SPY Trends and Influencers May 4, 2019

Last week’s review of the macro market indicators saw in the last days of April the equity markets remained strong on a longer timeframe and mixed but good on the shorter timeframe. Elsewhere looked for Gold ($GLD) to possibly reverse higher out of a pullback while Crude Oil ($USO) paused in its uptrend. The US Dollar Index ($DXY) had changed to a short term uptrend while US Treasuries ($TLT) were biased higher. The Shanghai Composite ($ASHR) and Emerging Markets ($EEM) were both pulling back in their uptrends.

Volatility ($VXXB) looked to remain very low keeping the bias higher for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts were strong in the weekly timeframe with the QQQ leading the way at all-time highs and the SPY right behind with the IWM improving. On the daily timeframe the QQQ was ready for a pause and to possibly pass the baton to the IWM which was back at resistance. The SPY meanwhile remained strong and a fraction from new all-time highs.

The week played out with Gold dropping further before a Friday bounce while Crude Oil pulled back. The US Dollar pulled back but found support mid-week and reversed higher while Treasuries bounced around but ended the week little changed. The Shanghai Composite found its footing Tuesday and then closed down for the week while Emerging Markets made a small move higher at the end of the week.

Volatility tried to move higher early and then fell back Friday, shifting the bias lower for equities early in the week and then removing the pressure. The Equity Index ETF’s reacted with some mid-week movement to the downside before a strong bounce Friday. What does this mean for the coming week? Let’s look at some charts.

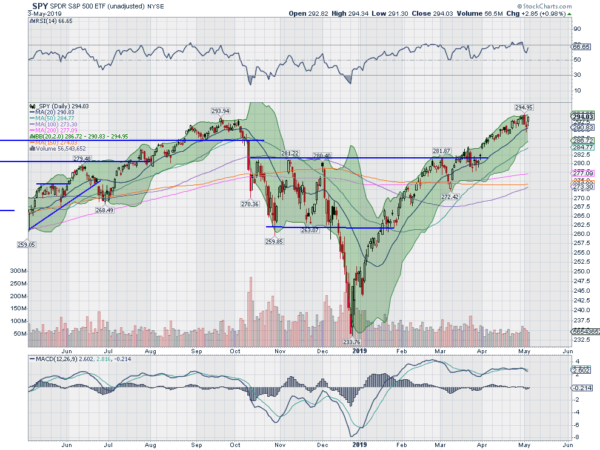

SPY Daily, $SPY

The SPY came into the week a fraction under the all-time high and moving higher out of consolidation. It made a new all-time high Monday and then again on Tuesday. But after starting higher Wednesday it fell back all day in a bearish engulfing candle. Top callers came out of the woodwork. It followed lower Thursday to the 20-day SMA and bounced. Friday saw it reverse higher and it drove to close at a new all-time high to end the week.

The daily chart shows the RSI pulled back to out of the overbought territory and dropped only slightly before bouncing. The MACD also reset slightly lower but quickly flattened. And the Bollinger Bands® continue to point to the upside. A strong move up off of the retest of the 20-day SMA.

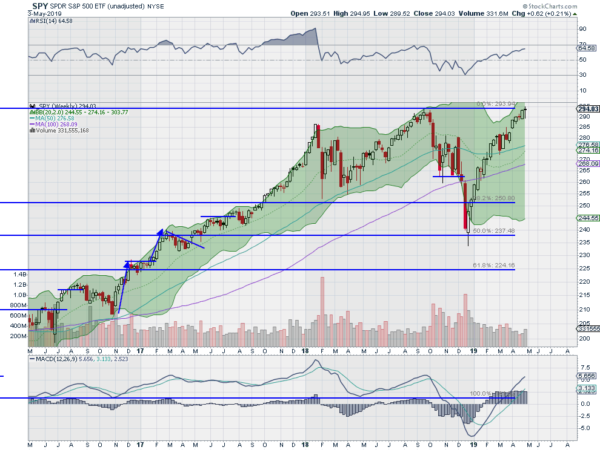

The weekly chart printed a potential Hanging Man at a new high. The RSI is rising and bullish with the Bollinger Bands pointing higher. The MACD is also rising and positive. There is no resistance above 294.50. Support lower sits at 293 and 292 then from 289.50 to 290.50 followed by 287 and 285. Uptrend.

SPY Weekly, $SPY

With another FOMC meeting in the books and the April employment report behind, equity markets are strong and moving higher again. Elsewhere look for Gold to continue lower in its pullback while Crude Oil joins it as it turns lower. The US Dollar Index is also reversing lower while US Treasuries reverse to the upside. The Shanghai Composite ended its short week pulling back but Emerging Markets are now poised to reverse back higher.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all look strong on the weekly timeframe. On the daily timeframe, it does looks like the QQQ is ready to consolidate while the IWM takes the lead, with the SPY driving higher as well. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.