A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators which as the calendar turned to May saw the equity markets looking worn out and in general better to the downside. Elsewhere looked for gold to continue its uptrend while crude oil moved higher as well. The US Dollar Index was on the cusp of a major breakdown while US iShares 20+ Year Treasury Bond (NYSE:TLT) churned with a bias to break to the upside.

The Shanghai Composite looked to continue to consolidate along with iShares MSCI Emerging Markets (NYSE:EEM) but looked for the latter to be biased to eventually break that consolidation higher. iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX) looked to remain subdued but not at the lows keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), despite the moves lower. Their charts were more mixed with the QQQ firmly heading lower, the SPY (NYSE:SPY) pulling back in its uptrend and the IWM stalling.

The week played out with gold probing lower in a bull flag before rebounding to end the week near unchanged while crude oil started lower but made another higher low and also rebounded late in the week. The US dollar broke support but then quickly recovered while Treasuries moved higher.

The Shanghai Composite pushed higher to resistance but failed again while Emerging Markets broke support and tumbled. Volatility stayed in a tight range in the normal zone. The Equity Index ETF’s started the week lower, with the SPY and IWM joining the QQQ, and then they all drifted down the entire week. What does this mean for the coming week? Lets look at some charts.

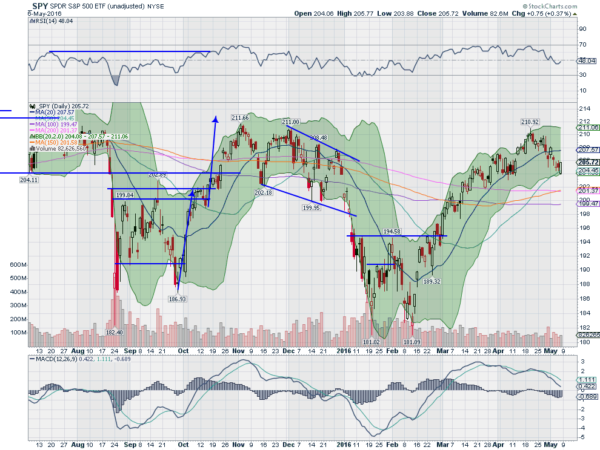

SPDR S&P 500 (NYSE:SPY)

The SPY started the week moving higher. That confirmed the reversal off of a Hammer the previous Friday. But that was all it got. Tuesday moved lower again with another Hammer and Wednesday added a doji but lower again. Thursday saw yet another small body candle and then Friday opened lower again at the lower Bollinger Band®. But that ended it as the price action improved all day and ended at the highs. A strong candle but not out of the woods yet.

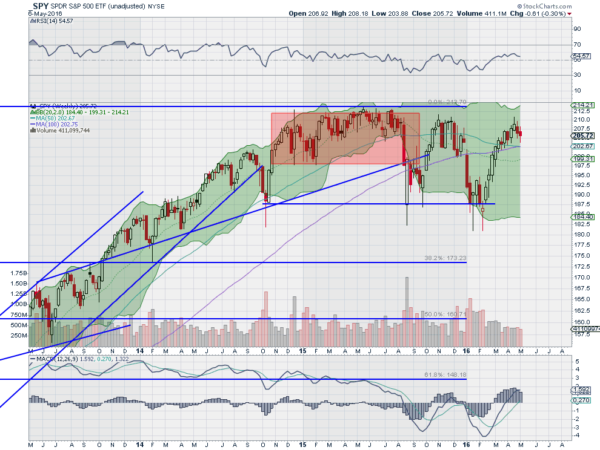

The RSI on the daily chart fell through the mid line but held in the bullish range with a turn higher Friday. With the low Friday above the April 7th low a Positive RSI Reversal remains a possibility on a continued move higher. This would target 211.71. The MACD is still falling though. On the weekly chart the pullback looks mild to this point, just a digestive move like a bull flag. It remains over the 50 week SMA with a RSI holding over the mid line and moving sideways just under the bullish zone entry. The MACD is rising but slowing its speed.

At the end of the day there are a series of lower highs, even if only marginally. Not a positive. There is resistance at 206 and 207.60 followed by 208.50 and 210.75 before 211.50 and the all time high at 213.78. Support lower comes at 203.75 and 201.50 followed by 200 and 198.30. A move higher Monday would change things to a more positive short term tone. Intermediate Consolidation with a Short Term Downward Bias.

SPY Weekly

Heading into next week equities continue to look better to the downside short term after a week lower, but with a glimpse of promise from the Friday action. Elsewhere look for Gold to resume its uptrend while Crude Oil moves higher as well. The US Dollar Index is set to continue the bounce while US Treasuries consolidate with an upward bias.

The Shanghai Composite continues to consolidate with a bias lower and Emerging Markets are biased to the downside. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves lower. Their charts suggest more short term downside though with the QQQ looking the worst. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.