in the short run.

Elsewhere looked for gold (N:GLD) to continue lower, while crude oil (N:USO) consolidated in its downtrend. The US Dollar Index (N:UUP) was consolidating with an upward bias and US Treasuries (N:TLT) were moving higher in the consolidation range. The Shanghai Composite (N:ASHR) looked ready to resume the move higher out of consolidation and Emerging Markets (EEM) were biased to the upside short term in their downtrend.

Volatility (N:VXX) looked to remain low, adding some wind to the backs of the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts looked good in the short term, with the SPY and QQQ moving higher and the IWM biased higher in consolidation. Longer term, the SPY and QQQ looked ready to attack their all-time highs, while the IWM lagged behind.

The week played out with gold running flat until pushing lower to end the week, while crude oil started higher but could not continue. The US dollar drifted slightly higher while Treasuries found 1 day of upside before consolidating. The Shanghai Composite muddled along sideways until a drop Friday, while Emerging Markets pulled back from a lower high.

Volatility settled in a tight range, at low levels for the week. The Equity Index ETFs were mixed, with the SPY and the QQQ holding steady, while the IWM marched higher. What does this mean for the coming week? Lets look at some charts.

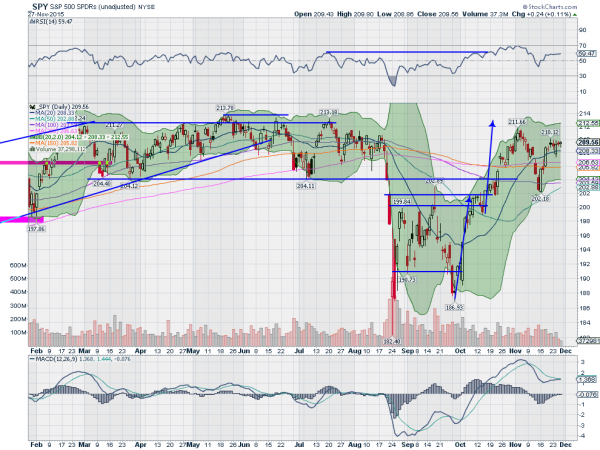

SPY Daily

The SPY started the week confirming the doji to the downside, but with another small body candle. It gapped lower at the open Tuesday but buyers showed up and it closed the gap by days end, back to the prior level. Wednesday saw a very tight range and Friday was only slightly wider. This made for a pretty boring week for the SPY, as was expected during the Holiday.

The daily chart shows the stall at 210 and the RSI flat lining as well. The MACD looks to be kissing the signal line, not crossing. On the weekly chart, the picture makes for an interesting 4 weeks. A doji followed by a long down candle followed by a large up candle, both near Marubozus, and then a second doji. The result is a consolidation in the prior range.

The RSI on this timeframe is rising off of the mid line, but has not gone back into the bullish zone over 60 yet. The MACD is rising as well. These support a push higher. There is resistance at 210.25 and 211 followed by 212.50 and 213.78. Support lower comes at 209 and 208.40 followed by 206.40. Consolidation in Short Term Uptrend.

SPY Weekly

Heading into December, the equity markets look solid and may have new leadership. Elsewhere look for gold to continue lower while crude oil builds a bear flag in its longer downtrend. The US Dollar Index is breaking out to multi-year highs, while US Treasuries consolidate with a short term bias higher. The Shanghai Composite broke consolidation to the downside and may be resuming the downtrend, while Emerging Markets are moving lower after failing at resistance.

Volatility looks to remain subdued and possibly fall keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. The SPY and QQQ paused this week and the IWM has taken over leadership in the short term. All look positive on the intermediate term chart. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.