Last week’s review of the macro market indicators heading into May options expiration saw the equity markets looked mixed, with strength in the QQQ (NASDAQ:QQQ) and exhaustion in the iShares Russell 2000 (NYSE:IWM) and SPY (NYSE:SPY). Elsewhere looked for a possible reversal higher in gold (NYSE:GLD) downtrend while United States Oil (NYSE:USO) consolidated. The US Dollar Index looked to continue the drift lower while US Treasuries (NASDAQ:TLT) were biased lower in consolidation, but showed the possibility of a reversal short term.

The Shanghai Composite was trending lower but also showed signs of a possible reversal while Emerging Markets (NYSE:EEM) continued to roar higher. iVolatility (NYSE:VXX) looked to remain at exceptionally low levels keeping the wind at the backs of the equity index ETF’s SPY, IWM and QQQ. Their charts showed continued strength in the QQQ with consolidation in the SPY and IWM.

The week played out with gold reversing higher and running up while crude oil consolidated but broke to the upside late in the week. The US dollar moved lower breaking significant support while Treasuries broke their consolidation to reverse higher. The Shanghai Composite also bounced to the upside but weakly while Emerging Markets pulled back to support before a bounce to end the week.

Volatility started the week stable, spiked to one month highs and then sold back lower. The Equity Index ETF’s started the week well with both the SPY and QQQ printing new all-time highs as the IWM held flat. A mid-week thrashing left them all lower, but they moved toward recovery late in the week. What does this mean for the coming week? Lets look at some charts.

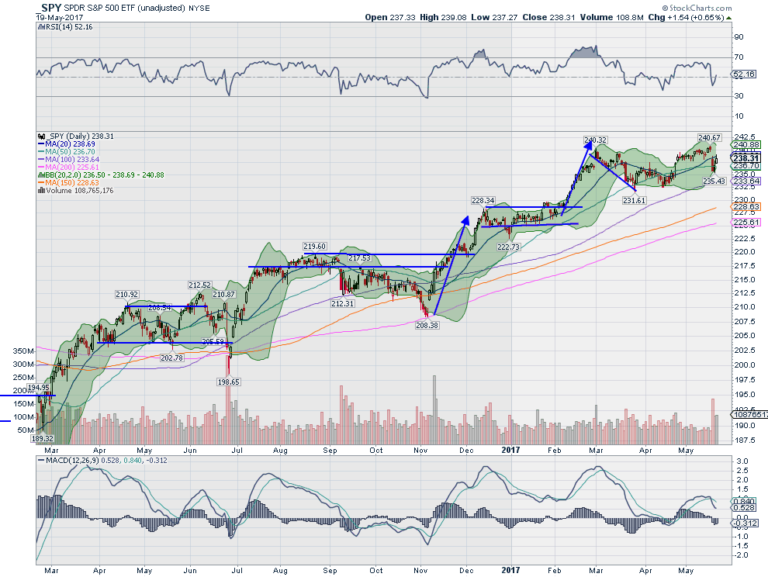

The SPY started the week with a new all-time high and the first close over 240. It started higher again Tuesday but could not hold the gain, dropping back slightly, but holding over 240. Wednesday saw a gap down and strong move lower. Thursday hit the lower Bollinger Band® and then moved back higher. Friday saw follow through as it moved into the gap. It closed lower on the week and still has an open gap above.

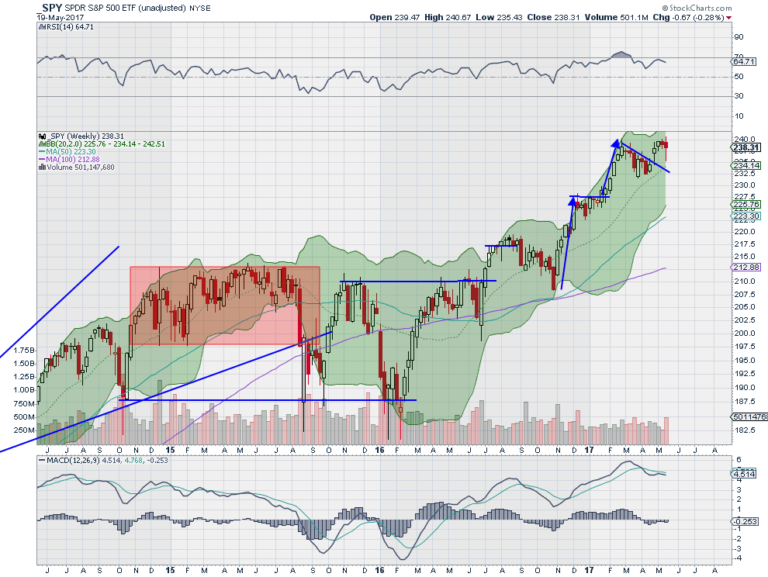

On the daily chart the Bollinger Bands are squeezing, often a precursor to a move. The RSI is moving higher after a touch near 40, still bullish, while the MACD is slowing its descent, but crossed down. A mixed case, and supports the continuation of the consolidation since February. On the weekly chart the full move of the week closed the gap from 5 weeks ago and is holding near the high.

The RSI on this timeframe is firmly in the bullish zone with the MACD level after a slight pullback. There is resistance at 240.30 and then a Measured Move to 248 above that. Support lower may be found at 238 and 237.10 then 236 followed by 233.70 and 232.20. Continued Consolidation in the Uptrend.

With May Options Expiration in the rearview wind traders will be looking toward the Memorial Day Weekend and official kick off of the flight to the Hampton’s each Friday. Equities head into the summer doldrums firm on the longer time frame but a little shaky short term. Elsewhere look for gold to continue to trend higher while crude oil retains an upward bias in consolidation. The US Dollar Index is sick and looks to continue lower while US Treasuries continue their consolidation.

The Shanghai Composite is also in consolidation mode while Emerging Markets are biased to continue to the upside. Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all show consolidation in strength in the longer term, with the QQQ joining this week. In the shorter term there is some minor damage to repair that begun Thursday. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.