Last week’s review of the macro market indicators noted with November Options Expiration in the rear view mirror and traders looking forward to a short Thanksgiving week, equity markets were hinting at reversing higher. Elsewhere looked for Gold (GLD (NYSE:GLD)) to continue in its short term uptrend while Crude Oil (USO (NYSE:USO)) paused in its downtrend. The US Dollar Index (DXY) was resuming its move higher while US Treasuries (TLT) continued to consolidate in their downtrend.

The Shanghai Composite (ASHR) was staging a possible reversal while Emerging Markets (EEM) were trying to buck their downtrend. Volatility (VXX) looked to remain slightly elevated but drifting lower, easing the downward pressure on the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed some signs of reversing in the short timeframe, while on the longer timeframe the consolidation was more obvious.

The week played out with Gold drifting higher only to give it back Friday while Crude Oil moved lower all week accelerating at the end. The US Dollar made a higher low and then moved higher while Treasuries slowly moved up all week. The Shanghai Composite made a higher high and pulled back to a higher low keeping hopes alive for a reversal while Emerging Markets tightened their consolidation.

Volatility moved slightly higher, keeping pressure on equities. The Equity Index ETF’s all pulled back immediately Monday killing the buzz for a reversal. As the week wore on they gained their footing with the IWM looking the strongest at the end of the week. What does this mean for the coming week? Lets look at some charts.

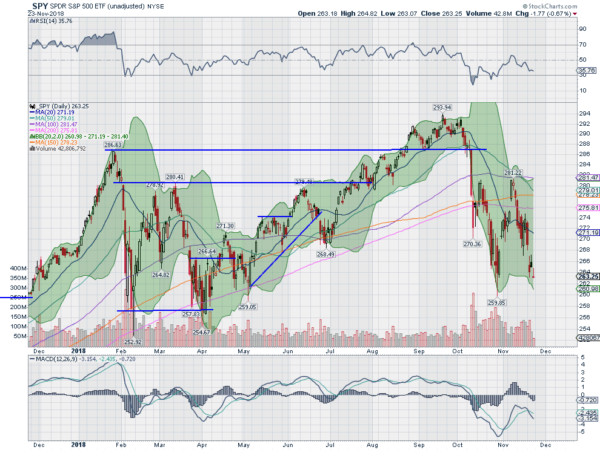

SPY (NYSE:SPY) Daily, SPY

The SPY was bouncing off of a higher low coming into the week. This gave some promise for a reversal. But the price action Monday ended that. A strong move lower erased the bounce and it was followed by a gap down Tuesday. It bounced slightly Wednesday and then dropped back, to finish at the low of the week Friday and below the October low.

The daily chart shows the RSI driving back to the oversold level, in bearish territory with the MACD negative and falling. The only saving grace was that the latest leg down has been on declining volume. But you cannot buy and sell volume.

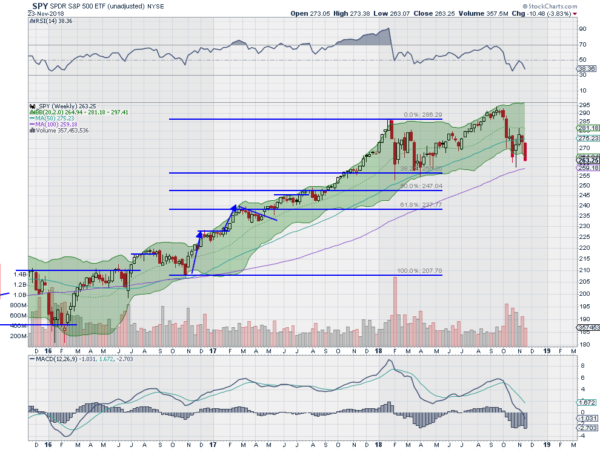

The weekly chart shows a bearish Marubozu candle driving toward the 100 week SMA and the February lows. The RSI on this timeframe is falling and bearish with the MACD falling and negative. There is support lower at 261 and 257.50 then 254.35 and 250. Resistance above comes at 263 and 265 then 269 and 271.40. Downtrend.

With Thanksgiving behind the holiday shopping season is in full swing but the price action in the equity markets are casting a dark shadow over the festivities. Elsewhere look for Gold to continue in its uptrend while Crude Oil continues to move lower. The US Dollar Index is resuming its move higher while US Treasuries are reversing to the upside. The Shanghai Composite may also be reversing higher while Emerging Markets continue to pause in their downtrend.

Volatility remains elevated and has an upward bias which is keeping the bias lower for the equity index ETF’s SPY, IWM and QQQ. Their charts all look weak on the shorter timeframe, with the QQQ the worst under the October lows and nearing the February lows. The IWM is nearing 12 month support while the SPY sits at the October low. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.