A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two time frames.

As last week’s review of the macro market indicators suggested, heading into the unofficial start of summer, the equity markets looked positive and better in the longer time frame than the shorter one.

Elsewhere, look for gold to continue to hold near 1200, while crude oil consolidated with an upward bias. The US dollar index was biased to the upside, but it was still too soon to declare a reversal higher, while US Treasuries were biased lower, but showing signs of consolidation. The Shanghai Composite was moving higher in renewed strength, and Emerging Markets were biased to the downside in the uptrend, debating whether it was a bull flag or a reversal.

Volatility looked to remain subdued, keeping the bias higher for the equity index ETF’s SPY (ARCA:SPY), IWM (ARCA:IWM) and QQQ (NASDAQ:QQQ). Their charts agreed with that on the weekly timeframe, but showed better strength on the SPY and QQQ on the daily timeframe than in the IWM.

The week played out with gold probing lower under 1200, but quickly finding support, while crude oil tested the consolidation zone, but held and bounced. The US dollar continued higher before a pause, while Treasuries broke the downtrend, moving higher. The Shanghai Composite made another new 7 year high before pulling back, while Emerging Markets took another turn lower.

Volatility opened higher Tuesday, but then stayed in a tight range all week. The Equity Index ETF’s all fell from their recent highs to start the week, with the SPY then consolidating, the IWM reclaiming some ground along with the QQQ, which also printed a new 14 year high close along the way. What does this mean for the coming week? Let's look at some charts.

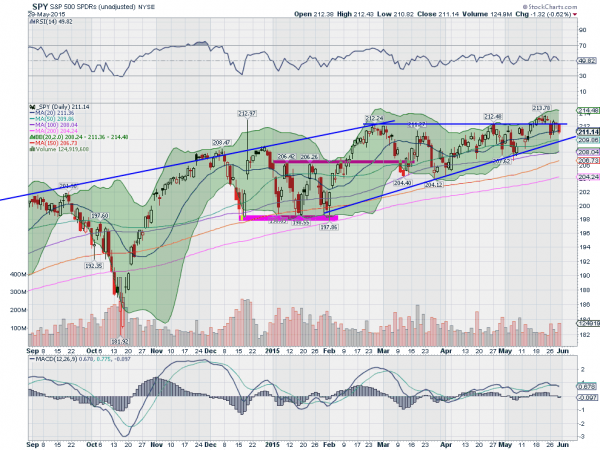

SPY Daily

The SPY started the week pulling back under the 212.50 breakout level and running lower. A failed breakout thus far. It found support at the 20 day SMA, and bounced Wednesday back to the break out area, where it held Thursday with a doji candle. Friday saw another move lower to the 20 day SMA, where it ended the week. In all, a tight range, but lower and importantly, under the breakout level. The RSI on the daily chart pulled back, but is holding at the mid line in the bullish zone, while the MACD is crossing down. These would support more downside.

The weekly chart shows last week’s break out, but as a possible Evening Star reversal candle, that was confirmed lower this week. The momentum picture on this timeframe is similar to the daily one, with the RSI at the mid line and the MACD about to cross down. There is resistance higher at 212.50 and 213.78, with a Measured Move to 216.50 and then 221 above. Support lower comes at 211 and 210.25, followed by 209 and 208. Consolidation in the Long Term Uptrend with a Short Term Downside Bias.

SPY Weekly

Heading into June the equity markets are mixed, with the QQQ strong, but the SPY and IWM showing some short term weakness.

Elsewhere, look for gold to continue to hold between 1180 and 1200, while crude oil consolidates with an upward bias. The US dollar index looks to continue higher, while US Treasuries also are looking stronger, possibly breaking their downtrend. The Shanghai Composite is in pullback mode in the uptrend, but at a good support level, while Emerging Markets are falling and look weak.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are a bit mixed, with all better on the weekly timeframe than the daily, and the QQQ’s the strongest short term, while the SPY and IWM may pullback. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.