A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators noted that with November Options Expiration behind and heading into the shortened Thanksgiving holiday week, equity markets looked strong. Elsewhere looked for Gold to continue lower while Crude Oil moved to the upside in the short run. The US Dollar Index remained strong as it moved higher while iShares 20+ Year Treasury Bond (NASDAQ:TLT) continued to be biased lower.

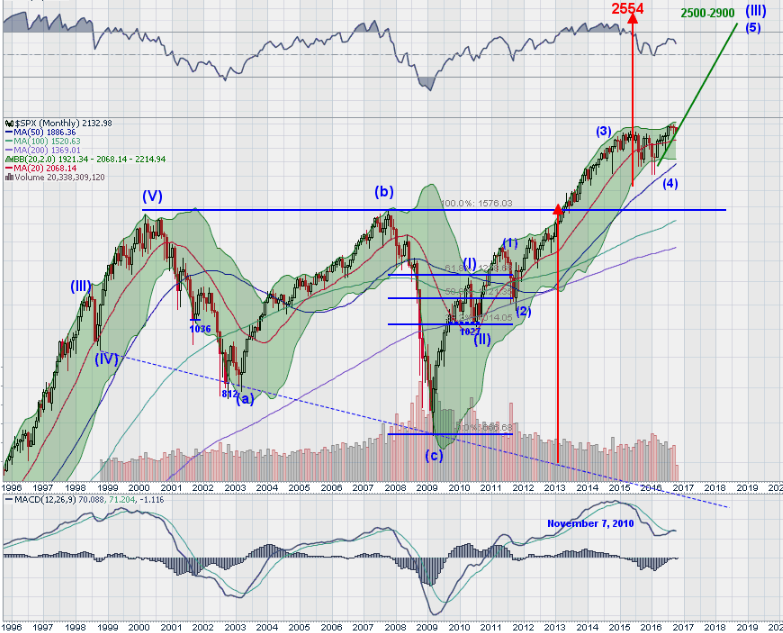

The Shanghai Composite looked to continue to drift higher and Emerging Markets (EEM) had found support in their move lower. Volatility (iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) looked to remain at unusually low levels keeping the bias higher for the equity index ETF’s SPY, iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed strength in the IWM and SPY (NYSE:SPY) both short term and in the intermediate time frame. The QQQ however remained stuck in consolidation in the longer timeframe.

The week played out with Gold continuing lower while Crude Oil started higher but gave it all back and then some later in the week. The US Dollar moved to a new high before a small pullback while Treasuries dipped lower Wednesday but recovered Friday. The Shanghai Composite continued higher while Emerging Markets continued their short term bounce higher. Volatility drifted lower in a tight range.

The Equity Index ETF’s all started the week moving higher, then the SPY paused before continuing Friday, with the IWM driving higher all week and the QQQ pulling back Wednesday before advancing again Friday. What does this mean for the coming week? Lets look at some charts.

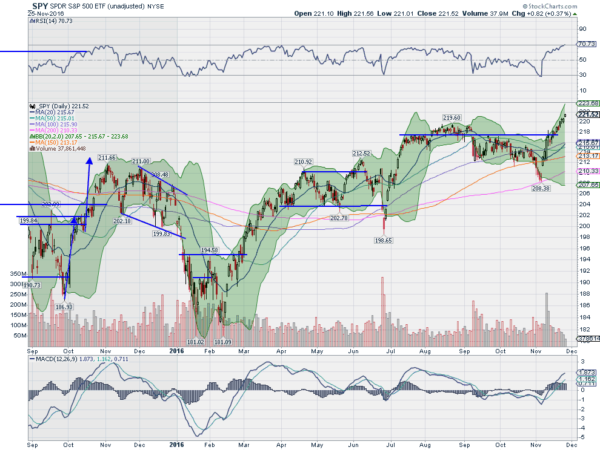

SPY Daily

The SPY came into the week having declared an uptrend and kept going. Monday moved to a new all-time high, and it was followed by repeat performances Tuesday, Wednesday and Friday. There is a target above to 229 on a Positive RSI Reversal but the daily chart is starting to get into overbought territory. The RSI is peeking over 70, not extreme, but a place it could not get to over the past 2 years. The MACD is rising and approaching prior tops.

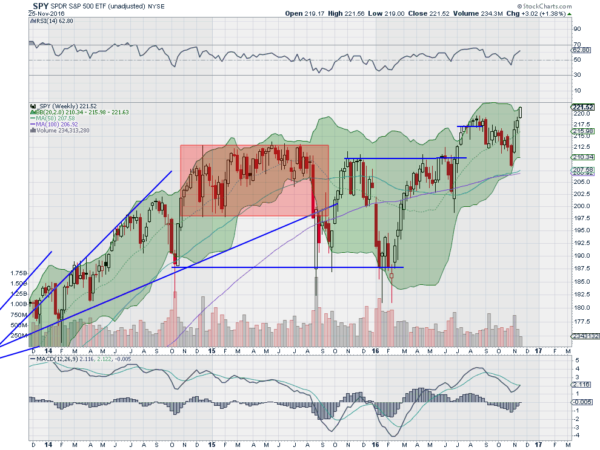

The weekly chart looks strong. There was a smaller Marubozu for the week, closing at the high, and pressing the Bollinger Bands® open. The RSI on the weekly timeframe is rising and bullish with the MACD about to cross up. There is no resistance above and support lower comes at 220.75 and 219 followed by 217.20 and 215.70. Continued Upward Trend.

SPY Weekly

Stuffed with turkey and shopped out from Black Friday, traders and investors see the equity markets still looking strong heading into December. Elsewhere look for Gold to continue lower while Crude Oil consolidates with a short term bias higher. The US Dollar Index continues to look strong as while US Treasuries are biased lower but may be finding support. The Shanghai Composite continues to look strong and Emerging Markets continue to consolidate in their downtrend.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The SPY looks strong and ready for more while the IWM may be getting overheated and should garner close attention for a possible short term pullback. The QQQ is sitting just under highs and could be the beneficiary of any short term rotation. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.