Last week’s review of the macro market indicators heading into May options expiration saw that the equity markets continued to look weak.

Elsewhere looked for gold to consolidate in its uptrend while crude oil continued higher. The US Dollar Index looked to continue the bounce in the downtrend while US Treasuries (NYSE:TLT) were biased higher. The Shanghai Composite and Emerging Markets (NYSE:EEM) looked better to the downside.

Volatility (NYSE:VXX) looked to remain subdued, though keeping the bias higher for the equity index ETFs SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), despite their moves lower.

Their charts looked better to the downside, with the IWM the worst, then the SPY and the QQQ with the best chance to consolidate and reverse.

The week played out with gold probing lower again while crude oil continued higher, stalling late in the week. The US dollar moved higher while treasuries confirmed another lower high, falling lower. The Shanghai Composite moved along sideways in a tight range while emerging markets continued lower.

Volatility marched higher but was turned back at its Bollinger bands. The equity index ETFs spent the week in a tight range, although not without some angst. They all started lower only rebound Friday, all finishing up on the week.

What does this mean for the coming week? Let's look at some charts.

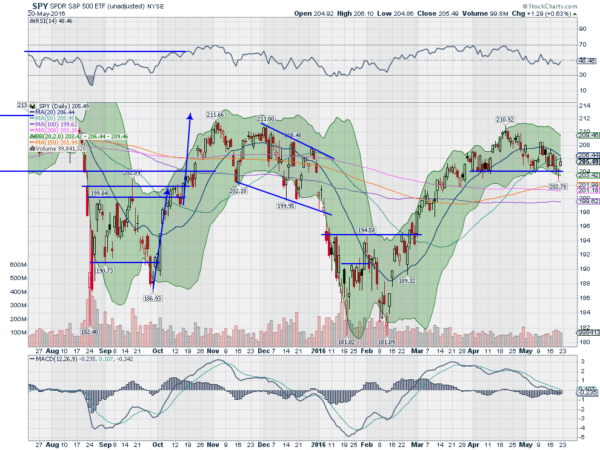

SPY Daily

The SPY started the week moving higher, but met resistance Monday at the 20 day SMA. It reversed that entire move Tuesday and then failed to move up Wednesday as it retreated intraday. Thursday saw a doji Hammer settle at support that has been in place since the beginning of April, and Friday a reversal confirmed with a move higher. It ended the week still shy of the 20 day SMA and the 50 day SMA, but on the positive side of the ledger.

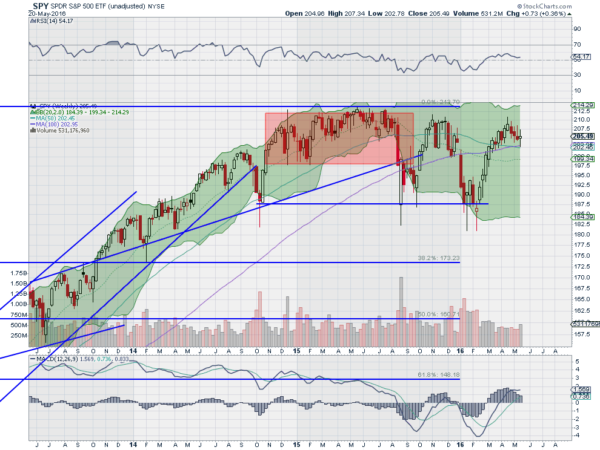

The daily chart shows the RSI holding under the mid line but in the bullish zone, while the MACD is falling and turned negative. This whole move from 210 lower could still be a bull flag, but it is getting a bit long. The weekly picture shows another candle with long shadows and a small real body, this one a doji. The price remains over the 20 and 50 week SMAs; much more of a bull flag feel on this timeframe.

The RSI is over the mid line but still has not cracked 60. It hasn’t been above 60, and bullish since December 2014. The MACD is positive and moving sideways after its run higher. There is resistance at 207.60 and 208.50 followed by 210.75. Support lower comes at 206 and 203.75 followed by 201.50 and 200.

There is consolidation of the move off the February low.

SPY Weekly

With options expiration behind us and heading into the last week before the unofficial start of summer, equity markets are treading water.

Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.